- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Can't e-file MN Schedule M1W duplicate W2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't e-file MN Schedule M1W duplicate W2

My wife and I own a business where we are each paid the same amount on our W2s with the same deductions. We've been doing it this way for at least 10 years. Turbotax flags a potential duplicate every time we do the entry, which I appreciate, but allows me to continue and it's never been an issue.

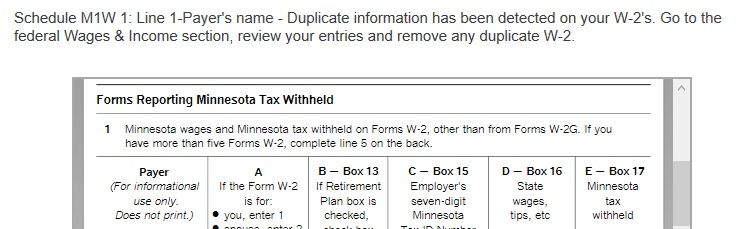

This year when I go to e-file it pops up a "Check this entry" error flagging the MN form M1W for duplicate information. The form correctly shows that one of the W2s is for me and the other for my spouse so it is correct. I tried going back to forms the income entry and changing the payer name slightly for one of them just to see if that would move it along but it must be using the tax ID and amounts to flag the duplicate.

What do I do to move it through?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't e-file MN Schedule M1W duplicate W2

Raise the income in box 1 by $1 for one of the forms W2.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't e-file MN Schedule M1W duplicate W2

I thought that would work for sure... but no luck. Even with a different amount it thinks it's a dupe.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't e-file MN Schedule M1W duplicate W2

On the W2 that you changed the box 1 amount also change the box 16 state wages amount to match.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't e-file MN Schedule M1W duplicate W2

Unfortunately, that doesn't work either. The first thing I tried was changing only box 16. That was what showed up in the form, so it was different than the other one on the form, but it still called it a dupe. So I went back and changed box 1 in addition to box 16 but still no go.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

irkedtaxpayer

New Member

kh77777

Level 2

Apricot6490

Level 1

DoctorJJ

Level 2

jessicasotelocsr

New Member