- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Illinois Property Tax, not receiving a credit for 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Property Tax, not receiving a credit for 2020

Made under 100K in 2020, paid over $3000 in property tax in 2020 but for some reason I am not receiving the property tax credit this year, shows 0 credit, first time I have never qualified for the credit... Anyone else having this issue? Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Property Tax, not receiving a credit for 2020

The property tax credit is nonrefundable, meaning that it can only offset any tax you owe, and you can't get a refund of the credit amount.

It's also possible that you don't qualify this year, or that you input information in TurboTax that makes the program believe that you don't qualify.

Please see Publication 108, Illinois Property Tax Credit for possible issues you may be encountering.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Property Tax, not receiving a credit for 2020

I just came across the same issue. There is an error in TurboTax. My Illinois return shows a preperty tax credit of zero. On schedule ICR, which is used to compute the credit, the credit is properly computed on line 4g. Then on line 5 it says to take the lesser of line 4g and line 3 (tax due before nonrefundable credits). The amount TurboTax put in there is zero. Clearly an error. I suggest you fill out your own Illinois form, if you have not already filed, put the correct amount in line 5 (most likely the amount from line 4g). Adjust line 6 of schedule ICR and follow the changes onto the IL-1040 so you can take the credit. It is near the end of the return, so there will not be that many lines to change.

If you have filed without taking the credit, you should be able to file an amended return.

I have been doing my state return for years (this is the first year using TurboTax) and that is definitely an error. As long as you have tax due you can take the credit. (It is nonrefundable, so the credit is limited to the tax due before the credit.)

I can't find any way to contact TurboTax to report this error, but hopefully someone monitors this board.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Property Tax, not receiving a credit for 2020

@lennysoffer I have flagged your post for the Moderator, although I haven't seen any other reports of this error. But, if you are using TT desktop, be sure to run a program update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Property Tax, not receiving a credit for 2020

I have the same problem. I am using turbotax on the web (Safari). I just spent an hour on the phone with turbotax support and they couldn’t figure out how to get to the schedule ICR to correct the error. Illinois accepted my return last night and then this morning they said Illinois rejected it because the property number was zero. It is so frustrating. I hope they fix this bug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Property Tax, not receiving a credit for 2020

Same problem for 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Property Tax, not receiving a credit for 2020

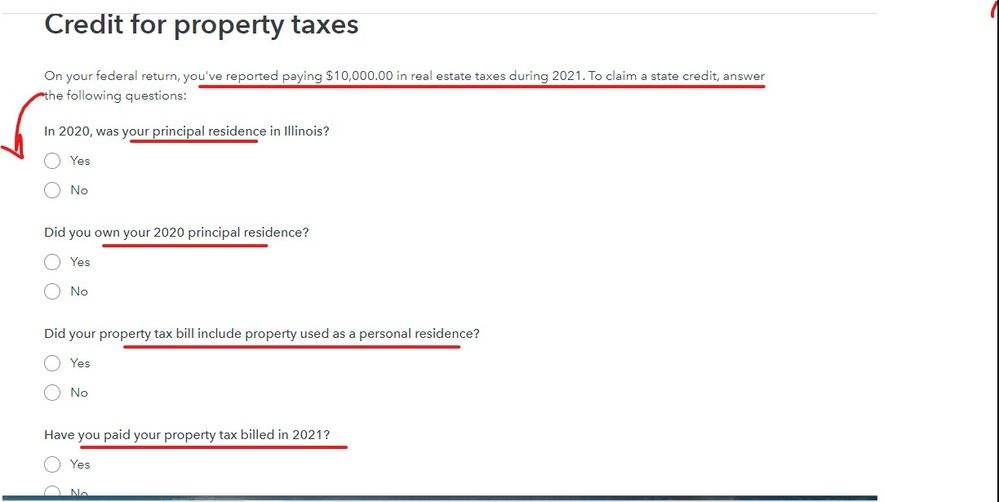

1. Was your principal residence during 2020 located in Illinois?

2. Did you own your 2020 principal residence?

3. Did you pay your property tax billed in 2021?

4. Did the property tax bill include property used as your personal residence?

5. How much did you pay in real estate taxes?

6. How much tax on IL-1040, line 14?

7. How much credit for taxes paid to other states? (line 15, form IL-1040)

I just ran a quick test, and my credit appeared, so what are your answers above?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Property Tax, not receiving a credit for 2020

Thanks for your reply. I did not realize that there is one additional condition that must be met and that is beginning 2017 there is an income limit. Here is the relevant language from the Illinois department of revenue website:

The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax (real estate tax) you paid on your principal residence. You must own and reside in your residence in order to take this credit. For tax years beginning on or after January 1, 2017, the Illinois Property Tax Credit is not allowed if a taxpayer's federal Adjusted Gross Income (AGI) exceeds $500,000 for returns with a federal filing status of married filing jointly, or $250,000 for all other returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Property Tax, not receiving a credit for 2020

@BillM223 I have the exact same problem, but not only do I meet the criteria for the tax credit, but I do not exceed the income limitations that were described.

TurboTax has to be incorrect. I am showing ZERO credit and I should be entitled to a 5% property tax credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Property Tax, not receiving a credit for 2020

To clarify, this is for 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Property Tax, not receiving a credit for 2020

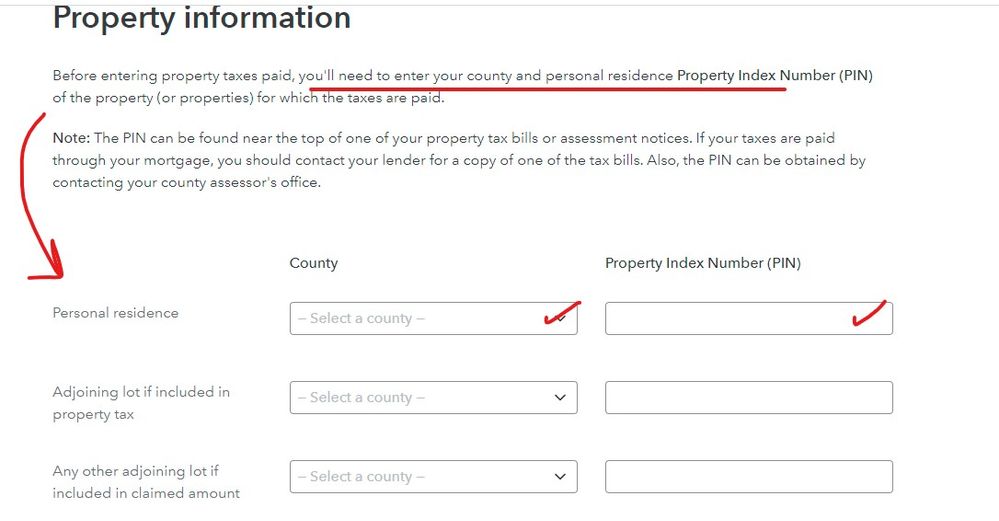

If you entered the RE taxes in the federal Deductions and credits tab then when you get to the state section you will see these screens which you must fill in to get the credit ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Illinois Property Tax, not receiving a credit for 2020

Turbotax did work for me. I was just over the income threshold and did not get a credit. So I made an IRA contribution to reduce my AGI to just below the cut-off and received the 5% property tax credit.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

powelltyler95

New Member

Breezy02

New Member

boohbahsmom

New Member

Jeff-W

Level 1

johnnyschine2355

New Member