- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I moved from New York to Virginia 2 years ago. I recently received a backpay from NY with NY State taxes deducted when I now live in VA. do I need to pay VA instead?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from New York to Virginia 2 years ago. I recently received a backpay from NY with NY State taxes deducted when I now live in VA. do I need to pay VA instead?

I haven't worked in NY since I moved to Virginia. Do I need to file new york to get the money back and account the backpayment to Virginia when I file even though it was earned originally when I lived in NY?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from New York to Virginia 2 years ago. I recently received a backpay from NY with NY State taxes deducted when I now live in VA. do I need to pay VA instead?

VA will tax all income received from all sources period. So what you will need to do is file a non resident NY return and a resident VA return where they will give you credit for any NY taxes you owe. Complete the returns in that order so the program completes the credit correctly ... NY FIRST then VA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from New York to Virginia 2 years ago. I recently received a backpay from NY with NY State taxes deducted when I now live in VA. do I need to pay VA instead?

It might be worth a call to the NY Department of Taxation and Finance to see of you are entitled to a refund (probably not).

It's, most likely, a double whammy. NY probably considers it taxable by NY because it was earned there. VA considers it taxable because it was received while you were a VA resident. But VA will give you a credit, or partial credit, for the net tax you pay to NY. So, there will actually be little or no double taxation. But you will probably pay more state tax because NY has a higher rate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from New York to Virginia 2 years ago. I recently received a backpay from NY with NY State taxes deducted when I now live in VA. do I need to pay VA instead?

Thanks you both for the great information!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from New York to Virginia 2 years ago. I recently received a backpay from NY with NY State taxes deducted when I now live in VA. do I need to pay VA instead?

when I file for my non-resident new york state taxes, do I need to report only the paycheck/income where new york state taxes were deducted, or do I report all income received in 2021, for even those paychecks where I earn in Virginia, and Virginia deducts state taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from New York to Virginia 2 years ago. I recently received a backpay from NY with NY State taxes deducted when I now live in VA. do I need to pay VA instead?

Yes, all the income that you reported on your federal return will flow to your NY non-resident return and VA return if you are using Turbo Tax. When you prepare your NY return, you will be asked to allocate your NY source income from the other income reported. Once you finish your NY state return, you will be given a credit on your VA return for the taxes paid to NY.

Make sure you prepare your NY non-resident return first to ensure that you are given credit for your taxes paid to NY.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from New York to Virginia 2 years ago. I recently received a backpay from NY with NY State taxes deducted when I now live in VA. do I need to pay VA instead?

@timk78 wrote:

when I file for my non-resident new york state taxes, do I need to report only the paycheck/income where new york state taxes were deducted, or do I report all income received in 2021, for even those paychecks where I earn in Virginia, and Virginia deducts state taxes?

Your NY non-resident tax return only reports and pays tax on NY-source income paid to you in 2021. However, you will probably be asked by Turbotax to manually allocate your income. (You will be asked to allocate all your income, including bank interest and investments as well. It's a bit annoying, but nothing would be NY source income except this back pay.)

Separately, I'm not entirely convinced this is NY-source income. However, because of the VA tax credit for out of state taxes paid, and the fact that NY's income tax rate is only 0.75% higher than VA's rate (for most taxpayers) it's probably not worth it to make a fight over it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from New York to Virginia 2 years ago. I recently received a backpay from NY with NY State taxes deducted when I now live in VA. do I need to pay VA instead?

my wife only has income from Virginia. Should I file a joint federal return, but file separately in the NY return for myself since she didn't receive any payment from NY? Not sure if the tax consequences would be the same if I file as (married but filing separately) so that NY only calculates my NY income w/o factoring her VA income when they do their calculation. Or does it not matter whether I file jointly in NY or separately?

Also, just fyi, if i try to file jointly on both federal, it rolls over automatically as joint for NY state. Turbotax advises to file one jointly as federal, and another mock federal as separate so that it doesn't flow downsteam to the NY filing as joint during their automatic data download from federal to state.

I noticed when I filed jointly in the state, I have a refund of 500 from NY, but I paid 1500 in taxes from my paycheck. Shouldn't I get most of the 1500 back since I'm a non-resident? In their tax summary calculation, they seem to be totaling the amount taxed by NY based on the sum of my wife's (VA) income and my income (VA plus the NY backpay). I just don't want NY to tax both my wife's VA income and my VA income. I would like to only file for the backpay I received (not the VA income) when i file in NY separate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from New York to Virginia 2 years ago. I recently received a backpay from NY with NY State taxes deducted when I now live in VA. do I need to pay VA instead?

NY uses all income to create your NY tax then it multiplies that by the percentage that was actually NY income. It looks confusing on the return because it shows all income and the next line is NY tax. Keep going and you will see the NY percentage.

For example:

- NY tax on your federal income is $8,000

- But only 10% of your income was earned in NY

- NY tax liability will be 10% of $8,000 or $800.

Here is how NY return works:

- The Federal AGI is used as a denominator and only the NY income as the numerator to calculate the percentage of income earned in NY. on line 45.

- NY determines the tax on your entire federal income, line 37, then multiplies the tax times the percentage just determined to create your actual tax on line 50.

- Tax withheld on line 62

Let me get you to preview your return and check.

- If you are using the online version:

- go to Tax Tools,

- then select Tools,

- select View Tax Summary,

- on the left side, select Preview My 1040.

- In the desktop program, switch to forms mode.

Your resident state taxes all income but gives a credit for income taxed by another state. Please carefully follow these directions to prepare the states in a special order. You may need to delete both states and begin again.

- First, prepare your non-resident NY return. This creates your tax liability for the non-resident state. How do I file a nonresident state return?

- Then prepare your resident state return and it will generate a credit for your income already being taxed in the non-resident state.

- The credit will be the lower of the state tax liabilities on the same income. You may owe your resident state, if they have a higher tax rate.

It isn't possible for the program to create a credit before it knows the liability. Your returns may be wrong if you do not prepare the states in this order.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from New York to Virginia 2 years ago. I recently received a backpay from NY with NY State taxes deducted when I now live in VA. do I need to pay VA instead?

We can’t see your tax return so we don’t know what you have done. It should be possible to file in your situation. You just have to make sure that you are filing a nonresident New York return and not a resident or partier resident return.

At the very beginning of the personal interview when you enter your Virginia address, TurboTax will ask if you earned income in any other state. When you check yes, that should bring up a series of questions about whether or not you moved, where you lived and whether you were a resident or non-resident of the other state.

into your joint federal return as normal. When you come to the state section, do New York first. You should be able to tell the program that you were a New York non-resident. In that case, TurboTax should bring up a list of all of the income that you entered on the federal return for both yourself and your wife, and ask you to allocate that to New York State. All of your income will be zero for New York State except this bonus we are talking about.

New York’s income tax rate is about 7% unless your income is more than $1 million. So $1000 of New York tax would mean that the bonus would have to be about $14,000. If that is not the case, the only way to check your figures would be to print a copy of your full state return and see how you allocated your income. But you said you had $1500 withheld from this bonus, so it obviously wasn’t a small bonus. There’s no reason you would owe less state tax by being a non-resident, the tax rates are the same.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I moved from New York to Virginia 2 years ago. I recently received a backpay from NY with NY State taxes deducted when I now live in VA. do I need to pay VA instead?

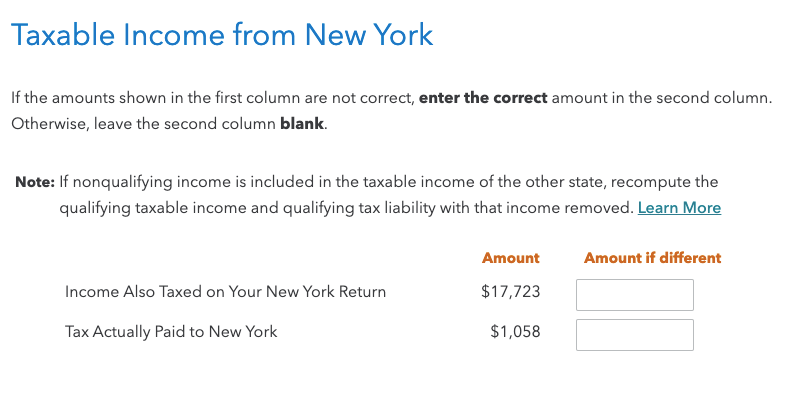

Hi,

what does "income also taxed on your new york return" mean? I can't find the number, 17,723, anywhere on my w2. Is this something calculated?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Rprincessy

New Member

q1williams

New Member

cordovasoftball

New Member

rkplw

New Member

mulleryi

Level 2