- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

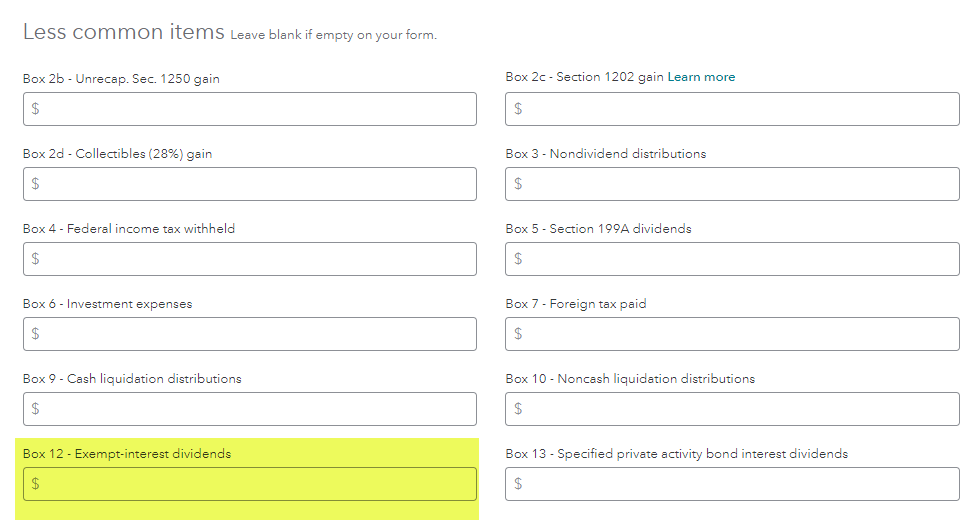

No, you do not need to wait for an update or list them manually and there is a way to determine if you entered them as non-taxable for NYS although it is a bit of a roundabout way to see. First thing is how did you enter the dividends on the main screen? Below is a typical dividend entry screen and the numbers showing are for example only:

The above shows that the checkbox after box 2a indicates additional information from the 1099-DIV needs to be entered. Box 12 that is highlighted indicates that there are exempt interest dividends to be entered. If they are fully exempt you would enter them here. If they are only State exempt enter what is shown on the 1099-DIV and click continue.

The next screen shown below tells TurboTax that some of the dividends would not be taxable at the state level. Place a check in the first box as indicated and click continue.

The next screen will ask you what portion of the dividends represents a non-taxable distribution for state tax purposes. The default is for exempt interest dividends but it also applies to dividends not taxable at the state level or for a specific state if that is the case.

Once the above is entered, if you wish to determine that the dividends have been included in New York Subtractions, follow the steps below. It may be cumbersome but you will know if you have entered the amount property to not be taxed but the State of New York.

Click on the left side of your screen and scroll down to Tax Tools and click on Tools, then View Tax Summary. The screen will show your federal tax summary so look back to the left and click on NY Tax Summary. Take note of the amount that shows on the fourth line for New York Subtractions. If you did not have any other subtractions for New York income the amount of the exempt dividends should be shown here.

If there are other subtractions, take note of the amount and write it down, click on the left where it says "Back" and you should revert back to the Investments and savings summary page. Scroll to your dividends, click on the down arrow and then edit and continue to where you entered the amount for exempt dividends.

Change the amount that shows in exempt-interest dividends from whatever you entered to $1 and then navigate back to the New York Tax Summary as we did above and check line 4 for New York Subtractions. Did it change? It should have from what you had in there to a smaller number. After reviewing, navigate back to the exempt-interest dividends and enter the correct amount and you should be good to go. Again, I understand this seems somewhat cumbersome but it should give you the reinforcement that you are not going to be taxed at the state level on exempt dividends you received.

**Mark the post that answers your question by clicking on "Mark as Best Answer"