- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

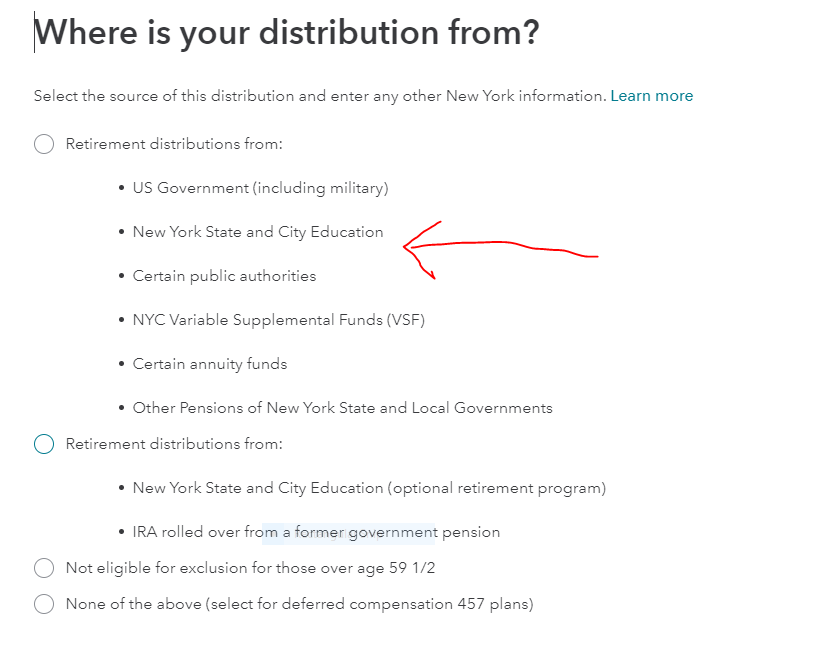

When you initially entered the Form 1099-R in the Income Section (Federal Return), after you enter the 1099-R, you need to select the right category as to where the 1099-R was issued from, to get it to flow to your NYS return properly and be tax-exempt. This will be one of the subsequent questions that come up right after you enter your Form 1099-R.

When you select this (see below), it will flow properly to your NYS return as nontaxable.

Go back to your Form 1099-R in your Income section. Try to edit it. You may have to delete and reenter the Form 1099-R to get this question to pop back up.

Click here for information on deleting your Form 1099-R in TurboTax

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 2, 2023

4:57 PM