- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How to answer “Is any of this interest from funds with less than 50% of their assets invested in California and U.S. obligations?”

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to answer “Is any of this interest from funds with less than 50% of their assets invested in California and U.S. obligations?”

How to answer “Is any of this interest from funds with less than 50% of their assets invested in California and U.S. obligations?”

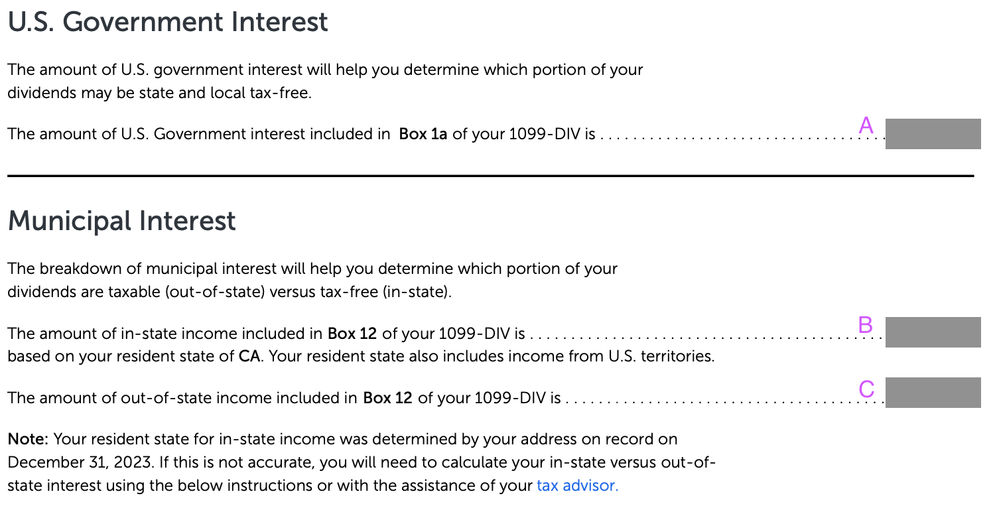

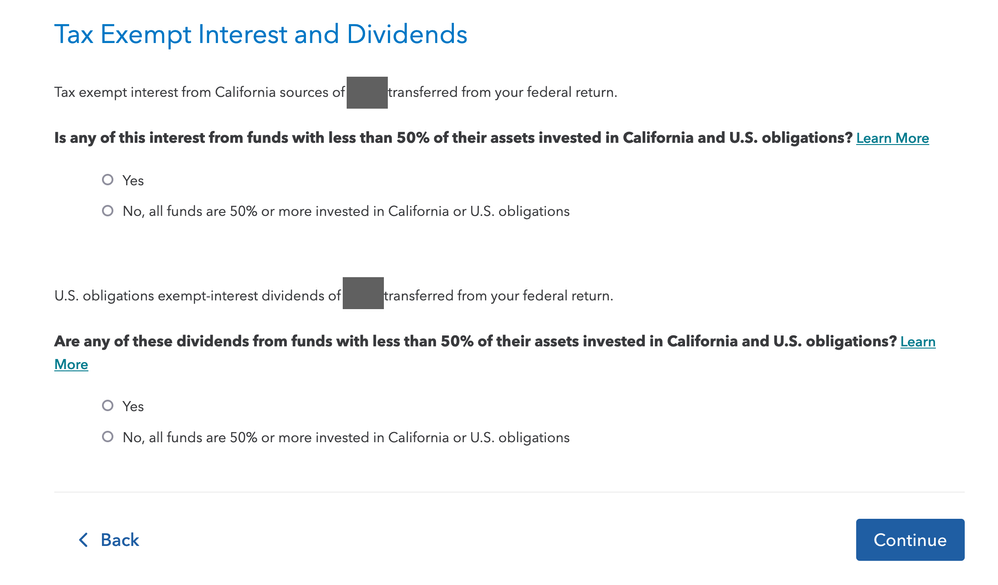

This question refers to US government interest and municipal interest earned from Betterment. Below is a screenshot of the supplemental tax form from Betterment. How would I answer the question above for each type of interest shown on the form: A) US government interest, B) in-state municipal interest, and C) out-of-state municipal interest? Thank you!

Betterment supplemental tax form:

Turbotax question from CA state taxes:

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to answer “Is any of this interest from funds with less than 50% of their assets invested in California and U.S. obligations?”

A and B would be exempt for California.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to answer “Is any of this interest from funds with less than 50% of their assets invested in California and U.S. obligations?”

You could look at the total amount of interest/dividends you received, compared to the amount shown as US Government and California amounts on your supplemental statement.

If total interest is $100, for example, and Government interest is $50, and California interest is $20, then No, the interest is not from funds with less than 50% of their assets invested in CA and US obligations.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

catdelta

Level 2

johnsmccary

New Member

puneetsharma

New Member

xsun226001

New Member

drm101214arm

New Member