- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Getting taxed for ALL of my wages, not what was earned in state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting taxed for ALL of my wages, not what was earned in state.

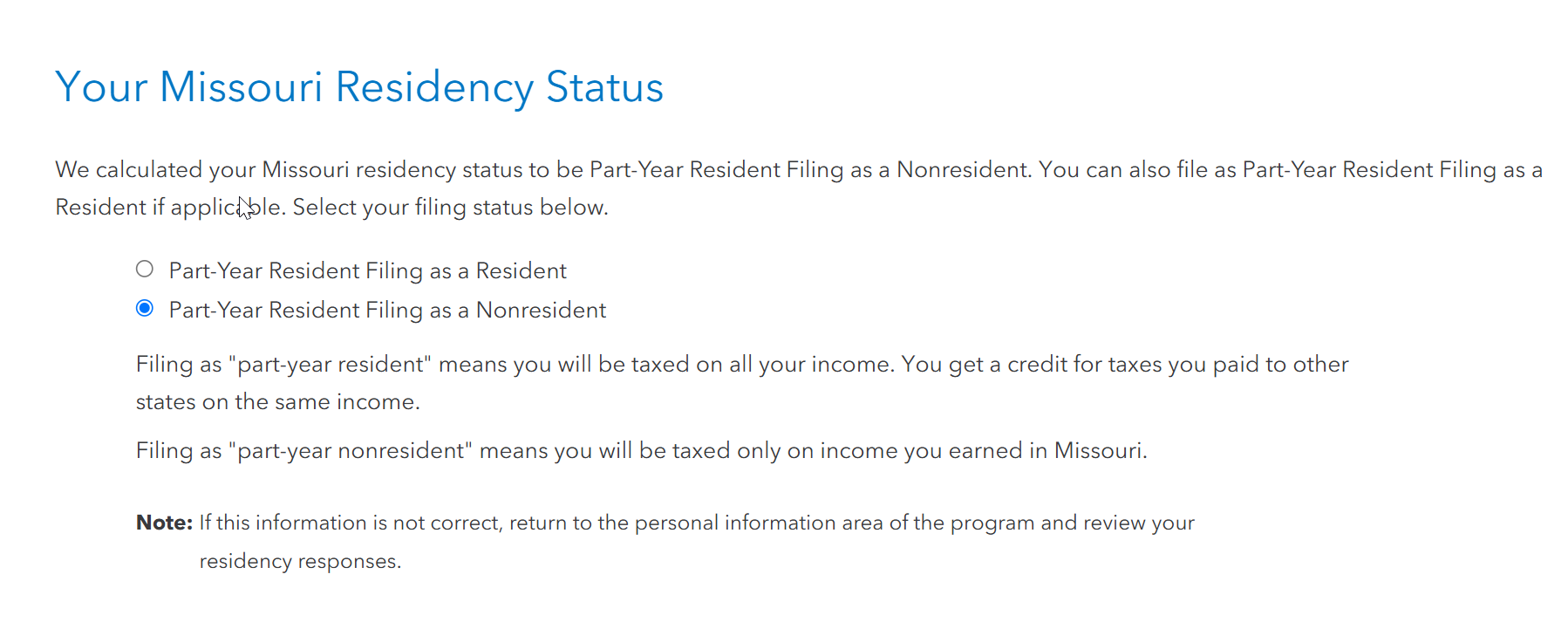

I am filing in MI and MO this year. I've only lived in MO since November, but I am getting taxed on all my income. My MO taxable income should only be $21,244 (wages earned), not $76,837. How do I reduce this number to be accurate? See image below for MO taxable income.

In the Taxes Paid to Another State section I put in the 'Income reported to MI" but it didn't change anything. I also put in the amount I paid in MI taxes.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting taxed for ALL of my wages, not what was earned in state.

Missouri taxes Part Year residents an full year residents (in which case you apply the credit for the tax paid to another jurisdiction) or as a nonresident (in which case you indicate the Missouri source income).

You can go back through Missouri and make sure you have the correct choice selected if you want to use the nonresident option.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jstan78

New Member

girishapte

Level 3

breanabooker15

New Member

dpa500

Level 2

srobinet1

Returning Member