- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- I am having issues completing box 14 on my W2. I work for the Long Island rail road and contribute to tier 1, tier 2, and tier 1 med. It keeps saying I over paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having issues completing box 14 on my W2. I work for the Long Island rail road and contribute to tier 1, tier 2, and tier 1 med. It keeps saying I over paid.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having issues completing box 14 on my W2. I work for the Long Island rail road and contribute to tier 1, tier 2, and tier 1 med. It keeps saying I over paid.

Try adding an additional box 14 entry with the amount reported in box 1 using the drop-down code RR for Railroad Retirement Compensation.

This should clear the error message.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having issues completing box 14 on my W2. I work for the Long Island rail road and contribute to tier 1, tier 2, and tier 1 med. It keeps saying I over paid.

Adding an additional box 14 entry with my wages lowered the amount I overpaid. But it still is saying I over paid. Is there anything else I can try? Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having issues completing box 14 on my W2. I work for the Long Island rail road and contribute to tier 1, tier 2, and tier 1 med. It keeps saying I over paid.

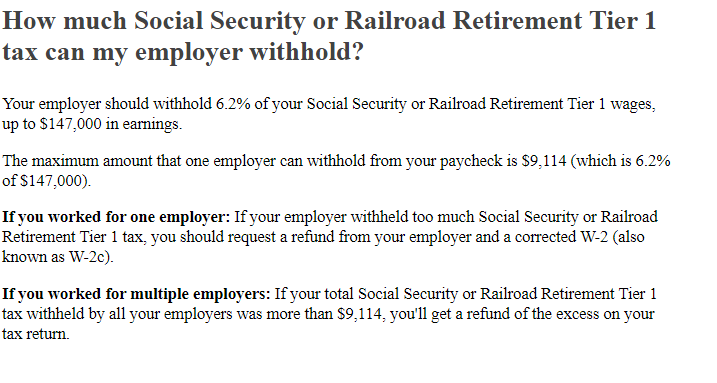

It is possible that your railroad Tier I or II tax is actually overpaid. Tier I should be 6.2% of your wages and Tier II should be 6.2%, up to wages of $147,000 of Railroad Retirement wages.

You will see this help box in TurboTax:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having issues completing box 14 on my W2. I work for the Long Island rail road and contribute to tier 1, tier 2, and tier 1 med. It keeps saying I over paid.

NYS on Turbo tax does not accept that, its saying to pick 414(h) exempt or taxable. but there is no 414 (h) on line 14 in Long Island Railroad, and Federal does not accept additional line description RR retirement compensation, shows up in red, very confusing. 414(h) tax exempt its ok but if you pick taxable calculates more tax than i think, not handled well by Turbo Tax, need more explnation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am having issues completing box 14 on my W2. I work for the Long Island rail road and contribute to tier 1, tier 2, and tier 1 med. It keeps saying I over paid.

The words in the description are causing the error and forcing you to choose 414(h) exempt or taxable in Box 14. Please try adding a space between words or changing to another description, such as Retirement. This should clear the error.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jmigala317

New Member

march142005

New Member

marisavelasco22

New Member

Primerrycaregvr

New Member

ue000013

New Member