- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- How can I find my "Total Tax" after completing MA Non-Res tax but before submitting all my taxes so that I can get credit in my CT Resident tax filing?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I find my "Total Tax" after completing MA Non-Res tax but before submitting all my taxes so that I can get credit in my CT Resident tax filing?

Lived in CT, worked in MA. Filed Non-Resident taxes for MA and paid taxes on full income from work in that state. CT also taxed this income so I'm trying to get the credit for taxes paid to MA. CT form wants my "Total Tax" paid to MA but I can't see how to find that in turbotax before I completely file.

Topics:

posted

February 28, 2023

5:18 AM

last updated

February 28, 2023

5:18 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I find my "Total Tax" after completing MA Non-Res tax but before submitting all my taxes so that I can get credit in my CT Resident tax filing?

You can actually view the MA tax summary. View only your MA form by selecting Tools. Next, select View Tax Summary in the pop-up, then Preview my MA in the left menu.

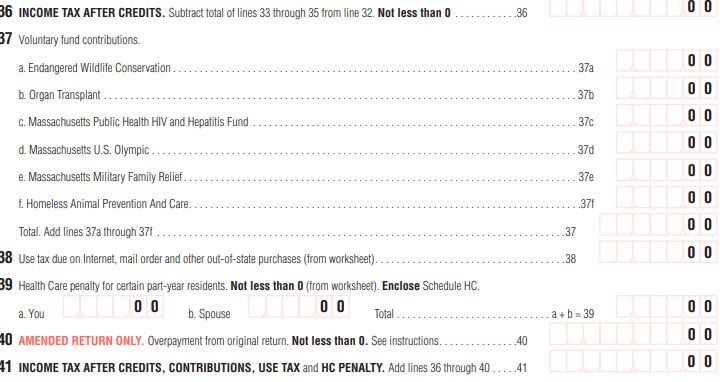

On the MA non-resident/part year return, line 41 is total taxes. See sample below.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 28, 2023

5:46 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HiroshimaTrashys

New Member

chris-einkorn

New Member

Jcmorgan-Jc

New Member

info135

New Member

jsefler

New Member