- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- California has a penalty for not having health insurance, but I did not live in California for most of the year. how do I waive the months I lived out of state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California has a penalty for not having health insurance, but I did not live in California for most of the year. how do I waive the months I lived out of state?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California has a penalty for not having health insurance, but I did not live in California for most of the year. how do I waive the months I lived out of state?

File a California part-year resident return if you did not live in the Golden State for most of the year.

Residents living abroad or residents of another state or U.S. territory are exempt from the California health insurance requirement for the months of they were not CA residents.

You can change your resident information in Personal Info. Select your state of residency on December 31, 2020. Then say Yes “I lived in another state in 2020.” Choose California or the other state you lived in (depending on whether you moved into or out of California) and the date you became a resident of your current state. TurboTax will create a part-year California return.

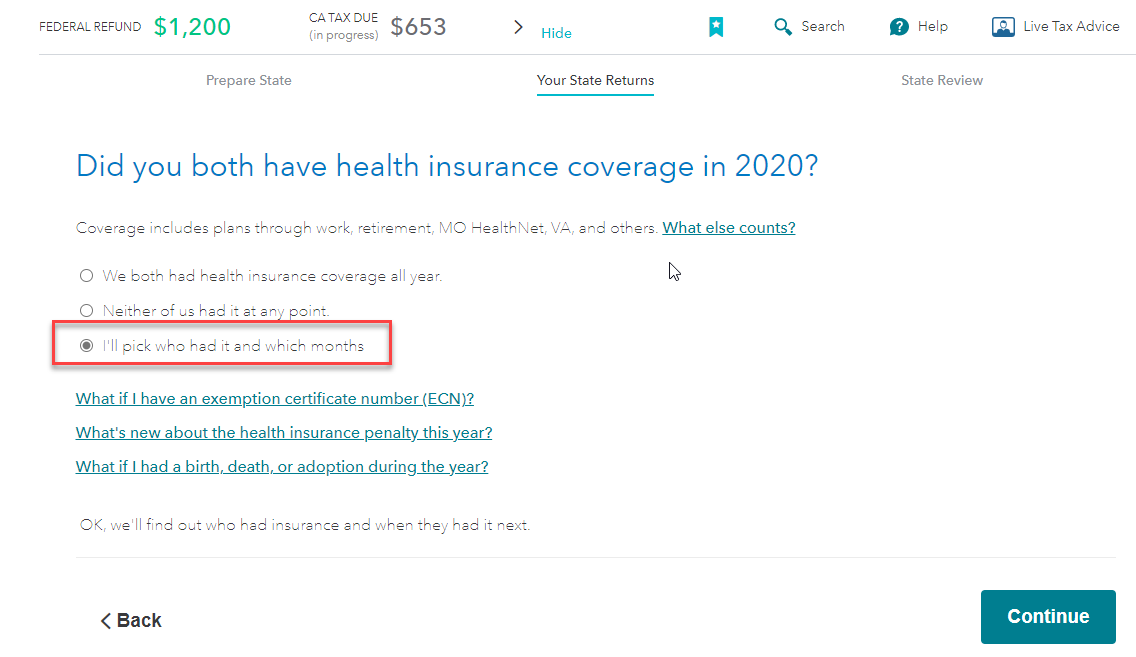

On the screen Did you (both) have health insurance coverage in 2020? select I’ll pick which months I had it and choose the months you had coverage while living in CA.

If you were living overseas, rather than in another state, the California health insurance section includes a section Wasn’t required to get insurance. Select Resident of foreign country or U.S. territory and choose the months you were not living in the U.S.

You will not be penalized for not having coverage during the months you were not a California resident.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

California has a penalty for not having health insurance, but I did not live in California for most of the year. how do I waive the months I lived out of state?

Hi,

My wife lived outside USA(foreign country) from 13th Dec 2020 to 17th Aug-2021. From 18th-Aug-2021 till date she is in California. She was having insurance for those days she is in California.

While filling tax for California for year 2021. It is asking to pay penalty for not having insurance from Jan to Aug-2021. Is there way to get exempt from California health insurance requirement? Since she lived most of the time outside USA, will she be consider as Resident of foreign country for 2021? Please suggest.

Thanks

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

g456nb

Level 1

cpengert

New Member

kendall96666

New Member

Vickiez1121

New Member

Vickiez1121

New Member