- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Incorrect State Listed on W2. Taxes taken in WI not GA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect State Listed on W2. Taxes taken in WI not GA

Hello, my employer is based in WI but I work remotely in GA. They incorrectly listed me as a resident of WI on my W2 and took out taxes based on WI tax rates. I had them issue a W2c to reflect GA as the state I reside in but I'm unsure how to file on TurboTax. My employer indicated I needed to get a refund from WI to pay for GA taxes.

Do I need to file a nonresident WI state tax return and then file a GA tax return? Or can I just file my GA tax return since a W2c with the correct W2c information was created?

I haven't filed my taxes yet.

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect State Listed on W2. Taxes taken in WI not GA

Since you had taxes paid to Wisconsin, you need to file a non-resident tax return there to get those refunded. You need to file a resident tax return in Georgia to pay in the taxes you owe there. Your corrected W-2 should show the taxes you had withheld in Wisconsin to get credit for them. However, if not you can enter them in box 17 on your W-2 form entry and you should get credit for them, as the state will have a record of the taxes sent to them under your social security number. Make sure you enter "WI" in box 15 on your W-2 entry for the Wisconsin taxes withheld.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect State Listed on W2. Taxes taken in WI not GA

Thanks. So, when entering my income I used the w2c which listed the taxes (box 17) in GA. I went ahead and filed a non-resident tax return for WI and a resident tax return for GA. When updating WI, I listed $0 taxable income and TurboTax asked me to confirm that I didn't live in WI and have any income there, which I confirmed.

Additional question, I was kind of expecting to receive the taxes withheld (box 17) back from WI as a refund and then having to pay that amount back to GA to balance everything out. But TurboTax didn't do that and I received a $0 refund from WI and a normal refund from GA.

Is this correct? Would GA contact WI to transfer the income taxes listed in box 17?

Chris

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect State Listed on W2. Taxes taken in WI not GA

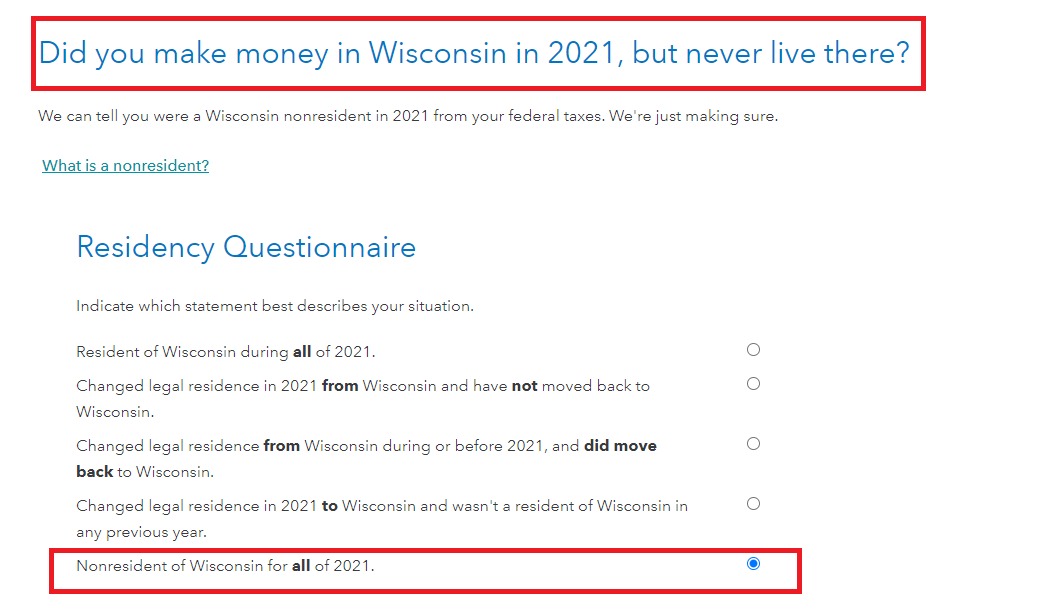

No. The states will not contact each other. You should get a full refund from Wisconsin (WI) for any withholding on your W2 because you do not live in or work inside of WI. When you prepare your WI return you should see a place to remove the income as you go through the step-by-step screens.

Make sure your W2 shows zero wages for WI and the withholding is entered in the adjoining state tax box.

When you move through the WI return there may come a screen where you need to enter 'Non Wisconsin Income'. This is an important entry because none of your income was from WI.

See the images below for assistance. @bigterpfan1

[Edited: 02/23/2022 | 9:13a PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Incorrect State Listed on W2. Taxes taken in WI not GA

@DianeW777 thanks. Yes I selected the box about being a non-resident of WI and removed my income below. When I did that it issued a full refund for the amount listed in box 17 on my W2. When I updated GA I owed almost the amount of box 17 so I'm receiving a full refund from WI and using it to pay GA. It balances itself out.

My corrected W2c showed my income/taxes was moved to GA but when I listed them under GA beforehand it didn't calculate my refund correctly. I updated my income/taxes back to WI and it calculated my refund correctly. Hopefully that's correct.

Thanks

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

daisy6060

New Member

texasgranny

Level 1

candylou2008

New Member

Neilpierceallen

New Member

dcnkkrewer

New Member