- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

@rjs wrote:When you enter the sale in the Investments section, the date sold and sale proceeds that you enter should be the date and proceeds from boxes 1 and 2 of the 1099-S.

The (Substitute Form) 1099-S that my wife received has values only boxes 1-3.

Does it matter how I report the basis?

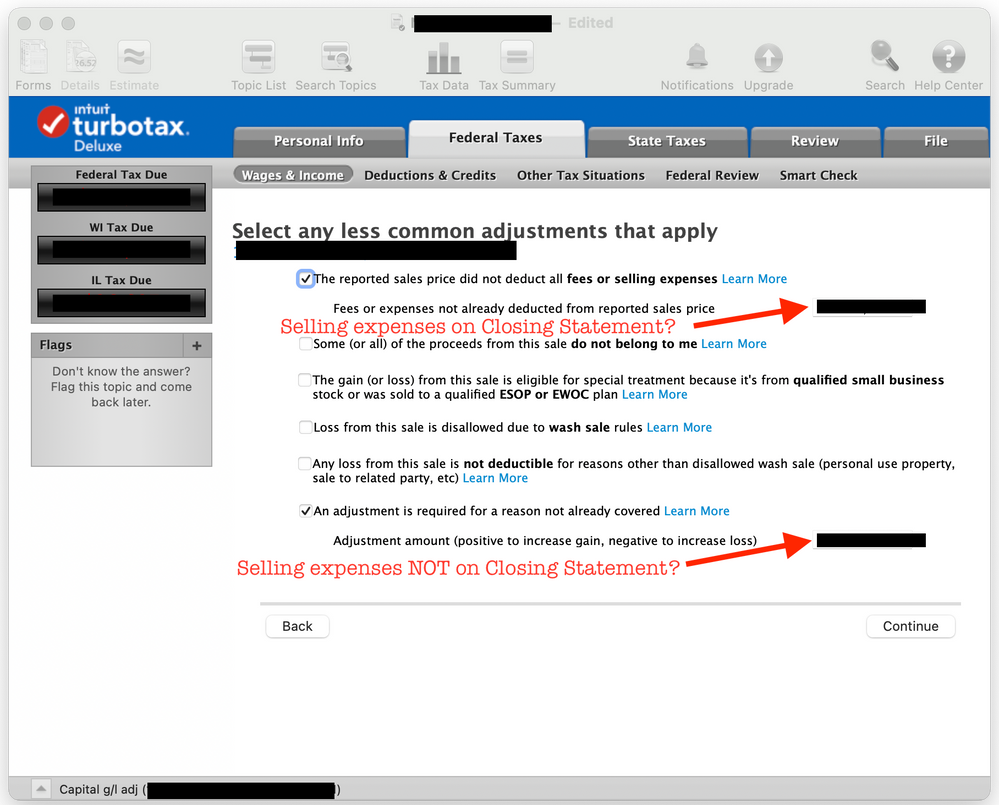

I have an broker’s estimate for the house’s value on the date of death and I was going to make two separate adjustments to this estimate based on whether that the adjustment comes from the closing statement or not. An example of an adjustment that appears on the closing statement is the brokers’ commissions. An example of an adjustment that is not on the closing statement is the cost of transportation and meals to work on preparing the house for sale.

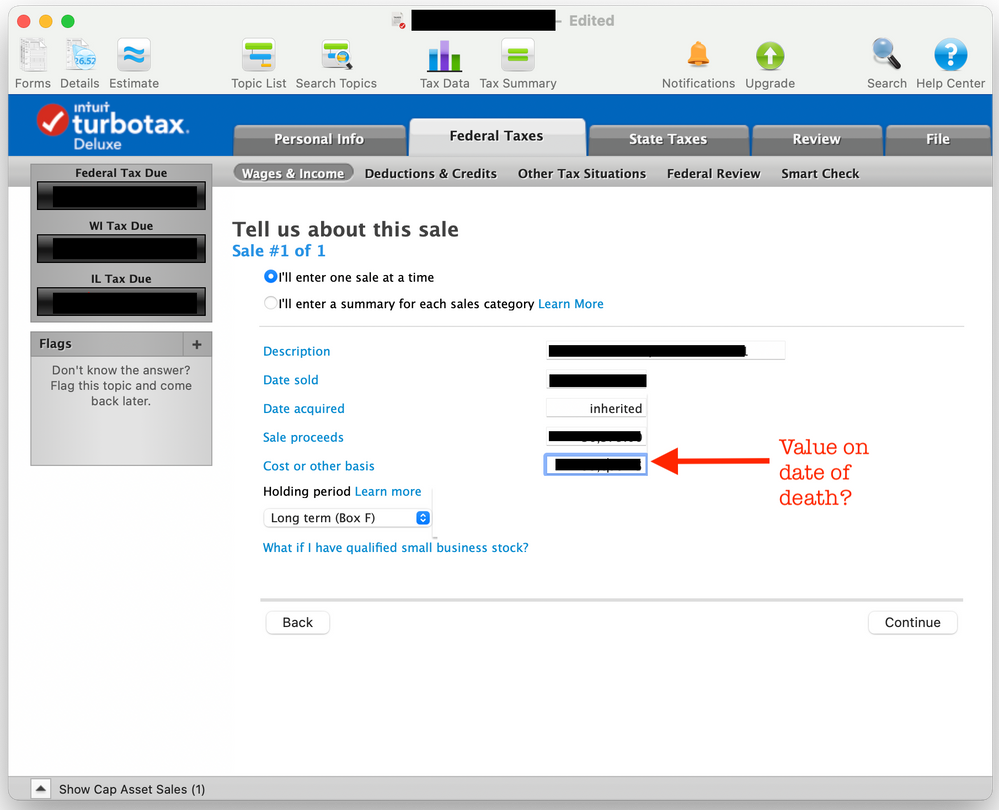

So, my plan is to put the estimate of value on the date of death in the “Cost or other basis” field on the Tell us about this sale screen:

And put the two types of adjustments on the Select any less common adjustments that apply screen:

Is this a good approach? The accountant in me wants to show lots of detail so that amounts are easy to tie back to source documents. But, maybe all this detail just raises unwarranted questions for the IRS. Maybe I’m better off just netting all three values and reporting the total in the “Cost or or other basis” field.

What are your thoughts on reporting the seller’s basis in the real estate?

Thank you for your help.