- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in NJ, Work remotely in NJ most of the time, Assigned to Company's NYC branch

I live in NJ but I'm assigned to my company's NY branch. My company almost only withholds NY state tax.

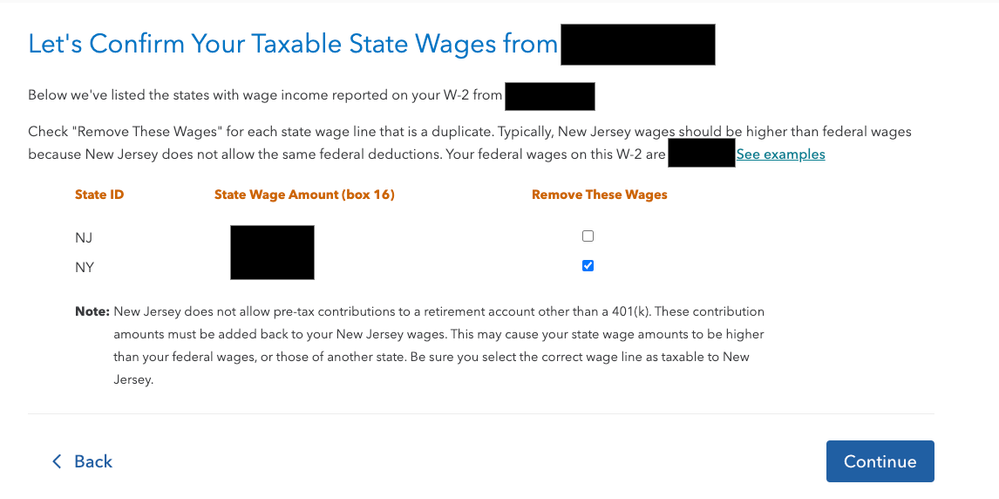

Most of the time I work remote in NJ but come in to the office 1-2 a week. When I'm on the below page, should I be removing NY or NJ state wages? What's the reasoning?

Also, should I allocate 100% of my W2 wages from the company to NY or should it be ~25% because I'm remote in NJ ~75% of the time?

Topics:

April 6, 2024

2:05 PM