- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How do I account for other dates of residency, if I only lived and worked in Ohio at school for a few months. I seem to be stuck in a loop.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I account for other dates of residency, if I only lived and worked in Ohio at school for a few months. I seem to be stuck in a loop.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I account for other dates of residency, if I only lived and worked in Ohio at school for a few months. I seem to be stuck in a loop.

I believe you're referring to the dates you lived in a school district in Ohio. Even if you were just a part-year resident, you've got to account for all the days of the year.

To do this in TurboTax Online:

1. Go back into your Ohio return

2. On the Your 2023 Ohio taxes are ready for us to check screen, select Edit to the right of Other situations

3. On the A few things before we wrap up your state taxes screen, select Revisit to the right of Ohio school district taxes

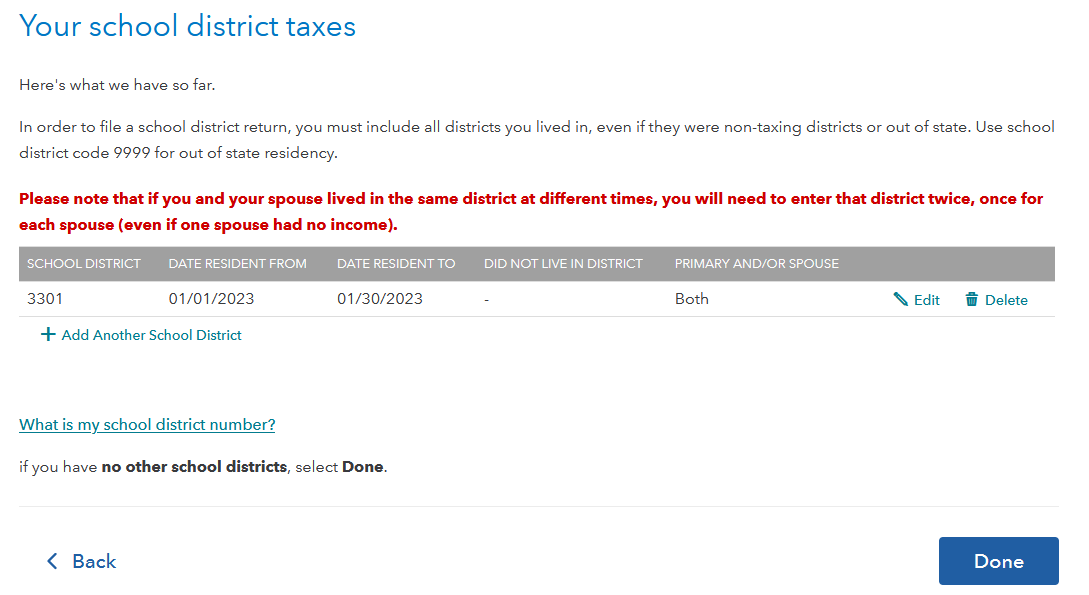

You should see this screen:

Pay careful attention to this text: In order to file a school district return, you must include all districts you lived in, even if they were non-taxing districts or out of state. Use school district code 9999 for out of state residency.

So,

4. Select + Add Another School District

5. On the Add New School District Number screen, enter 9999, then select Continue

6. On the Residency for School District 9999 screen, don't select the box next to Did not live in this school district. Simply select Continue

7. On the Residency dates for School District 9999, enter (this is based on your information) 01/31/2023 and 12/31/2023. Then, select Continue

8. On the Your school district taxes screen, select Done

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I account for other dates of residency, if I only lived and worked in Ohio at school for a few months. I seem to be stuck in a loop.

What are you trying to accomplish?

Out of state students, attending school in Ohio (or any other state) are treated as non-residents, for tax purposes. You are considered to only be in Ohio temporarily and you do not file as a part year resident.

If you are a resident of a neighboring state (KY, MI, WV, IN, PA) you are not required to pay OH income tax on any income in OH. However the reciprocity agreement does not apply to local city taxes. You can not get those refunded.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

flyday2022

Level 2

geraldstarling65

New Member

catdelta

Level 2

rdemick54

New Member

mrboobearsh

New Member