- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I have a very important question and it is that I live in Massachusetts, but I work in Connecticut, and in my work they give me two W2s, in which part should I put what they take away from the state o

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a very important question and it is that I live in Massachusetts, but I work in Connecticut, and in my work they give me two W2s, in which part should I put what they take away from the state o

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a very important question and it is that I live in Massachusetts, but I work in Connecticut, and in my work they give me two W2s, in which part should I put what they take away from the state o

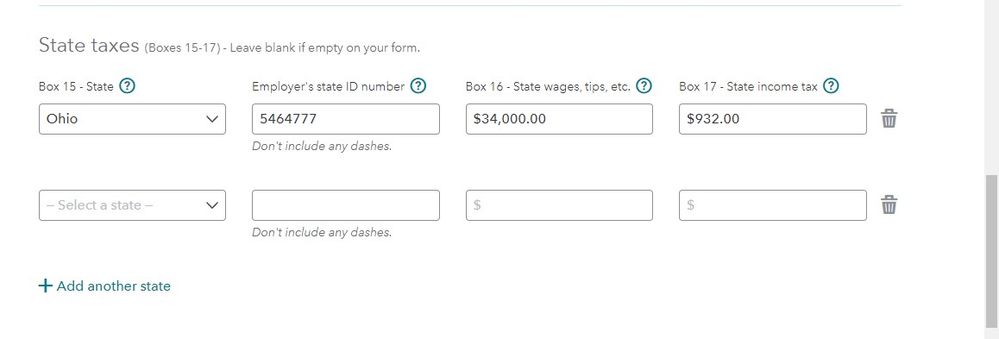

Even though they gave you two W2's you only enter all of the information from one W2 into TurboTax. Then you take the other W2 and go to the state taxes section of the W2. Click the box that says "Add Another State"

Then just type in the information from the second W2 in Box 15, the state ID, and Boxes 16 and 17.

I am assuming that every other field on the 2nd W2 matches the numbers on the first one. That is how most employers handle your situation. If they truly broke up the work between the states and the numbers are all different then you would enter two separate W2's.

Please contact TurboTax for assistance if this is not enough information for your situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a very important question and it is that I live in Massachusetts, but I work in Connecticut, and in my work they give me two W2s, in which part should I put what they take away from the state o

By putting in the same amount of what you earn, does not double the amount ??? I thought that you only had to put box 15 the employer's ID and 17 ??? Thanks @MissMCJ

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a very important question and it is that I live in Massachusetts, but I work in Connecticut, and in my work they give me two W2s, in which part should I put what they take away from the state o

Do your non-resident state return first.

Then take the credit for taxes payed to other jurisdictions on your resident state tax return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a very important question and it is that I live in Massachusetts, but I work in Connecticut, and in my work they give me two W2s, in which part should I put what they take away from the state o

@edwinomar33 Please use this correct answer from Champ @DJS provided in your other thread:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a very important question and it is that I live in Massachusetts, but I work in Connecticut, and in my work they give me two W2s, in which part should I put what they take away from the state o

What you doing is showing your state earnings for each state. By putting in box 16 for each state it will not double anything. It is the boxes on top that would double up your federal income. Box 16 only carries to the state returns. And it will not double up, it will have the right amount on each state return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

PCCMCC

New Member

JoeJiang2023

Returning Member

fcp3

Level 3

JohnS2024

New Member

CC444

Returning Member