Native Americans who work and live on a reservation and are enrolled members of a tribe or nation recognized by the United States or by New York State, can subtract income included in federal AGI and earned on that reservation.

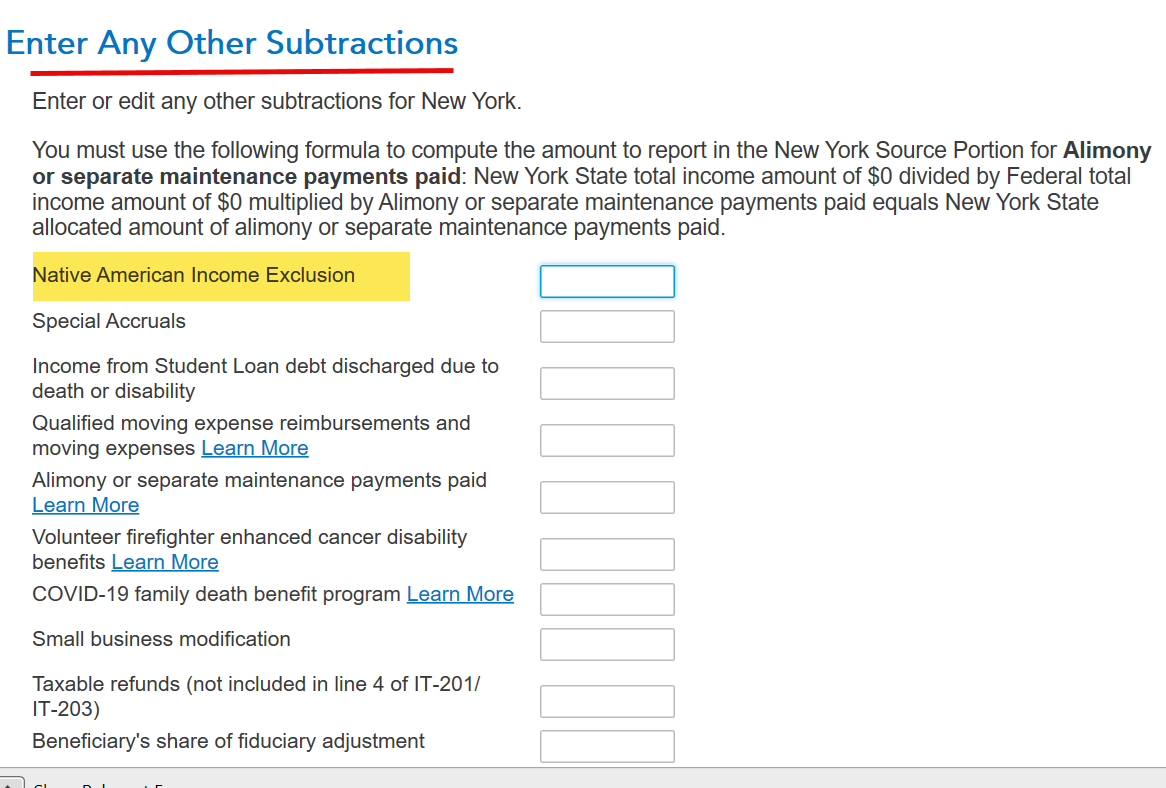

When you go through the NY state return, on the Enter Any Other Subtractions page, the first item is Native American Income Exclusion.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"