- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

No, the $10,200 does not include your taxable Social Security on Line 6b.

The $10,200 exclusion is for unemployment income, not social security. Social security is taxed differently depending on the rest of the income on the return.

For more information, see: New Exclusion of up to $10,200 of Unemployment Compensation | Internal Revenue Service

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

I think OP is asking whether the calculation of the percent of Soc Sec that is taxable (which is based on total income) is affected by the reduction in that total income if also receiving unemployment comp.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

I am not a tax person so i am waiting to see how Turbo handles this. But i was wondering when do you do the Social Security worksheet and will it lower my SS taxed income. If line 8 on 1040 is reduced then my total income on line 9 changes. This changes my taxable income on line 6b when i do the SS worksheet. I'm i right or wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

The answer is blowing in the wind

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

@wdunn wrote:

I am not a tax person so i am waiting to see how Turbo handles this. But i was wondering when do you do the Social Security worksheet and will it lower my SS taxed income. If line 8 on 1040 is reduced then my total income on line 9 changes. This changes my taxable income on line 6b when i do the SS worksheet. I'm i right or wrong?

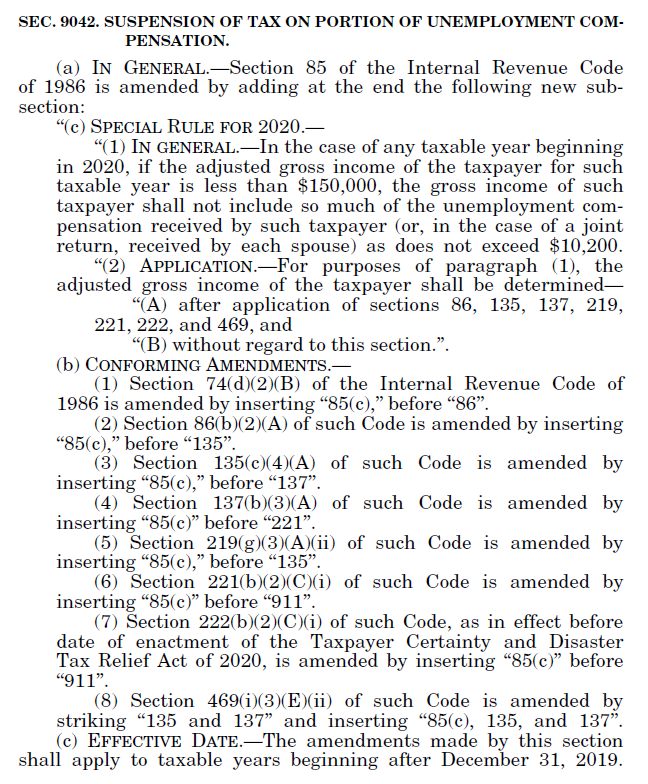

Those of us who have actually read the law believe that even though the first $10,200 of UEC is excluded from taxable income, it is still included in the calculation of taxable social security. There are a series of carve-outs and exceptions in the law, and this was also posted someplace on the AARP web site.

However, the ultimate final confirmation would come whenever Turbotax is reprogrammed for the change, since the reprogramming has to be tested and approved by the IRS. One news site says Turbotax will be updated tonight or tomorrow, but I don't have official word on that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

My question, Is the unemployment compensation worksheet available in the Turbo tax program?

Because i have been unable to find it. Can You or any body found it already?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

the solution published by IRS and implemented by TurboTax and other tax software

has various side effects throughout your return, because your AGI is reduced.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

@ernesto3118 wrote:

My question, Is the unemployment compensation worksheet available in the Turbo tax program?

Because i have been unable to find it. Can You or any body found it already?

None of the worksheets are available to users of Turbotax Online. If you are using the desktop version installed on your own Mac or PC, I don't believe the program is updated yet for the unemployment exclusion, so I can't say where the worksheet will be located or what it looks like.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

According to what I am reading, jobless benefits are not counted as wages under Social Security's annual earnings limit. It has nothing to do with the $10,200. Is this correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

From what I am reading, it has nothing to do with the $10,200. Unemployment benefits are not considered earned and they don't count as wages under Social Security's annual earnings limit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

You are answering a different question than was asked. For purposes of determining how much Social Security benefits are taxable, the IRS considers all the recipient’s taxable income, there is no exclusion for unemployment compensation.

For purposes of determining if a retiree’s future benefits will be reduced because they earned too much income during retirement, unemployment compensation does not count as earned income. But that is not the question that was asked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

Thank you, I do apology if I asked or answered a different question.

Thank you for answering my questions. With that said, when computing earned income for Social Security purpose, unemployment benefits should not be count as earned income. This makes a hugh difference in the outcome or results of where one will get a refund, smaller refund or owe. The $10,200 may reduce that amount, but what you are saying is that the unemployment benefits should not be counted. Correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

@chobson5116 wrote:

Thank you, I do apology if I asked or answered a different question.

Thank you for answering my questions. With that said, when computing earned income for Social Security purpose, unemployment benefits should not be count as earned income. This makes a hugh difference in the outcome or results of where one will get a refund, smaller refund or owe. The $10,200 may reduce that amount, but what you are saying is that the unemployment benefits should not be counted. Correct?

I think you are still confused.

When the Social Security Administration reviews your tax return to see if you earned too much income, and must reduce your future benefits, they don't count unemployment or other unearned income, just income earned from working.

However, for income tax purposes, ALL your other income is used to calculate how much of your social security benefit is taxable, including earned and unearned income. And, according to the AARP, even though the first $10,200 of unemployment compensation is excluded from income tax for 2020, it does still count to determine the amount of taxable social security.

They say that the American Rescue Plan Act specifically says that the excluded unemployment income is NOT to be subtracted in calculating the following.

- Taxable Social Security

- Savings bond interest exclusion for education

- Employer-provided adoption benefits

- Deductible IRA contributions

- Student Loan Interest Deduction

- Tuition and Fees Deduction

- Passive activity loss limitation for rental real estate

These provisions are included in the law in the section called "Conforming Amendments" where the law specifies how the exclusion interacts with various calculations of "modified adjusted gross income" (MAGI) for various purposes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will Unemployment Compensation Exclusion Worksheet affect on taxable social security. Does the $10,200 reduce my taxable Social Security on line 6b ?

The answer to your question appears to be no.

There are other areas where the reduced AGI will change your return.

For my niece's tax return, we found

- Retirement Savings contributions credit, increased

- Earned Income credit, increased.

It will depend on the circumstances of your tax return.

We will be looking carefully to see that the IRS's refund includes these amounts.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eschneck

New Member

pennylaramore1961

New Member

jjgsix

New Member

elliott-mercatus

New Member

IFoxHoleI

Level 2