- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- how to report a newly purchased refrigerator as expense in state tax return in the second year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to report a newly purchased refrigerator as expense in state tax return in the second year?

Hi,

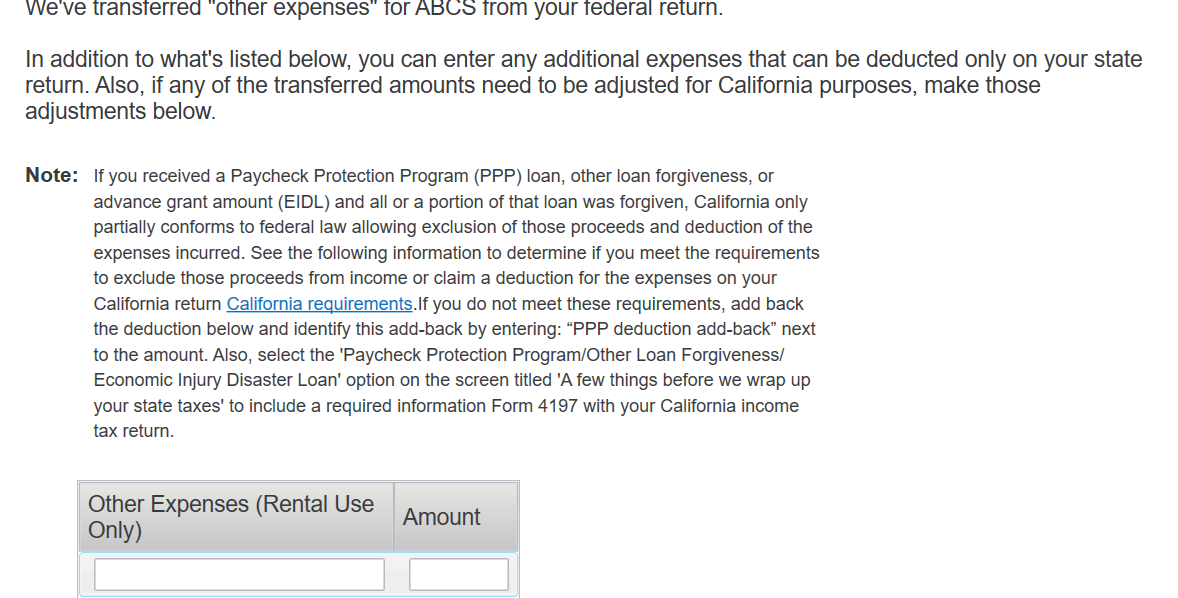

I started a rental property in 2021 and purchased a new refrigerator which I used section 179 to deduct it at the full price for federal tax return in 2021. As in California this refrigerator needs to be deducted in 5 years, so 4/5 of the full price was added back as income in state tax return in 2021. This year (2022), 1/5 of the purchased price should be claimed as expense in state tax return but not federal tax return. Wonder how to claim it in state tax return only? Please help.

Thanks,

Belinda

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to report a newly purchased refrigerator as expense in state tax return in the second year?

When you start or review your California return, you see a screen that says Here's the income that California handles differently and there is an option for Business that you need to choose that says Rental Adjustment. In that section, you will see a screen that says Other Rental Expense Adjustments. You can enter your depreciation not listed on your federal return in that section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

scatkins

Level 1

djpmarconi

Level 1

kac42

Level 1

SunnySix

New Member

user17549282037

New Member