- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@chobson5116 wrote:

Thank you, I do apology if I asked or answered a different question.

Thank you for answering my questions. With that said, when computing earned income for Social Security purpose, unemployment benefits should not be count as earned income. This makes a hugh difference in the outcome or results of where one will get a refund, smaller refund or owe. The $10,200 may reduce that amount, but what you are saying is that the unemployment benefits should not be counted. Correct?

I think you are still confused.

When the Social Security Administration reviews your tax return to see if you earned too much income, and must reduce your future benefits, they don't count unemployment or other unearned income, just income earned from working.

However, for income tax purposes, ALL your other income is used to calculate how much of your social security benefit is taxable, including earned and unearned income. And, according to the AARP, even though the first $10,200 of unemployment compensation is excluded from income tax for 2020, it does still count to determine the amount of taxable social security.

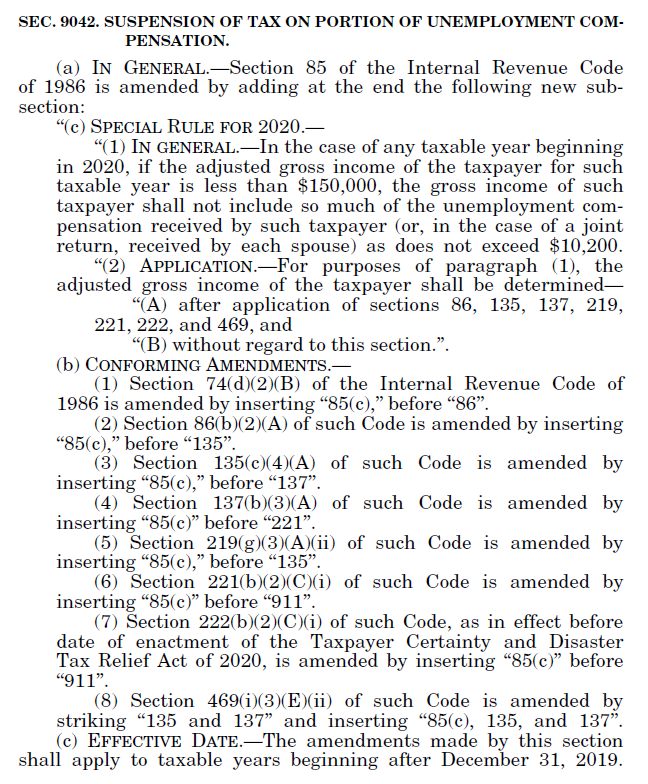

They say that the American Rescue Plan Act specifically says that the excluded unemployment income is NOT to be subtracted in calculating the following.

- Taxable Social Security

- Savings bond interest exclusion for education

- Employer-provided adoption benefits

- Deductible IRA contributions

- Student Loan Interest Deduction

- Tuition and Fees Deduction

- Passive activity loss limitation for rental real estate

These provisions are included in the law in the section called "Conforming Amendments" where the law specifies how the exclusion interacts with various calculations of "modified adjusted gross income" (MAGI) for various purposes.