- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How do I bypass the Kansas KS-40-SCR in TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I bypass the Kansas KS-40-SCR in TurboTax?

I'm not eligible for the credit/refund and one screen even echoed that "You're not eligible because your income is too high". Then it proceeds to waste my time asking me all these inane questions to determine my eligibility for the credit that it just TOLD me I'm not eligible for.

I'm really frustrated with this. Fix the code and stop wasting our time!

I better not have to do my KS return on paper because your stupid program won't let me past these questions that (1) don't make sense; and (2) I don't even know the answers to!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I bypass the Kansas KS-40-SCR in TurboTax?

SVR, not SCR!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I bypass the Kansas KS-40-SCR in TurboTax?

Would be nice if this forum had an edit function...

I must add to my complaint here that in addition to requiring me to answer stupid questions that don't apply to me, there is no help available on that screen--not even a "Learn More" link. And it is also difficult to find help on the Kansas.gov website. I'm still looking.

Bottom line, this is maddening AND it is completely unnecessary. Seems like sloppy coding. Guess I'll have to find a different product to do my 2023 taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I bypass the Kansas KS-40-SCR in TurboTax?

@mytoiletsclogged Being not familiar with a Kansas return, I created a test tax return using the TurboTax online editions.

Completed the federal section and then started the Kansas state section.

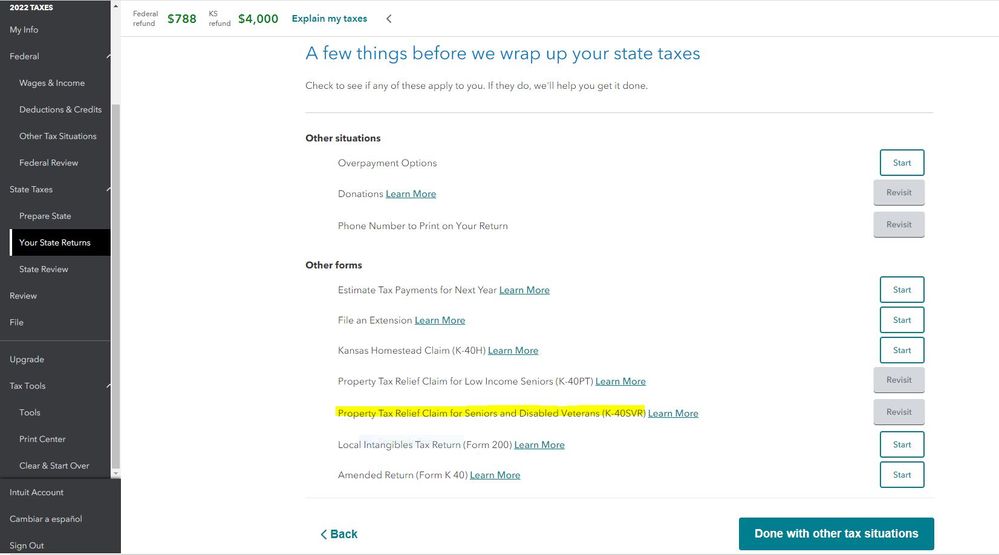

In the section for Other Situations under Other Forms there a line for Property Tax Relief Claim for Senior and Disabled Veterans (K-40SVR) with a Learn More link.

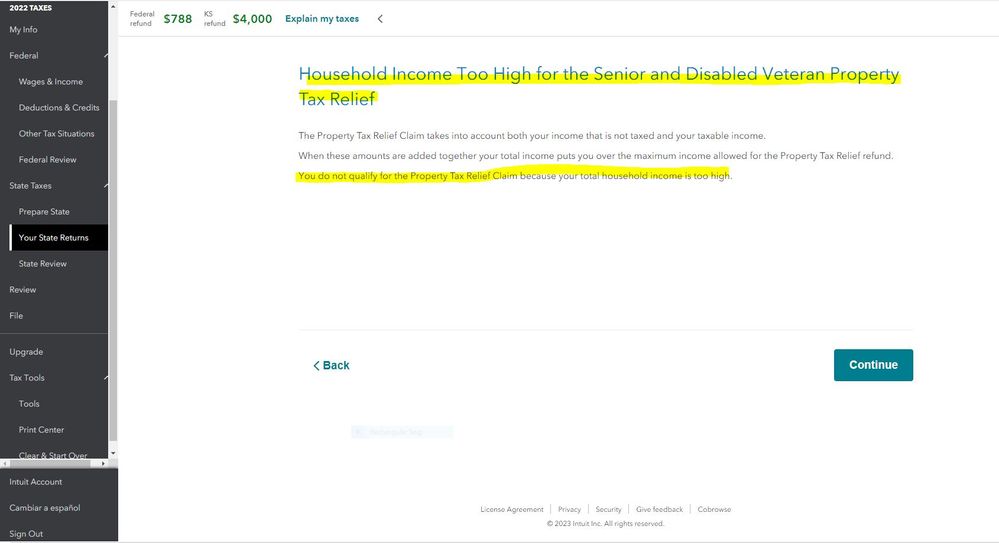

Accessing this section I was presented with the following screen indicating that my Household Income was to high for tax relief.

Clicking on Continue took me right back to the first screenshot I posted. No other questions were asked. I did a State Review and a Final Review without any type of errors.

My suggestion to you would be to delete the K-40SVR and if that does not resolve your issue then delete the state return and then go back through the state return again.

To delete a form, schedule or worksheet -

Click on Tax Tools on the left side of the online program screen

Click on Tools

Click on Delete a form

Scroll down to the state section and delete the K-40SVR if displayed.

See this TurboTax support FAQ for deleting a state tax return using the online editions - https://ttlc.intuit.com/turbotax-support/en-us/help-article/state-taxes/delete-state-return-turbotax...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I bypass the Kansas KS-40-SCR in TurboTax?

I did both of those things--MULTIPLE TIMES, just to be sure--and still the system pulls them back up.

One person posted that it happens automatically if your birthdate tells the program that you're over 55.

That's a lame answer.

But then another place says ""If line 10 is more than $50,000, you do not qualify for the property tax relief refund, and the program will not complete lines 11 through 15."

But that is not true. It DOES insist that you complete lines 11 through 15.

So because there appears to be no workaround for this particularly poor coding and lame response from Intuit, I spent several hours muddling through it and figuring a dozen ways from Sunday what numbers the program is looking for that it apparently is incapable of pulling through to this screen by itself.

I got my return done, but I will be seriously considering another product for 2023, because I have been considering switching from TT for a couple years anyway, and this behavior and lack of support by Intuit is inexcusable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I bypass the Kansas KS-40-SCR in TurboTax?

Understand that you are having this specific issue.

However, when I created the Kansas return using an age over 65 and taxable income of over $50,000 the program indicated I was not eligible for the tax relief and then did NOT ask any further questions concerning the credit. Then completed the state return with no other issues.

I am not seeing what you are seeing that is why I suggested you either delete the K-40SVR or delete the state return and re-start.

The Kansas return is populated by the information from the federal return so the state program only asks the user the difference between the federal information received and the state.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

res03uhn

New Member

rondoctor

New Member

jscw98

New Member

user3a186802

New Member

eveheidekat

New Member