- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

Someone else had this issue.

....what worked for them was to take the tax-exempt $$ for their own state, and put those on a separate form....designating all as being from their home state....and then the original form would all be designated as "Multiple states"

______

So if the combined $$ were in box 12 of a 1099-DIV, the NY (or CO) person would subtract the NY (or CO) $$ from that original combined 1099-DIV...and put those $$ in box 12 of a new separate 1099-DIV....marking it all as NY (or CO)..... and the original 1099-DIV would be marked as "Multiple States"

__________

That worked for them.....not supposed to have to do that...but we just work it out as best we can.

Maybe a fix will be in place for this week's software update (Wed or Thurs nights)....or maybe they don't know about it yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

I have the same problem with the Colorado version. Non-Colorado tax-exempt interest doesn't seem to be added to the Colorado 2022 return. This worked as expected for the 2021 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

Someone else had this issue.

....what worked for them was to take the tax-exempt $$ for their own state, and put those on a separate form....designating all as being from their home state....and then the original form would all be designated as "Multiple states"

______

So if the combined $$ were in box 12 of a 1099-DIV, the NY (or CO) person would subtract the NY (or CO) $$ from that original combined 1099-DIV...and put those $$ in box 12 of a new separate 1099-DIV....marking it all as NY (or CO)..... and the original 1099-DIV would be marked as "Multiple States"

__________

That worked for them.....not supposed to have to do that...but we just work it out as best we can.

Maybe a fix will be in place for this week's software update (Wed or Thurs nights)....or maybe they don't know about it yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

Thanks for your help. I wouldn’t have thought of that on my own.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

One clarification--my issue was with a 1099-INT rather than 1099-DIV, but I suspect this same work-around will work for that situation as well.

So, I have to take a single downloaded 1099-INT and manually split it into 4 1099-INTs since TT doesn't handle more than one type of accrued interest adjustment for a single 1099-INT.

1. 1099-INT for normal interest (Box 1)

2. 1099-INT for US Government interest (Box 3)

3. 1099-INT for Colorado tax-exempt interest (my home state)

4. 1099-INT for non-Colorado tax-exempt interest (taxable on the Colorado return)

The need to split 1099s for the accrued interest issue is documented and has been that way for years. I always keep hoping they will fix that. The issue for Colorado/non-Colorado tax-exempt interest seems to be a new issue this year and is presumably a bug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

I am also a NYS resident with non-NY tax-exempt interest from a mutual fund. I have had this for many years and have always separated out NY and non-NY on separate forms but this is not the first year that the addition to NY income has not transferred properly even though the numbers are entered in the correct spaces. In the past, I think it was eventually addressed by a software update, but as of today, it still hasn't updated for this year. Everything else has been ready to go for some time, but I cannot file until this is fixed because if I enter it manually and an update comes along, my tax will be wrongly high and if I wait for an update that doesn't come, the tax will be wrongly low. How do we get an estimated date of update? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

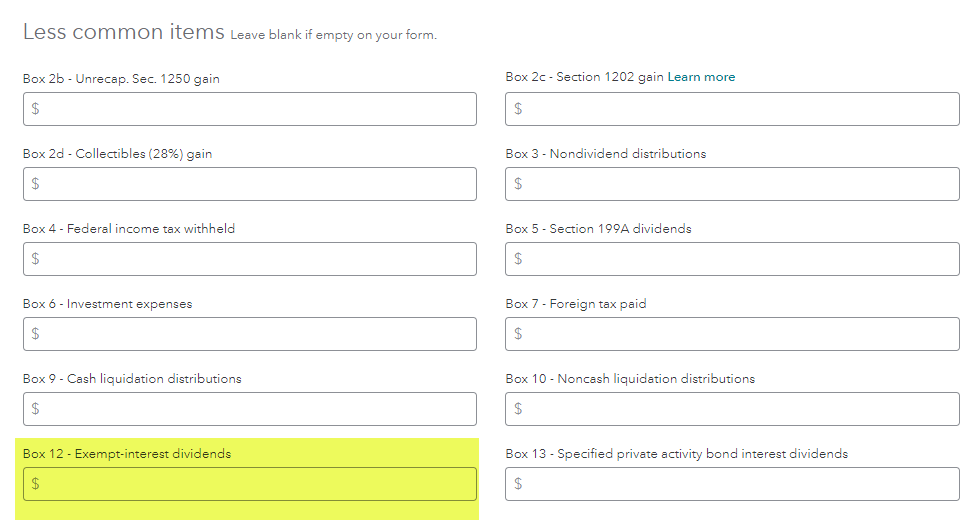

No, you do not need to wait for an update or list them manually and there is a way to determine if you entered them as non-taxable for NYS although it is a bit of a roundabout way to see. First thing is how did you enter the dividends on the main screen? Below is a typical dividend entry screen and the numbers showing are for example only:

The above shows that the checkbox after box 2a indicates additional information from the 1099-DIV needs to be entered. Box 12 that is highlighted indicates that there are exempt interest dividends to be entered. If they are fully exempt you would enter them here. If they are only State exempt enter what is shown on the 1099-DIV and click continue.

The next screen shown below tells TurboTax that some of the dividends would not be taxable at the state level. Place a check in the first box as indicated and click continue.

The next screen will ask you what portion of the dividends represents a non-taxable distribution for state tax purposes. The default is for exempt interest dividends but it also applies to dividends not taxable at the state level or for a specific state if that is the case.

Once the above is entered, if you wish to determine that the dividends have been included in New York Subtractions, follow the steps below. It may be cumbersome but you will know if you have entered the amount property to not be taxed but the State of New York.

Click on the left side of your screen and scroll down to Tax Tools and click on Tools, then View Tax Summary. The screen will show your federal tax summary so look back to the left and click on NY Tax Summary. Take note of the amount that shows on the fourth line for New York Subtractions. If you did not have any other subtractions for New York income the amount of the exempt dividends should be shown here.

If there are other subtractions, take note of the amount and write it down, click on the left where it says "Back" and you should revert back to the Investments and savings summary page. Scroll to your dividends, click on the down arrow and then edit and continue to where you entered the amount for exempt dividends.

Change the amount that shows in exempt-interest dividends from whatever you entered to $1 and then navigate back to the New York Tax Summary as we did above and check line 4 for New York Subtractions. Did it change? It should have from what you had in there to a smaller number. After reviewing, navigate back to the exempt-interest dividends and enter the correct amount and you should be good to go. Again, I understand this seems somewhat cumbersome but it should give you the reinforcement that you are not going to be taxed at the state level on exempt dividends you received.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

Thanks for the quick and detailed response. But unfortunately it doesn’t quite address my issue. I’m not having a problem with federal bond interest being subtracted from my NY return. Rather, I can’t get non-NY municipal bond interest to be added into my NY income. On the “Tell us more about your exempt-interest dividends” page, first I entered the amount of my NY generated municipal bond income and then I entered the remainder as attributable to “multiple states”. The remainder should be a NY addition but it doesn’t show up in either the NY Tax Summary (thank you for showing me this feature!) or the final printed return. I’m happy to split the 1099 in two to resolve the problem as suggested by another user, but if there’s another fix, please let me know. I appreciate you taking the time to look into this problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

Thank you Joseph S1 for your reply, but as the original poster has commented, most of these details do not address the actual problem. These are not government obligations directly, but municipal bond mutual funds from regulated investment companies. Although these funds are federal tax free, NY State taxes the portion attributable to non-NY sources (other states). That portion is a NY *addition,* not a subtraction. NY State does *not* tax NY sources and nothing needs to be subtracted.

I have owned this fund for many years and also used TurboTax for many years. I have long split out NY and non-NY amounts in separate entries in order to facilitate this process. The appropriate number is correctly entered in Box 12, Tax Exempt Income and noted as More Than One State. I understand where the number goes and what should happen according to how TurboTax functioned in previous years. This number should automatically transfer to the NY State return *additions* section, but it is not happening yet this year. I imported my data into 2022 TurboTax directly from 2021 TurboTax. All I did, and should need to do, unless something in 2022 TurboTax has changed, is update the number for 2022 figures.

TurboTax is currently showing my additional income of that type as zero, when it is *not* zero. This isn't user error or unfamiliarity with TurboTax on my part. This is a TurboTax glitch that needs to be updated. I hope it will be soon and if you have any information on when that will be, I would appreciate it. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

Did my original breakout into two 1099-DIV forms work?

OR are you just not ready to try it.

_______

Software fixes come on Wed or Thursday evenings...so if you want to wait to see if the proper 1-form way is fixed, you would wait until Friday and check again then.

(You might have to delete the original 1099-DIV and re-enter it again. Make sure you step thru the NY Q&A again to ensure the data at least attempts to transfer to NY.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

Hi Steam Train,

Yes. I tried your solution today and it worked! Thanks for the help. I never would have come up with this fix on my own. Let’s hope they fix this problem next year.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

We had the same problem with our 2022 Colorado return. It did not add the taxes back to the state return. Unfortunately we submitted it before noticing.

Now trying to amend but cannot find the interview question or section to make it show up on the amended return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

I suspect that you would do it this way.

1) Start the CO amended tax return process.

2) Then go to the Federal section...In the Wages&Income area, for either the 1099-INT or 1099-DIV (or both) that show tax exempt $$ on them....and break out the CO Bond $$ from "Multiple States" $$ into separate 1099-INT and 1099-DIV forms the way I indicated above.

You aren't really needing to amend the Federal section, since the total $$ reported there are exactly the same (If you do it right)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

thank you so much. This helped me get it right -- very helpful and clear

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm a NY resident with non-NY exempt interest dividends which I've entered. They don't show up as an "addition" on my NY tax form. Anyone have the same issue?

have same issue and I've been audited by NYS where is income entered for line 20 on return?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

powderjack

New Member

thisblows

Returning Member

dalibella

Level 3

scatkins

Level 2

user17539892623

Returning Member