- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How to determine income taxed by both NY and NJ

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to determine income taxed by both NY and NJ

Hi,

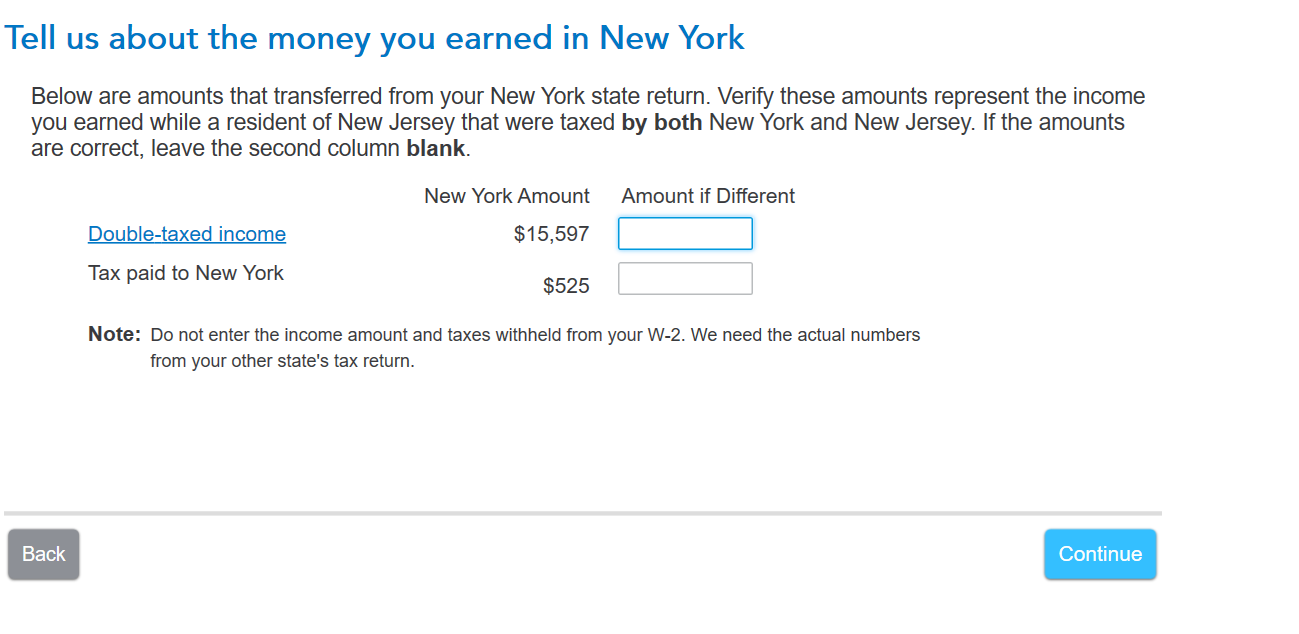

I live in NJ, but work in NY. I am filing out my NJ tax return form and I am trying to understand how to determine the amount taxed by both NY and NJ for credit.

From my NY return, I have the following:

- NY Non-resident AGI is $28,700

- NY taxable income is $32,200 (which is higher than my W2 NY income, which is confusing but maybe right due to this)

Which number should I put in as taxed by both NY and NJ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to determine income taxed by both NY and NJ

The income you should use comes from Line 29, Form NJ-1040 and should agree with your NY AGI, Line 31, Column B. The amount you enter as double-taxed income should appear under the New York column on the screen Tell us about the money you earned in New York. You should only enter this amount if different.

New York State uses the New York Income Factor when determining your tax amount. Their state return starts with all your taxable income and taxes it at the applicable New York State rate based on your total income. However, your NY taxable income should not be greater than your NY AGI,

Example:

I would like to take a deeper look at this. However, I need a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:

TurboTax Online:

- Sign into your online account.

- Locate the Tax Tools on the left-hand side of the screen.

- A drop-down will appear. Select Tools

- On the pop-up screen, click on “Share my file with agent.”

- This will generate a message that a diagnostic file gets sanitized and transmitted to us.

- Please provide the Token Number that was generated in the response.

TurboTax Desktop/Download Versions:

- Open your return.

- Click the Online tab in the black bar across the top of TurboTax and select “Send Tax File to Agent” *

- This will generate a message that a diagnostic copy will be created. Click on OK and the tax file will be sanitized and transmitted to us.

- Please provide the Token Number (including the dash) that was generated in the response.

*(If using a MAC, go to the menu at the top of the screen, select Help, then, “Send Tax File to Agent”)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

g456nb

Level 1

josht777

New Member

aashish98432

Returning Member

dabbsj58

New Member

jangsarah11

New Member