- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Can i remove solar and wind energy credit carryover from my New york state return

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

Hello, AmyC,

Thank you for your explanation in details. Yes, I am using the PC version. May I know what the form is called? It seems that I don't have that form in my TurboTax file. So if you would give me the name or number of the form, it will help me to locate or to add the form then delete it.

Thank you very much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

Yes. The solar energy credit for the New York (NY) state return would be Form IT-255 and for the federal return Form 5695. Follow the instructions from our Tax Expert @AmyC to remove it from your tax file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

After trying everything in this thread with my desktop cx this is what worked for me too.

THIS IS WHAT WORKED:

This finally worked!! go to the section "Other Tax Credits" then "Non-Refundable Credits". After you get to that section, make sure those boxes are blank! I had zeros in both boxes.

It would not continue or save so we logged out and back in and then went back, deleted the zeros, and continued to review and the error was gone.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

Can I remove solar and wind energy credit carryover from my new york state return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

Yes, the solar and wind energy credit carryover can be deleted from your NY return.

Please follow the steps below:

- Open your return.

- Click on State on the left-hand side.

- Continue through the return.

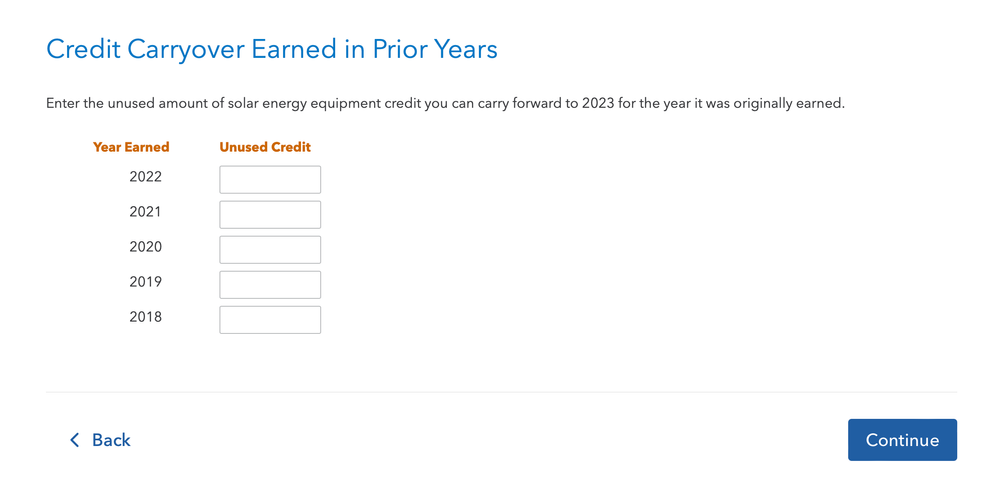

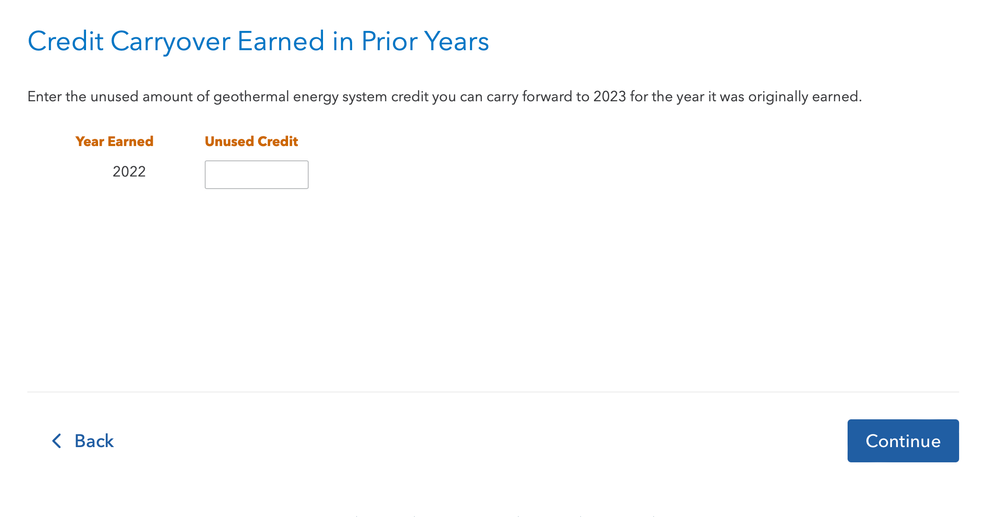

- On the page, Take a look at New York credits and taxes, and scroll down to Unused Solar Energy Credit Carryover from Prior Years.

- Delete the unused credit on the page Credit Carryover Earned in Prior Years.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

I had this same problem when trying to file my 2022 taxes today. Deleting 'Other Tax Credits and Taxes Worksheet' worked. I obviously did not have any credits, so I was able to use this solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

THIS IS WHAT WORKED: Copied from another user a couple of years ago:

This finally worked!! Thanks so much! If you have an on-line version of Turbotax, you can't see lines so you have to go to the section "Other Tax Credits" then "Non-Refundable Credits". After you get to that section, make sure those boxes are blank! I had zeros in both boxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

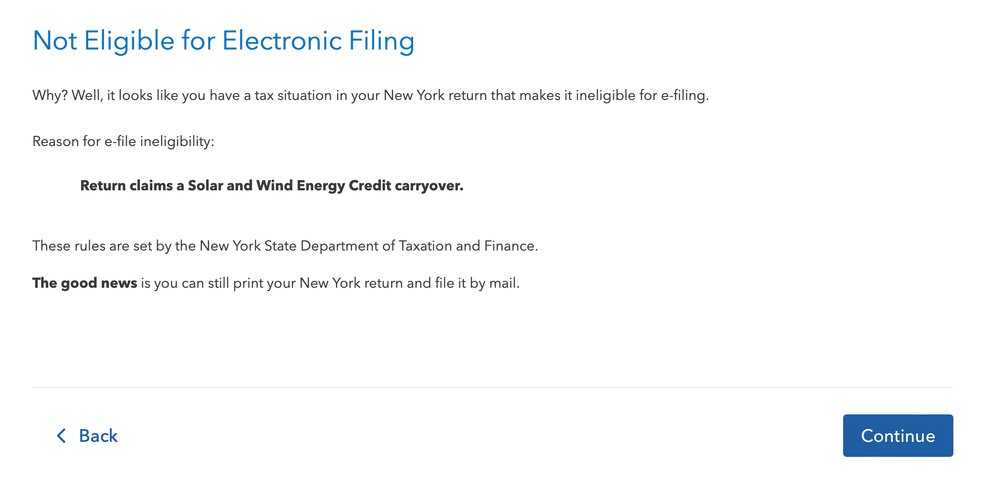

When trying to e-file my New York State return, during the review it is telling me that I am ineligible to e-file because my "Return claims a Solar and Wind Energy Credit carryover" and the first thing I did was the steps you outlined below and verified everything was blank. After going through all of the energy related credits and verifying it was $0 or blank, I have turned to this message board for a solution and I cam across this response.

Do you know where I need to navigate in TurboTax so I can clear this as this is not applicable to me and is preventing me from e-filing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

Since you followed the steps from the first post and saw all blanks, that leaves a piece of data somewhere. You will want to delete the form Other Tax Credits and Taxes Worksheet'

Always use extreme caution when deleting information from your tax return. There could be unintended consequences. Follow these steps:

- On the menu bar on the left that shows.

- Select Tax Tools

- On the drop-down select Tools

- On the Pop-Up menu select Delete a Form

- This will give you all of the forms in your return

- Scroll down to the form you want to delete

- Select the Form

- Click on Delete.

If the problem still persists,

Desktop version:

- Delete the form

- Save your return while closing the program.

- Update the program

- Open and file

Online version:

A full or corrupted cache can cause problems in TurboTax, so sometimes you need to clear your cache (that is, remove these temporary files).

For stuck information follow these steps:

- Delete the form/ worksheet- if possible, see How to Delete

- Log out of your return and try one or more of the following:

- Log back into your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

This worked!! Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

Thank you! That saved me in Mar 2024! Exactl same issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

Hi! I've tried every solution added in this thread to get this of this "Return claims a Solar and Wind Energy Credit carryover." issue. I've tried leaving the boxes empty, I've tried writing in zeros, I don't know what else to do. I can't delete the entire credits form because I have a credit elsewhere. I do not have the form IT-255 to delete, either. Is there anything else I can possibly check so that I can e-file? There is no possible way I have a solar and wind energy credit. Thank you in advance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

You have to delete the $0 in the NY state interview. Please follow the steps below @K8B98 :

- Open your return.

- Click on State on the left-hand side.

- Continue through the return.

- On the page, Take a look at New York credits and taxes, and scroll down to Unused Solar Energy Credit Carryover from Prior Years.

- Delete the unused credit on the page Credit Carryover Earned in Prior Years.

This is the screen you need to delete the zero from----

Delete all the zeros

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

Hi Dawn! Thank you for the prompt assistance. I did both of those steps and I'm still getting the same result... I'm at a loss for what to do! Here are the screenshots of what it looks like on my end...

Any other ideas/work arounds? Thank you again, I appreciate the guidance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i remove solar and wind energy credit carryover from my New york state return

Yes, try this:

- Sign out of your TruboTax account.

- Clear your cache and cookies. If you aren't familiar with doing that, follow this link for instructions.

- Close your browser.

- Open a new browser window and sign in your TurboTax account.

- Select Review. If that is clear of details, Continue and try to e-file your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tddunn84

New Member

mdktech24

Level 3

dbnewmiller

New Member

in Education

kudoqs

Returning Member

sudeepdesh

New Member