- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

Unfortunately, I'm using the online version, not the desktop version. But, I'llgive it another try tomorrow. But, trust me, I did the efile of both my federal and state returns. The federal return was accepted, but the state return was rejected due to incomplete address on the 310 form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

Well, I just tried again, and the Arizona return is still being rejected. Accordingly, here is the reject code/info:

Arizona return rejectionReject Code /ReturnState/ReturnD

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

To correct this error, please follow these steps:

1. Click Fix (If you haven't done so already).

2. Enter your address in the blank box.

3. Click Continue.

4. Click Tax Tools. (This will be located on the left side of your screen).

5. Click Tools.

6. Click Delete a form.

7. Scroll down till you see the state return forms, then select Delete beside Form 310.

8. Click Delete this Form.

9. Click Continue.

Now the error should be corrected for your Arizona return. You should be able to continue from the Review page of your return to complete filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

Again, I am claiming Solar Energy Tax Credit carryover, so deleting the form is not an option for me. Turbo Tax needs to fix the bug in form 310 than prevents it from allowing the full address.

Really tiring of support that doesn't read what the problem is.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

@patatkinson2 I have gone through both online and desktop versions now. Both versions are allowing me to put in very long street number and name, city, state, zip. I wonder if you have some stuck piece of information. I know you don't want to delete the form because of the carryover amounts. That would be a last option so try #7-10 below. If all fails, follow the whole thing. Just be sure to write down your carryover information first.

- Delete the form:

- Open or continue your return in TurboTax.

- In the left menu, select Tax Tools

- then select Tools.

- In the pop-up window named Tool Center,

- choose Delete a form.

- Select Delete next to the form/schedule/worksheet in the list and follow the instructions.

- Log out of your return

- Try one or more of the following:

- Don't use Internet Explorer.

- Clear cookies and cache, instructions on the links.

- Internet Explorer

- Mozilla Firefox

- Google Chrome

- Safari

- Safari for iOS (mobile devices)

- Sign in using a different browser.

- Sign in using a different device.

- Sign in using a different browser.

- Sign in using a different device.

- Log back into your return.

- Enter the form again.

Related:

Form 310 Instructions - Arizona Department of Revenue

Use lines 1 through 9 to figure your credit for the current tax year. Enter the address of the residence where you installed the solar energy device for which you are claiming the credit. Enter the cost of the solar energy device. The cost of installing the device may be included in the cost of the device.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

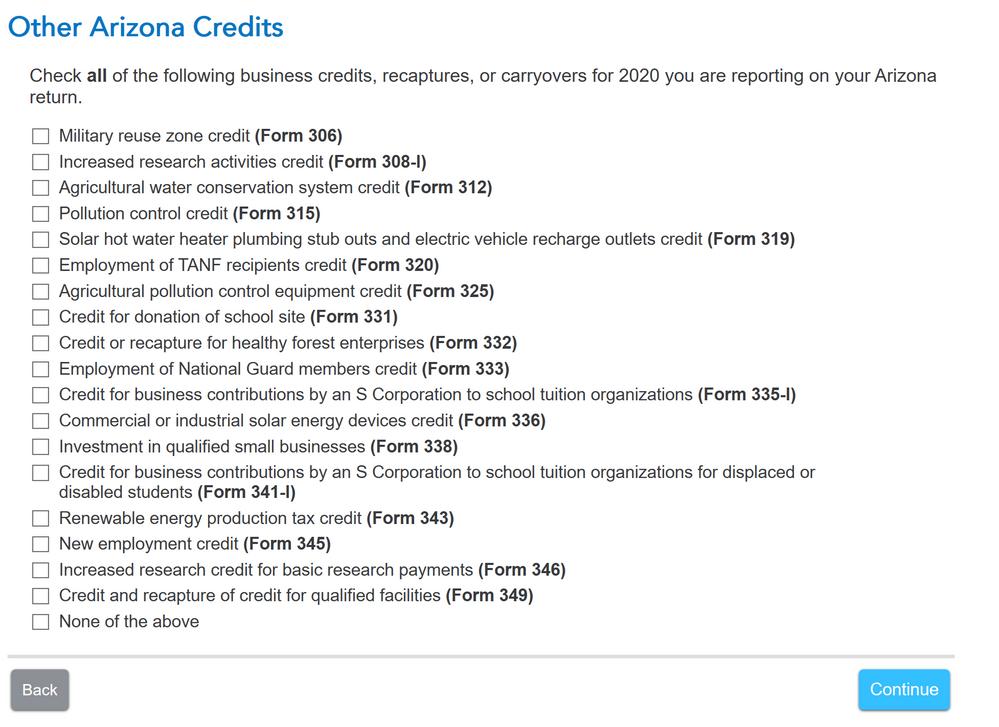

I have another complete opposite problem. We do have solar energy credit to claim (solar tubes with night light). But there is no way to find AZ Form 310, even after it is submitted to the federal return with 26% credit shown as federal refund. Please see the attached screen shot. Is this a bug in Turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

If you were Arizona resident you will be able to select AZ form 310 form the screen Other Nonrefundable Credits? However, if you are not an Arizona resident you won't have that option. To be eligible for this credit, you must be an Arizona resident who is not a dependent of another taxpayer.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

We of course are AZ residents.. We even haven't been outside of AZ last year due to COVID...LOL. We just have the option of "Other Arizona Credits" as shown in the screenshot above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

I recommend going over your state interview section again. There will be a screen titled Other Nonrefundable Credits that you should see before the screenshot you posted above.

- Select State in the black panel on the left hand side of your screen when logged into TurboTax.

- This will take you to a screen titled Let's get your state taxes done right. Click continue on this screen.

- You will see the following screen titled Status of your state returns. Select Edit to the right of Arizona.

Proceed through the screens until you see the following screen titled Other Nonrefundable Credits:

Be sure to mark the box titled Solar and wind energy devices.

Follow the prompts to enter your information as it applies to your tax return and the credit will be generated as applicable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

Ok got it! This page slipped thru when we entered the information. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

This didn't work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

Can you clarify what is happening on your return so we can assist you?

Are you able to access the pages as outlined above? If not, you may need to enter the information into the Federal interview section of the program as well to ensure if generate the credit on your Arizona return.

Residential Energy Credit details

Or do you not have any solar credit but the form is generating on your Arizona return?

Please comment so we can assist you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

Any luck with that? Working on the same issue right now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

Yes. I finally had to clear the form and start over. That time, it allowed me to fill in the complete address. Hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I don’t have solar energy installed and it’s asking for my adresss in Arizona form 310. I went to tax tools and delete forms and it’s not listed there.

Which issue are you referring to? There is a list of different things above, so we don't know which one you are referring to. Tell us what you have de and what messages you have gotten.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

AZCams Member 1989

Level 2

alexis-wallace3

New Member

kristobin

Level 2

romad

Level 2

Bugswell

Returning Member