- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Illinois taxes for Iowa resident calculated incorrectly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois taxes for Iowa resident calculated incorrectly

Hello. I work in Illinois while I am a resident of Iowa. When I filed my 2020 tax return, I did not get a refund on taxes withheld by Illinois, even though I am supposed to as an Iowa resident. On my Schedule NR, my income from Illinois in row 5 column B was listed as all of my income from Illinois, even though that number should have been 0, as is shown in the instructions for this form on page 7: https://www2.illinois.gov/rev/forms/incometax/Documents/2020/individual/il-1040-schedule-nr-instr.pd...

As far as I can tell, this glitch is still in this year's version of TurboTax. Can I get any compensation for this? Thank you in advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois taxes for Iowa resident calculated incorrectly

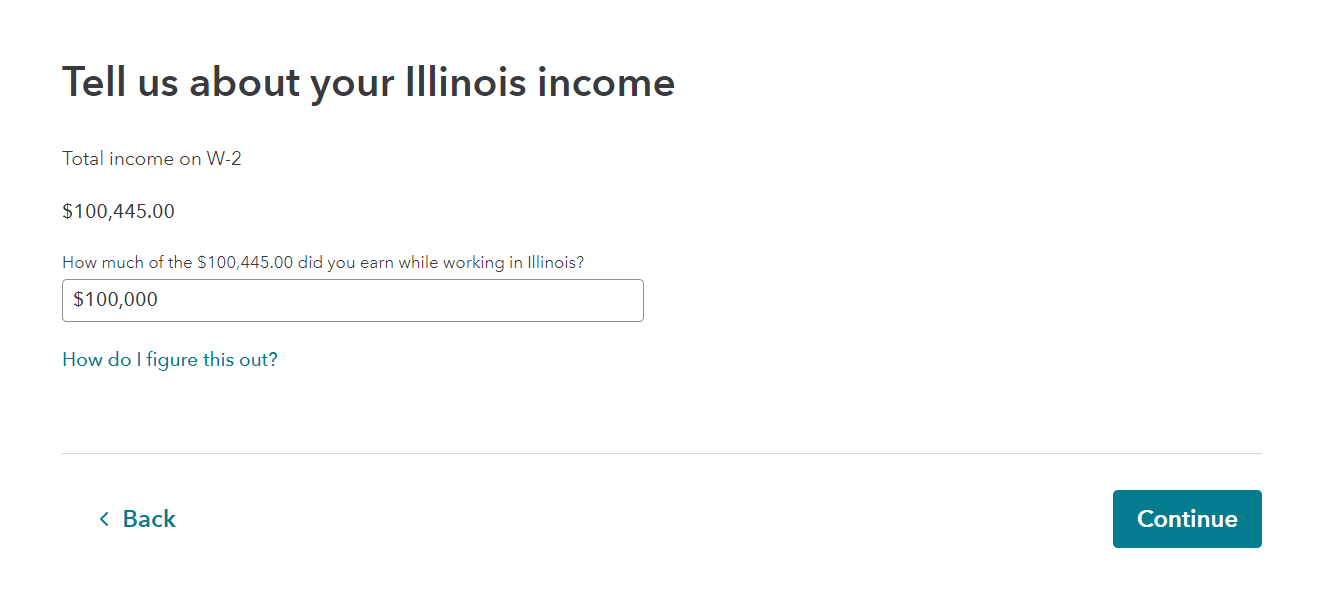

You must go back to the Illinois return and allocate the Illinois income as zero. (See below)

Any wages or salary made by an Iowa resident working in Illinois is taxable only to Iowa and not to Illinois.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

douglasjia

Level 3

user17525953115

New Member

WadiSch

Level 1

panerje

New Member

ahulani989

New Member