- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- incorrect NYS pension exclusion

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

incorrect NYS pension exclusion

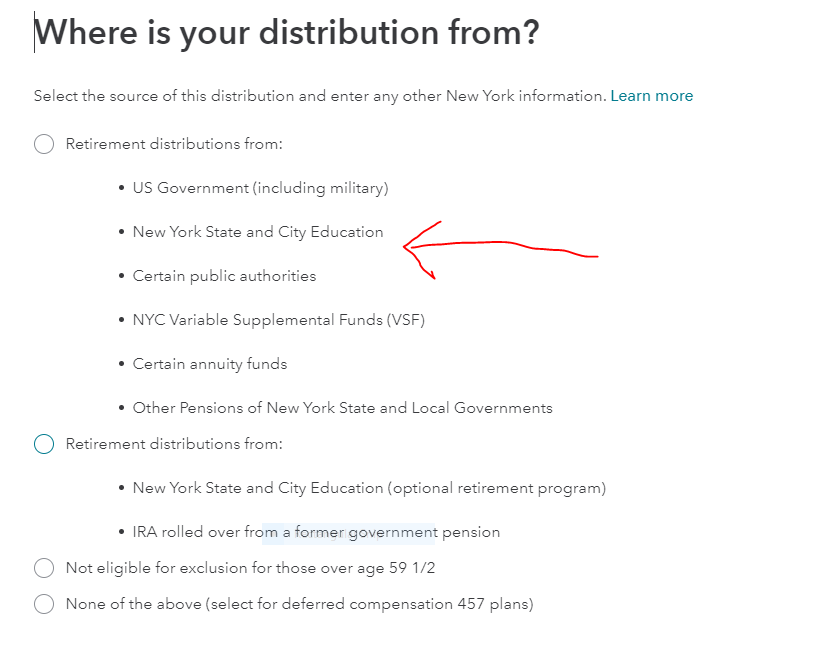

When you initially entered the Form 1099-R in the Income Section (Federal Return), after you enter the 1099-R, you need to select the right category as to where the 1099-R was issued from, to get it to flow to your NYS return properly and be tax-exempt. This will be one of the subsequent questions that come up right after you enter your Form 1099-R.

When you select this (see below), it will flow properly to your NYS return as nontaxable.

Go back to your Form 1099-R in your Income section. Try to edit it. You may have to delete and reenter the Form 1099-R to get this question to pop back up.

Click here for information on deleting your Form 1099-R in TurboTax

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

incorrect NYS pension exclusion

Three years later it still does not work correctly. I have to enter MTA pension as other state and local pension though it is not listed in the publication or as a federal government pension. If I correctly post pension as a state employee with 457 deferred compensation plan, the NY state taxes it.

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

InTheRuff

Returning Member

Slowhand

New Member

cpo695

Returning Member

trish2167

New Member

rbucking4

New Member