- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Illinois Resident with Wisconsin Real Estate Sale

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

My wife and I file jointly in Illinois as full-time, retired residents.

My wife inherited real estate in Wisconsin and sold it six months later.

Do we need to file a Wisconsin tax return to avoid a matching notice on the 1099-S from the Wisconsin closing?

Since this is a short-term capital gain—not W-2 income—how do I fill out the Illinois and Wisconsin returns? Does the answer change if it is a capital loss and it is more than offset by other (Illinois) capital gains?

Thank you for reading this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

@nello wrote:

What is the work around?

Today I contacted TurboTax by Twitter and phoned several times. Eventually I was transferred to a CPA from TurboTax Live. After a marathon call of 3 hours and 19 minutes, we confirmed the two bugs above.

Work around is:

- Remove all data from both IL and WI returns. (TurboTax → File → Remove Data, for each state).

- Quit TurboTax (saving tax file).

- Launch TurboTax.

- Complete WI just as before.

- Go to Forms view and change the column “Wisconsin Amount” of line 7 (Capital gain or loss) on the income allocation worksheet (“Inc Alloc Wks”) to the correct number.

- Repopulate IL using EasyStep → Federal Taxes → Federal Review and click on “Continue” button.

- Review both state returns to make sure that they are complete and correct.

The entire WI return, including Schedule WD, is now correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

Do we need to file a Wisconsin tax return to avoid a matching notice on the 1099-S from the Wisconsin closing?

you file form 1 NPR (non-resident form ) because your gross income for Wi purposes will be over $2,000

Since this is a short-term capital gain—not W-2 income—how do I fill out the Illinois and Wisconsin returns? Does the answer change if it is a capital loss and it is more than offset by other (Illinois) capital gains?

you prepare your federal return and then your non-resident Wi return reporting only the sale of the Wi real estate in the WUI column (not other capital gains you derived as an Illinois resident)

then you prepare your resident IL return taking credit on schedule CR for taxes paid to Wi

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

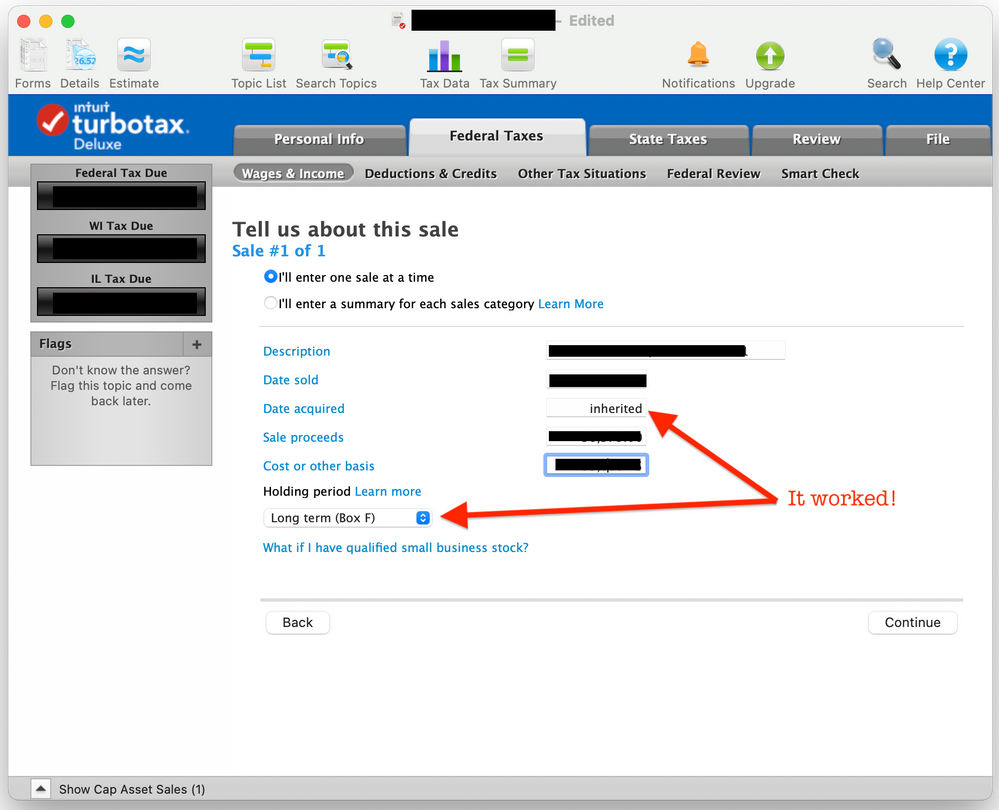

A sale of inherited property is always treated as long-term, no matter how long the decedent or the heir actually owned it. When TurboTax asks for the date acquired, enter the word "Inherited" (without the quotes) instead of a date.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

the fact that the gain is long-term makes no difference for state income taxes because the rate for short-term and long-term gains are the same.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

@rjs wrote:When TurboTax asks for the date acquired, enter the word "Inherited" (without the quotes) instead of a date.

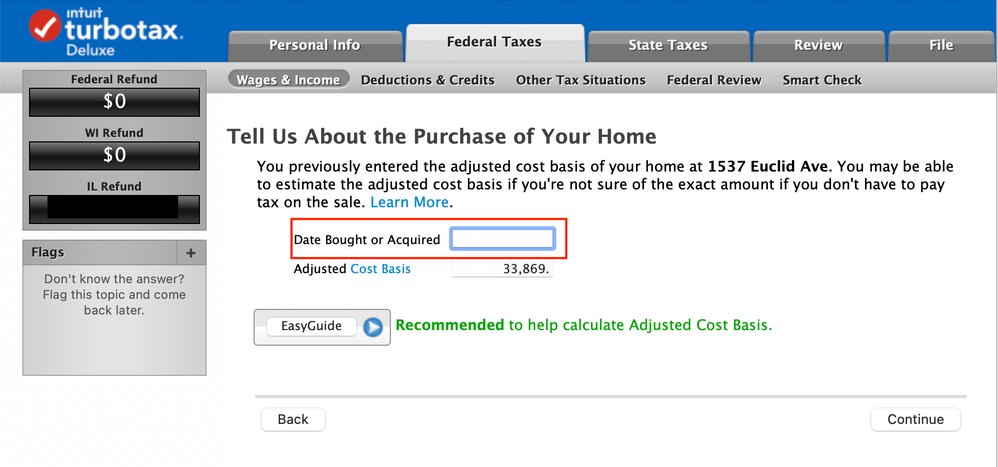

On the page titled “Tell Us About the Purchase of Your Home” in the field titled “Date Bought or Acquired” only numbers can be entered; I can NOT enter any letters, including the word ‘inherited’.

Where do I enter “inherited” in TurboTax Deluxe 2021 for Mac? (In EasyStep, or Forms?)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

@nello wrote:

Where do I enter “inherited” in TurboTax Deluxe 2021 for Mac? (In EasyStep, or Forms?)

There is no way to enter "Inherited" as the acquisition date for the sale of your main home. This seems to be a flaw in TurboTax. I will let the TurboTax people know, but I would not expect it to be fixed anytime soon. It's an unusual situation.

You can handle it in one of the following ways, depending on the details of your particular situation.

If you did not get a Form 1099-S for the sale, and you qualify to exclude all of the gain, or you have a loss on the sale, you do not have to report the sale on your tax return. Just omit it.

If you have to report the sale, enter the date of death of the person from whom you inherited the home, as long as it's more than a year before the sale date, and more than two years before the sale date if you qualify to exclude part or all of the gain.

If you do not qualify to exclude any of the gain, you could enter it as an investment sale for which you did not get a 1099-B, instead of as the sale of your home. For the description enter "Main home." You will be able to enter "Inherited" as the acquisition date. The way it appears on your tax return will be exactly the same as if you had entered it as the sale of your home.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

@rjs wrote:There is no way to enter "Inherited" as the acquisition date for the sale of your main home. This seems to be a flaw in TurboTax. I will let the TurboTax people know, but I would not expect it to be fixed anytime soon. It's an unusual situation.

I wish you hadn’t said in your December 11 that I should “… enter the word ‘Inherited’ (without the quotes) instead of a date.” I wasted a lot of time trying to figure out what I was doing wrong, looking through Forms, etc.

As far as this being an “unusual situation,” I’m not so sure. Taxpayers inherit real estate all the time. Selling such real estate within a year of inheriting it may be a small portion of total real estate sales. But it is not unusual; happens all the time.

Option 1

@rjs wrote:

If you did not get a Form 1099-S for the sale, and you qualify to exclude all of the gain, or you have a loss on the sale, you do not have to report the sale on your tax return. Just omit it.

Unfortunately, my wife did get a 1099-S. (It’s hard for me to imagine a title company that would NOT issue one.) Moreover, even if she didn’t get a 1099-S, I don’t think that she qualifies for a homeowner exclusion since she has NOT lived in the house for several decades; I don’t think the house qualifies as either her primary or secondary residence. In any case, we have to report the transaction or we’ll get a matching notice from the IRS as well as Wisconsin, and eventually from Illinois as well. We can’t “just omit it.”

So option one doesn’t fit the facts.

Option 2

@rjs wrote:

If you have to report the sale, enter the date of death of the person from whom you inherited the home, as long as it's more than a year before the sale date, and more than two years before the sale date if you qualify to exclude part or all of the gain.

Yes, I did enter her mother’s date of death. She died in January 2021 and the sale closed in July 2021. (In the original post I said: “My wife inherited real estate in Wisconsin and sold it six months later.”) So, it was NOT held for a year or longer and thus, based on the holding period, the gain is a short-term gain for federal tax purposes.

But in your December 11 post, you said: “A sale of inherited property is always treated as long-term, no matter how long the decedent or the heir actually owned it.”

So option two gives me the wrong tax treatment for the facts.

Bottom-Line Question

How do I recharacterize her gain from a short-term gain based on the holding period to a long-term gain based on the property being acquired through inheritance?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

The screen shot that you posted earlier today is from the interview for selling your main home. Because I recognized the screen, I assumed you were entering a sale of your main home. I did not look back at your question from two months ago and see that you are talking about a sale of real estate that your wife inherited in another state and sold six months later. Since you are not selling your main home, you are in the wrong part of the TurboTax interview.

The first screen in the Sale of Home interview says "In this section we'll record the sale of your main home, your principal residence. . . . This does not include the sale of a vacation home or a second home. You'll report that in the investments section."

You should be entering the sale under Investment Income, in the same place that you would enter a sale of stock. In that section you will have no trouble entering "Inherited" for the acquisition date and having it treated as long-term. Delete the Sale of Home entry and enter it as an investment sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

@rjs wrote:

You should be entering the sale under Investment Income, in the same place that you would enter a sale of stock. In that section you will have no trouble entering "Inherited" for the acquisition date and having it treated as long-term. Delete the Sale of Home entry and enter it as an investment sale.

I got into the home sale questionnaire because it seemed to be the only place to post a 1099-S.

Thank you for redirecting me to investments (schedule D) instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

You do not actually enter the 1099-S, but the fact that you got it means that you have to report the sale, even if you have no taxable gain. When you enter the sale in the Investments section, the date sold and sale proceeds that you enter should be the date and proceeds from boxes 1 and 2 of the 1099-S.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

@rjs wrote:When you enter the sale in the Investments section, the date sold and sale proceeds that you enter should be the date and proceeds from boxes 1 and 2 of the 1099-S.

Got it. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

@rjs wrote:

In that section you will have no trouble entering "Inherited" for the acquisition date and having it treated as long-term. Delete the Sale of Home entry and enter it as an investment sale.

Yes, I was able to enter “inherited” in the acquisition date and long-term was selected automatically.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

@rjs wrote:When you enter the sale in the Investments section, the date sold and sale proceeds that you enter should be the date and proceeds from boxes 1 and 2 of the 1099-S.

The (Substitute Form) 1099-S that my wife received has values only boxes 1-3.

Does it matter how I report the basis?

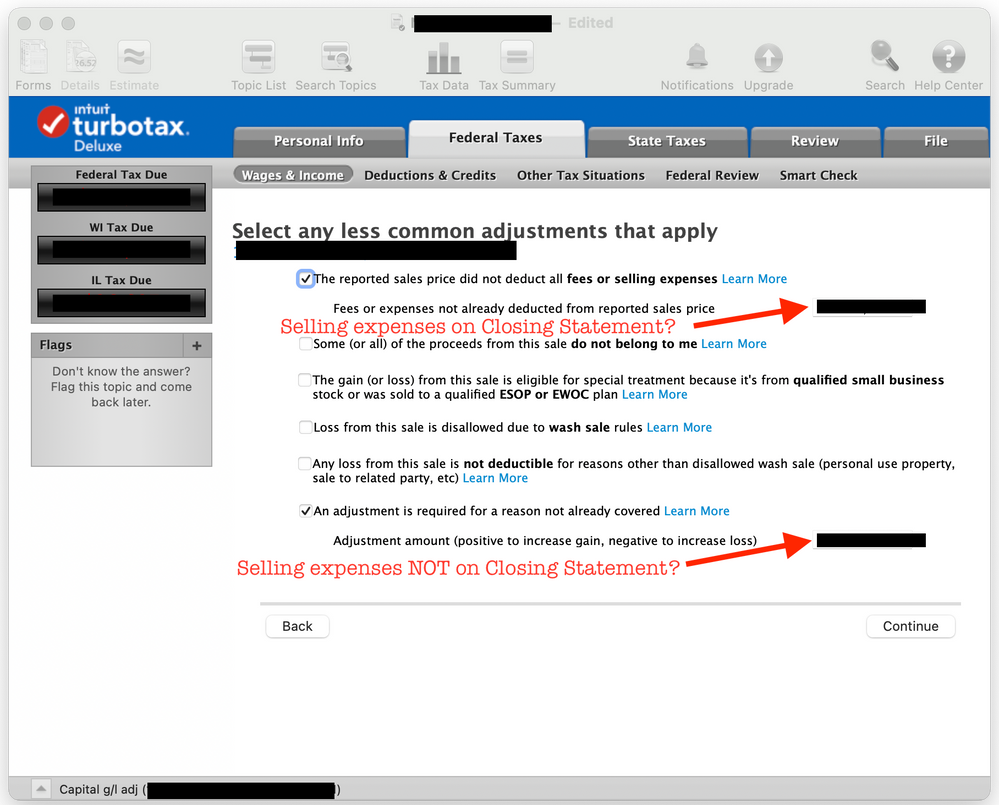

I have an broker’s estimate for the house’s value on the date of death and I was going to make two separate adjustments to this estimate based on whether that the adjustment comes from the closing statement or not. An example of an adjustment that appears on the closing statement is the brokers’ commissions. An example of an adjustment that is not on the closing statement is the cost of transportation and meals to work on preparing the house for sale.

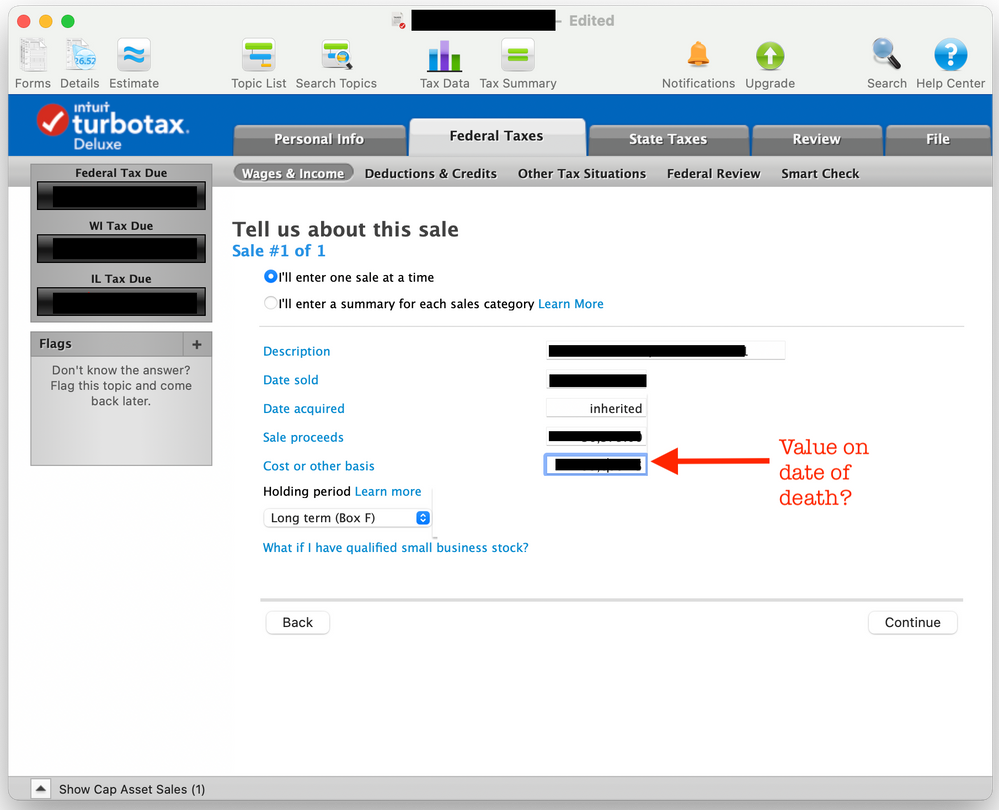

So, my plan is to put the estimate of value on the date of death in the “Cost or other basis” field on the Tell us about this sale screen:

And put the two types of adjustments on the Select any less common adjustments that apply screen:

Is this a good approach? The accountant in me wants to show lots of detail so that amounts are easy to tie back to source documents. But, maybe all this detail just raises unwarranted questions for the IRS. Maybe I’m better off just netting all three values and reporting the total in the “Cost or or other basis” field.

What are your thoughts on reporting the seller’s basis in the real estate?

Thank you for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

Yes, enter the value on the date of death for cost or other basis.

Yes, enter the broker's commission as a selling expense on the less common adjustments screen, provided that the commission is not already subtracted from the proceeds shown on the 1099-S.

Preparing the house for sale cannot be claimed as a selling expense or other adjustment.

I would not enter any adjustments other than the broker's commission. The adjustments "for a reason not already covered" are likely to raise questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Resident with Wisconsin Real Estate Sale

You can add the cost of improvement you made prior to the sale of the Inherited Home to the Cost Basis (FMV per appraisal) when reporting the sale.

You can't deduct the costs of travel, etc. since it was not a Business Property.

Click this link for more info on Deductions for Sale of Inherited Home.

Here's more details on Calculating Your Home's Basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

qadro

Level 2

EJack25

Returning Member

Taxfused

New Member

Taxfused

New Member

Mrbeetle

New Member