- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Can not e-file due to a 0. that it says should be blank and which I can't seem to remove or delete??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not e-file due to a 0. that it says should be blank and which I can't seem to remove or delete??

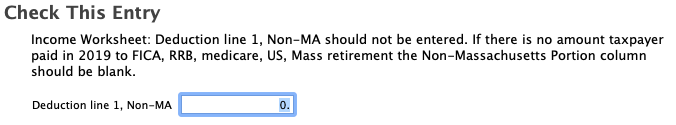

On Mass Form 1-NR/PY Income Worksheet I have a 0. in Part II Deductions, line 1, "Amount you paid in 2019 to Social Security (FICA) . . . Non-Mass Portion.

TurboTax flags the 0. as an error indicating that it should not be entered and should be blank. I do not know how it was entered and am unable to remove or delete the 0.

Any suggestions?

Thanks in advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not e-file due to a 0. that it says should be blank and which I can't seem to remove or delete??

Yes, return to your step-by-step interview for Massachusetts.

The Non-Massachusetts Portion of Deductions is adjusted during the interview. Since the interview is already complete, from the You've Finished Your Massachusetts Return page, scroll down to Adjustments and by Health care coverage, additions, deductions, click Update.

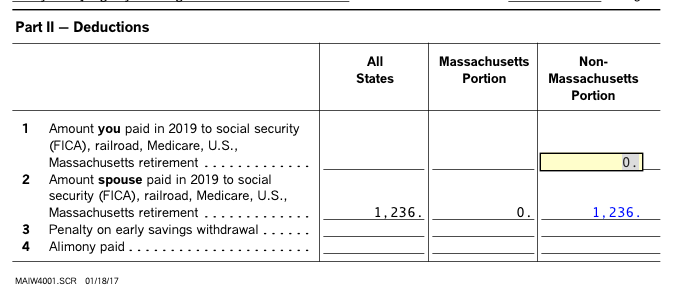

Well into the questions in this section, you will see the page that can be adjusted for Non-Massachusetts Portion of Deductions. See the screenshot below:

When returning to this page, highlight the Non-MA Portion cell and click delete several times to make sure there is nothing posting. Do not enter zero if possible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not e-file due to a 0. that it says should be blank and which I can't seem to remove or delete??

Thanks for the reply, unfortunately there is still a problem.

When I get to the Non-Mass Portion of Deductions page

it only show

my wife’s name, her All States and her Non-MA portion

which are correctly non-zero. Nothing shows up here for me.

When I switch to forms there is a line for me which is blank except for the Non-Mass portion which has the offending 0.

which I can’t seem to remove. My wife’s information is also there correctly.

Suggestions greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not e-file due to a 0. that it says should be blank and which I can't seem to remove or delete??

It depends what else is entered elsewhere in the return that would only trigger your wife's input, and not yours. When I specifically had entered MA for both spouses, then I had both list instead of just one in the screen shared earlier.

I recommend returning to other areas of input in the Step-By-Step interview, even by entering MA with no other details to get the option to delete the zero,

The additional information for this cell is:

Nonresidents: From federal Form W-2, boxes 4 and 6, allocated based on the ratio of state wages in box 16 (other than those identified as Massachusetts wages) to total state wages in box 16. If all the income subjected to the withholdings are not Massachusetts sourced, the entire deduction amount for Social Security (FICA), Medicare, Railroad, U.S., and Massachusetts Retirement Systems should be allocated as Non-MA portion.

Part-year residents: This amount needs to be entered as the social security withholding and medicare withholding which specifically relates to wages other than Massachusetts during the period of nonresidency. Do not include the amount that relates to Massachusetts wages or any state wages during the period of residency in Massachusetts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not e-file due to a 0. that it says should be blank and which I can't seem to remove or delete??

Hi, replied yesterday and the day before to e-mail asking if issue soled but both bounced from Microsoft outlook.

Unfortunately no solution. I’ve gone through all of our Mass and anything I thought may be involve in our Fed with no success.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not e-file due to a 0. that it says should be blank and which I can't seem to remove or delete??

Have you tried to replace this 0 with a 1 yet? As you can see, most tax authority e-File systems don't like 0s (it causes math errors with a lot of their checking systems) and they also don't like blanks.

Your situation is a bit unique.

I realize a 1 is not the correct answer, but it should not make a material difference and may allow you to submit your return electronically. It's okay to make corrections such at this which do not materially affect your tax in order to allow the return to e-File.

Let us know, if you don't mind, if this allows the return to go through.

If it does not, the return will have to be mailed. I do understand why, particularly now, you would like to avoid that if at all possible.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not e-file due to a 0. that it says should be blank and which I can't seem to remove or delete??

Thanks, I tried it, the 1. remained but I get the same error (i.e that it should be blank) . Anything I’ve tried to make it blank just returns the 0..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not e-file due to a 0. that it says should be blank and which I can't seem to remove or delete??

I'm getting the same error. How can we resolve this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not e-file due to a 0. that it says should be blank and which I can't seem to remove or delete??

Hopefully if the powers that be recognize that this is a real problem they will dig into it enough to fix it.

I have checked enough to convince myself that is it a problem with the software not with something that I entered incorrectly. If someone would show me otherwise I'd be more than happy to fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can not e-file due to a 0. that it says should be blank and which I can't seem to remove or delete??

Seems fixed.

New updates today after which I was able to file with no complaints.

Thanks to those who facilitated.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jmallard

New Member

paulamn-lima

New Member

lewholt2

New Member

Trabiti

New Member

v8899

Returning Member