- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- 20-S vs. OR-K-1 question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

20-S vs. OR-K-1 question

This is my first time using Turbotax to file my S-Corp 1120-S for both federal and state (Oregon).

In reviewing and comparing the final forms generated by Turbotax to my filing from last year, I see that my former accountant had used the form: OR-K-1 whereas Turbotax used form 20-S with the title (Oregon Schedule K-1 Equivalent).

Form 20-S has less information than the OR-K-1 in that it doesn't include lines for revenue ... Are these forms really equivalent?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

20-S vs. OR-K-1 question

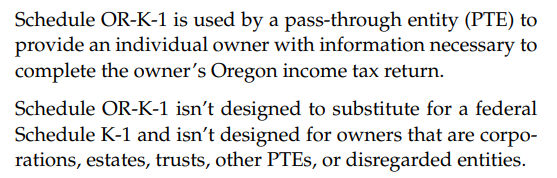

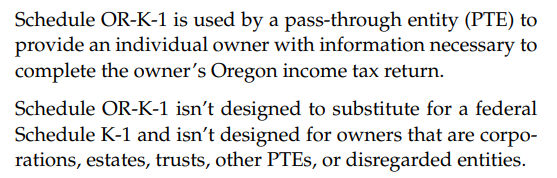

The forms aren't the same, as form 20-S is used to report "Oregon corporate excise or income tax liability of a business in Oregon." Whereas OR-K-1 is used by the S corporation to "provide an individual owner with information necessary to complete the owner's Oregon income tax return." Thus, form 20-S would be the proper form to file the S corporation income tax return to the state of Oregon. These are from the instructions to the forms:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

20-S vs. OR-K-1 question

The forms aren't the same, as form 20-S is used to report "Oregon corporate excise or income tax liability of a business in Oregon." Whereas OR-K-1 is used by the S corporation to "provide an individual owner with information necessary to complete the owner's Oregon income tax return." Thus, form 20-S would be the proper form to file the S corporation income tax return to the state of Oregon. These are from the instructions to the forms:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TSinTP

New Member

pajear2718

Returning Member

user17697187090

New Member

carlosprpr

New Member

STAWB

New Member