- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I dont understand arizona municipal intrest ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I dont understand arizona municipal intrest ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I dont understand arizona municipal intrest ?

AZ municipal Interest usually refers to any AZ-sourced Municipal bonds you may own...such that the interest was received by you from Bonds issued by an AZ-city/county/state government entity.

To the extend that the AZ-Muni-interest did come from AZ-based bonds, that interest would not be taxable by AZ.

1) IF you own individual bonds, where the total Muni-interest was reported in box 8 of a 1099-INT form, any interest from AZ bonds can be broken out separately from the rest of the $$ in box 8, adn might (possibly) give you a bit of income deduction for your AZ taxes

2) IF you own Mutual Bond Funds, where the total Muni-interest was reported in box 11 of a 1099-DIV form, any interest from AZ bonds can be broken out separately from the rest of the $$ in box 11, and also might (possibly) give you a bit of income deduction for your AZ taxes.

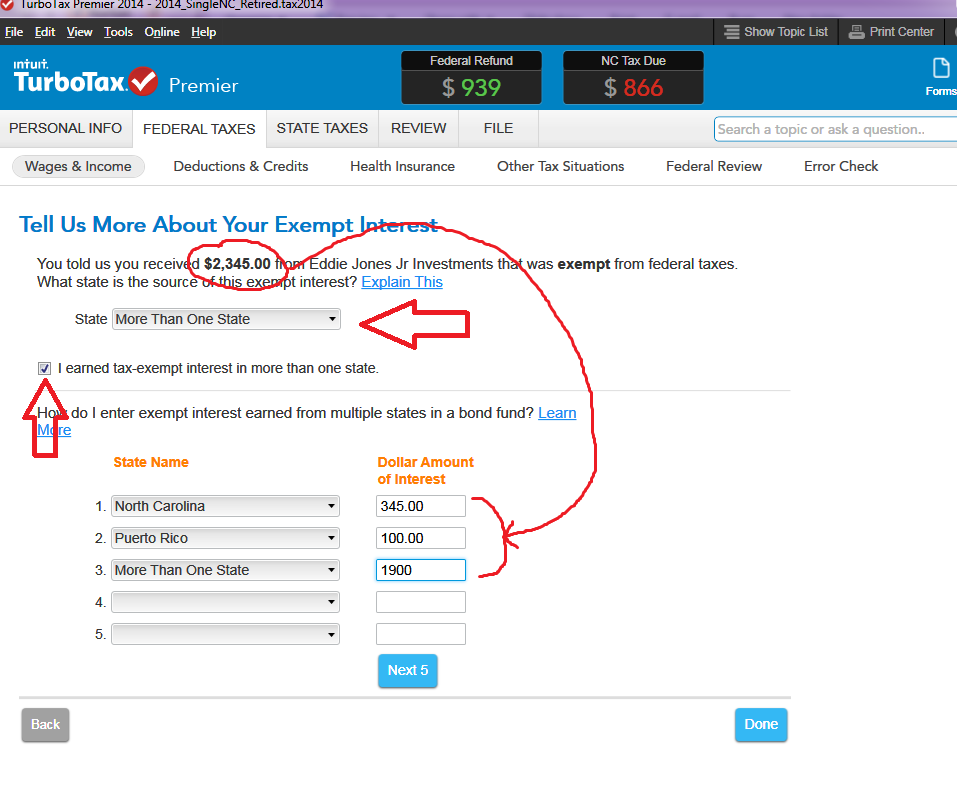

For both cases 1 and 2 above, you would have to identify the exact $$ amount that came solely fro AZ bonds form the information the Broker sent you...If the $ amount from AZ bonds is small, or you cannot calculate the exact AZ amount, then you just signify that it all came from "Multiple States" at the end of the list of states (Desktop software uses the term "More than one state" )

__________________________________

Example of a Muni break-out for an NC resident (IF you have Muni-interest from a US territory, that can be broken out too since your state would not tax ta hat interest either):

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I dont understand arizona municipal intrest ?

Most mutual funds will provide a breakdown. But they don't automatically sent it to you. You usually have to ask for it, or find it on their web site. The individual state amount can be small (average about 2% per state) and some people just don't bother with it.

If your mutual fund company provided you a breakdown, you are only interested in your home state (AZ apparently). Multiply the % for your state by your total tax exempt dividends to get a $ amount (you can't enter the % in TurboTax [TT]). When asked which state, check the box "I earned tax exempt dividends in more than one state". In the drop down menu, select your state and enter the $ amount you calculated. In the 2nd box, select "More than one state*" (at the bottom of the scroll down list) and enter the remaining dollar amount.

Your state will tax all the dividends except the dividends from municipal bonds from your state and US Territories.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jkucins

Returning Member

saelon

New Member

JohnHP

New Member

BarryJK

New Member

DanaJW

Returning Member