- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Does my investment in online website access to stock trading education considered an "Other" deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does my investment in online website access to stock trading education considered an "Other" deduction?

I purchased access to a stock trader's website for educational purposes to learn trading strategies, etc., so this is an investment and it cost me about $900. Can this be deducted in the "Other" investments area of Turbo Tax Premier? His company (website) is registered as an LLC in the state of Washington.

Thank you for your help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does my investment in online website access to stock trading education considered an "Other" deduction?

such expenses are no longer deductible for federal income tax purposes. some states allow some itemized deductions that the federal doesn't. if you want to enter it, it would be under schedule A itemized deductions under the section for state only.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does my investment in online website access to stock trading education considered an "Other" deduction?

Thank you. So to confirm I do not put it anywhere in the federal tax portion of TT to be carried over to the state? Just enter it directly into the state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does my investment in online website access to stock trading education considered an "Other" deduction?

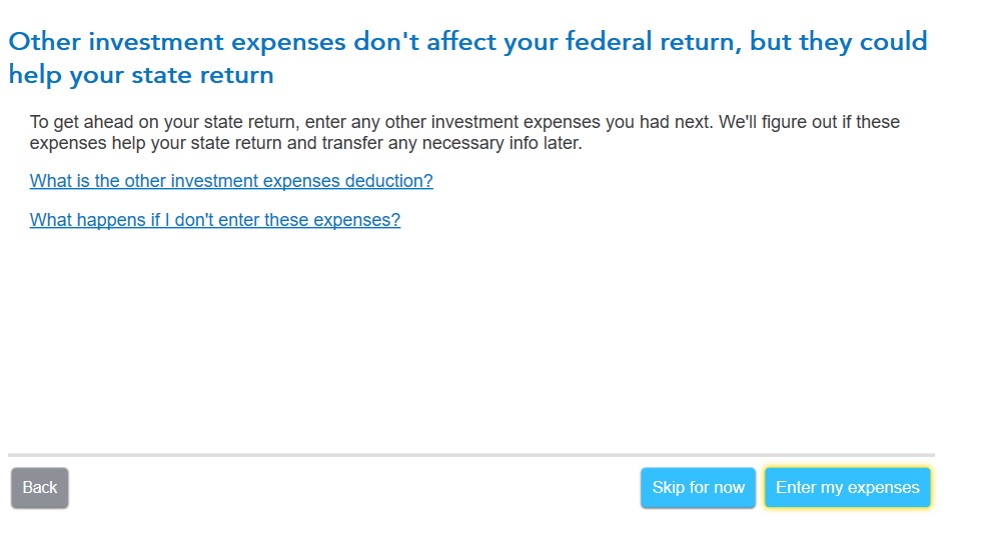

No you still enter this expense in the Federal Taxes, Deductions and Credits, Retirement and Investments, Other Investment Expenses. There is no place to enter this information in the state interview.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chesterspal

Level 1

shuffj

New Member

gabsev

New Member

user17673716559

New Member

zyppy

Returning Member