Yes. Nonresidents of Massachusetts pay income tax on income earned while working in Massachusetts. Approximately 60% (3/5 days) is MA income.

To apportion your wages:

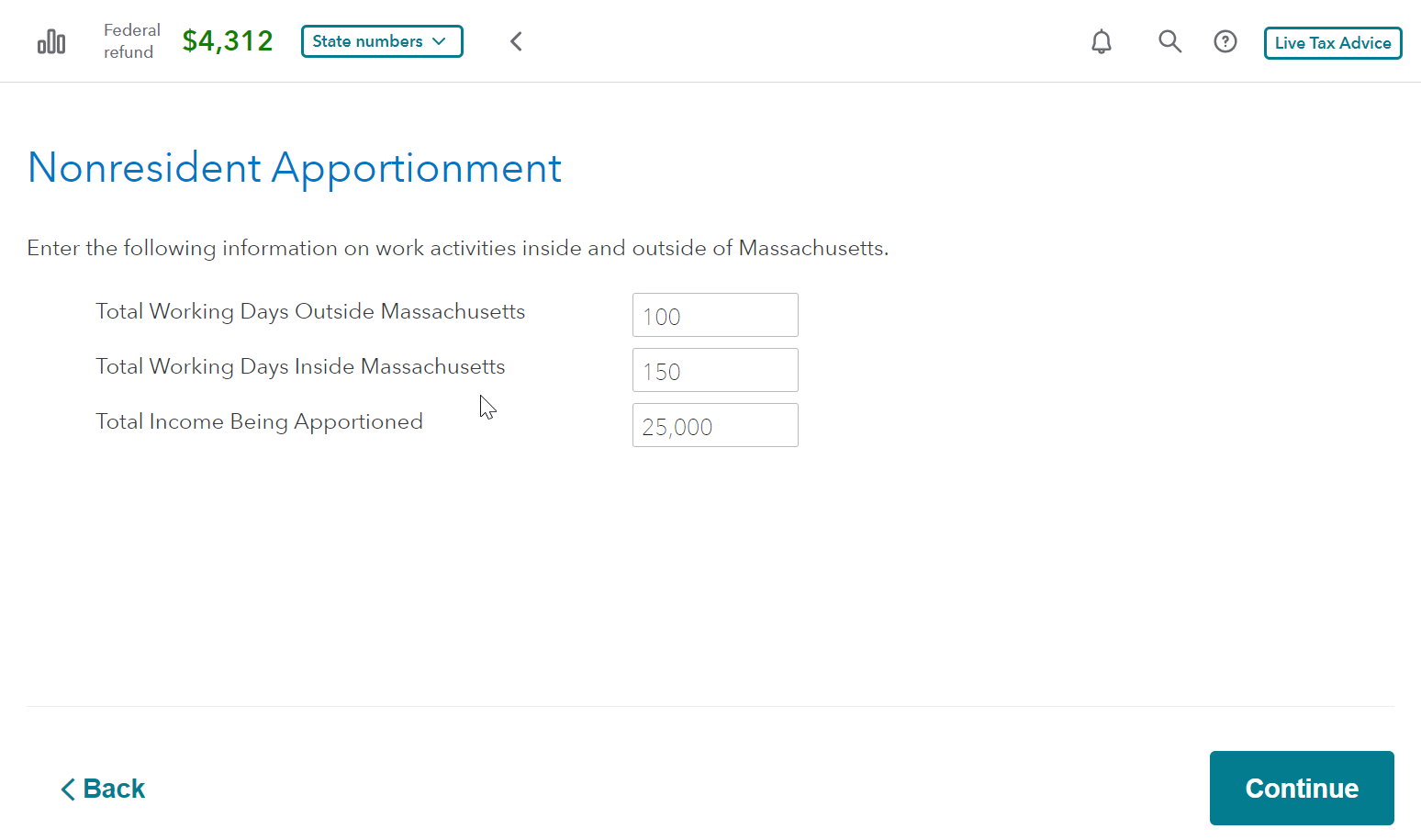

- Go to the screen “Nonresident Apportionment”

- Tap EDIT next to your W-2

- On “Apportionment Method,” choose Working Days, then Continue

- On “Nonresident Apportionment” fill in the days you worked inside and outside MA.

- Enter any other “Non-Massachusetts Portion of Income”

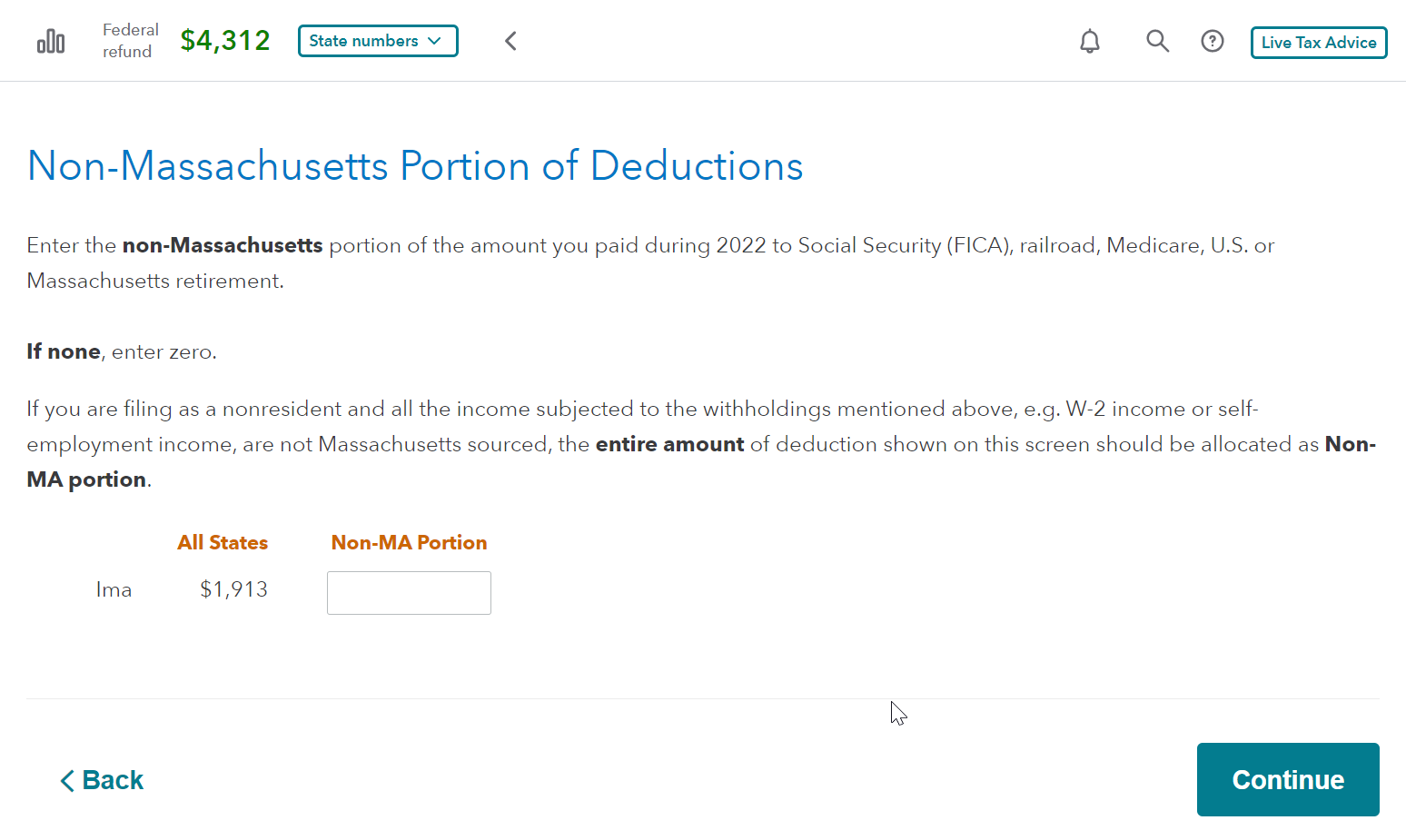

- Continue to “Non-Massachusetts Portion of Deductions.” This is your Social Security and Medicare withholding. Enter the Non-MA Portion. Use Wages earned outside of Massachusetts from earlier divided by Total Income for your percentage (which should be around 40% - 2/5 days)

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"