- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Why is my military pension being used on roth ira max contributions for Married Joint, with W-2 totals of $163K but TurboTax with military puts me over the $199K max?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my military pension being used on roth ira max contributions for Married Joint, with W-2 totals of $163K but TurboTax with military puts me over the $199K max?

I am having the same exact problem as the original post trying to file my 2022 taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my military pension being used on roth ira max contributions for Married Joint, with W-2 totals of $163K but TurboTax with military puts me over the $199K max?

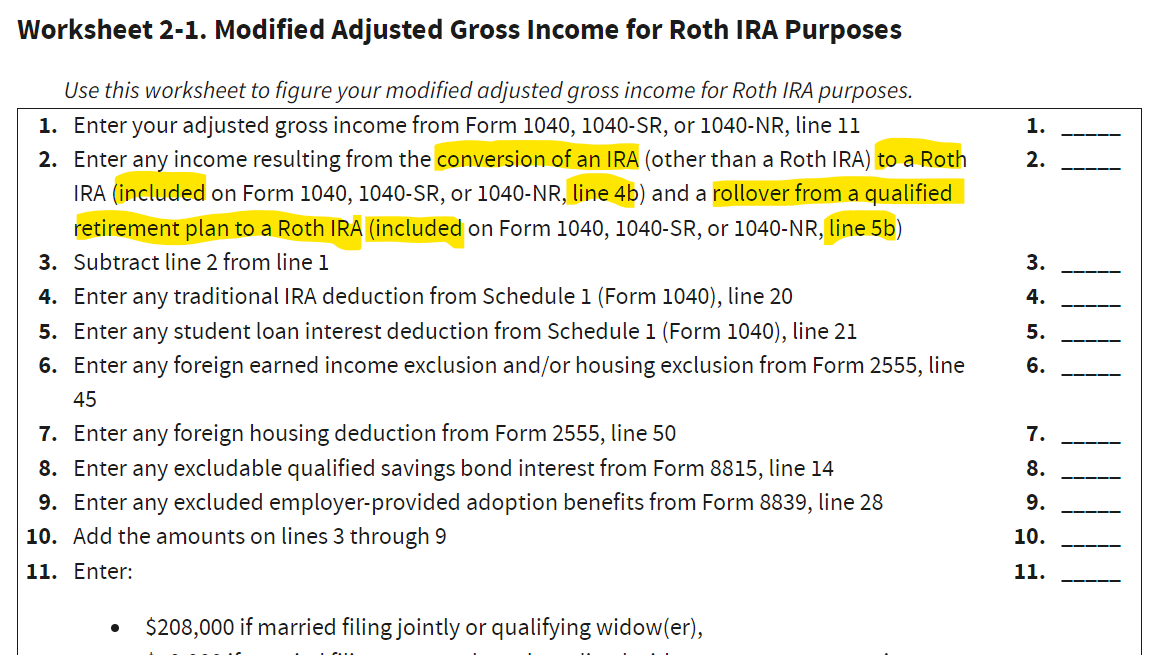

Please review Worksheet 2-1. Modified Adjusted Gross Income for Roth IRA Purposes and note that line 2 on the worksheet only subtracts conversions to Roth IRA from lines 4b and 5b of Form 1040. Therefore, the military retirement distribution will be included in the MAGI to determine if you can make Roth IRA contributions.

Please keep in mind you can only contribute to a Roth IRA if you have taxable compensation (military pension not included) and your modified AGI (military pension included) is less than:

- $214,000 for married filing jointly or qualifying widow(er);

- $144,000 for single, head of household, or married filing separately and you didn’t live with your spouse at any time during the year; and

- $10,000 for married filing separately and you lived with your spouse at any time during the year.

Please see What happens if I made an excess Roth IRA contribution for additional information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my military pension being used on roth ira max contributions for Married Joint, with W-2 totals of $163K but TurboTax with military puts me over the $199K max?

Dana,

Thank you for the response. I know you provided it before, but I wasn't understanding why. I am assuming that because it is taxable it is included in the AGI? We hadn't made the contributions yet as we were unsure if we could go the ROTH route this year. I guess we will have to go the Traditional route and then convert them.

Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my military pension being used on roth ira max contributions for Married Joint, with W-2 totals of $163K but TurboTax with military puts me over the $199K max?

See previous posts - a military pension should be on line 5b which is a subtraction from AGI to produce MAGI. Are you entering your pension in the correct place so it gets captured on 5b (as a 1099-R)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is my military pension being used on roth ira max contributions for Married Joint, with W-2 totals of $163K but TurboTax with military puts me over the $199K max?

Yes, the military pension will be listed on line 5b.

No, line 5b won't be always subtracted from the AGI to produce the MAGI for Roth IRA purposes. Please review Worksheet 2-1. Modified Adjusted Gross Income for Roth IRA Purposes and note that line 2 on the worksheet only subtracts conversions to Roth IRA on lines 4b and 5b of Form 1040. Therefore, the military retirement distribution will be included in the MAGI to determine if you can make Roth IRA contributions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

xiaochong2dai

Level 3

tcondon21

Returning Member

CTinHI

Level 1

drildrill23

Returning Member

lb101

New Member