- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I worked in NJ but by company has w2 address in MA. Also, they had state tax deduction for MA. Do i need to file state tax for MA? I am filing as NJ resident.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I worked in NJ but by company has w2 address in MA. Also, they had state tax deduction for MA. Do i need to file state tax for MA? I am filing as NJ resident.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I worked in NJ but by company has w2 address in MA. Also, they had state tax deduction for MA. Do i need to file state tax for MA? I am filing as NJ resident.

Yes. You will have to file a Massachusetts income tax return if you had MA tax withheld from your pay:

- Either your company made a mistake—in that case you will file to get back tax that should not have been withheld; or

- You have to pay MA tax.

It seems like a mistake. Massachusetts is taxing nonresidents who worked in MA prior to the pandemic but are now working from home. If that's you, then you have to pay MA tax. You can claim a credit on your New Jersey return for tax paid to MA.

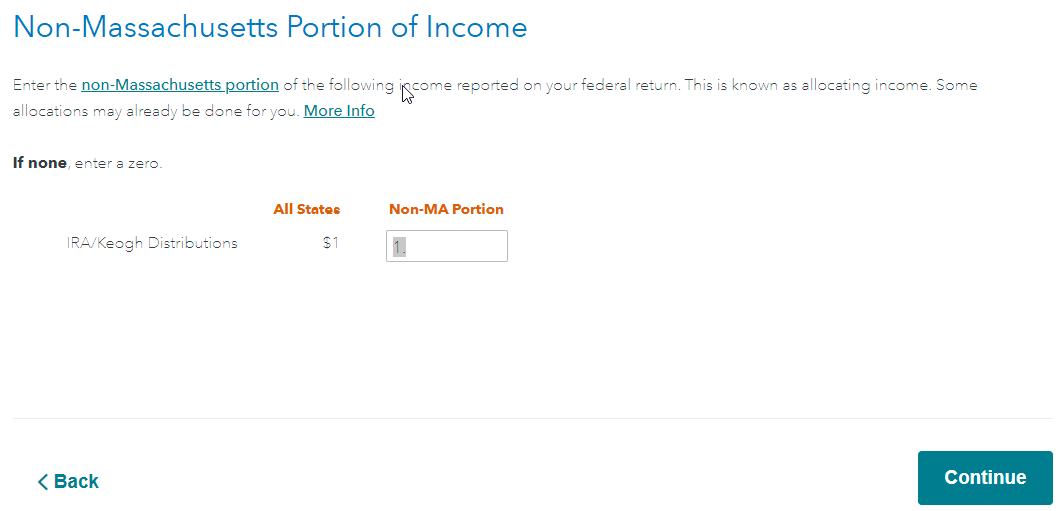

Otherwise you can file a MA return to get back your withholding. TurboTax will show you the types of federal income you have and a box for "Non-MA." All your income should be "Non-MA" making your MA income is $0.

Mail your MA return and attach an unsigned copy of your NJ return with a note explaining that your company take out MA tax by mistake.

Massachusetts says:

Pursuant to the regulation, for the duration of the Massachusetts COVID-19 state of emergency, all compensation received for personal services performed by a non-resident who, immediately prior to the Massachusetts COVID-19 state of emergency, was an employee engaged in performing such services in Massachusetts, and who, during such emergency, is performing such services from a location outside Massachusetts due solely to the Massachusetts COVID-19 state of emergency, will continue to be treated as Massachusetts source income subject to personal income tax under M.G.L. c. 62 and personal income tax withholding.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nirbhee

Level 3

sbansban

Level 2

jackkgan

Level 5

StPaulResident

Returning Member

rroop1

New Member