- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Why does Turbotax ask it all of the distribution from an IRA was RMD? It does not ask nor determine if the RMD was satisfied.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax ask it all of the distribution from an IRA was RMD? It does not ask nor determine if the RMD was satisfied.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax ask it all of the distribution from an IRA was RMD? It does not ask nor determine if the RMD was satisfied.

This is information that you need to know. For TurboTax to determine if you have taken the correct amount for an RMD there are many factors to consider, such as the amount you have in your retirement accounts, whether you are taking RMDs based on your life span or based on joint life span, if you have a spouse, if you have more than one retirement account. This is all information that the administrator of your retirement plan knows and calculates.

All the program needs to know to determine if you owe a penalty for not taking the correct amount is if the amount you took is correct for the RMD you are required to take.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax ask it all of the distribution from an IRA was RMD? It does not ask nor determine if the RMD was satisfied.

Actually it does ask that.

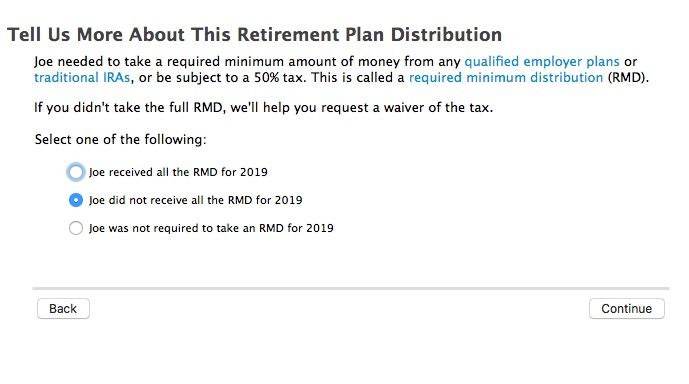

It asks for each 1099-R if *that* 1099-R was all a RMD or not.

Because you can have many IRA accounts with different financial institutions and the RMD can be taken from any (or several) accounts, it does not ask if the total years RMD was satisfied until all 1099-R's have been entered.

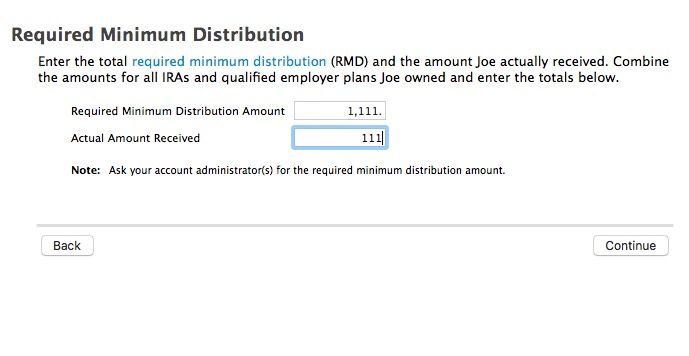

After the 1099-R summary screen it asks if the total RMD for the year has been taken and if not will ask the amounts and prepare a 5329 form if not all taken.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax ask it all of the distribution from an IRA was RMD? It does not ask nor determine if the RMD was satisfied.

If it was from an IRA make sure the little IRA/SEP/Simple box on your 1099R between boxes 7&8 and on Turbo Tax is checked.

Also check your date of birth under My Info.

if you are filing a Joint return make sure you assign the 1099R to the right spouse.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax ask it all of the distribution from an IRA was RMD? It does not ask nor determine if the RMD was satisfied.

TurboTax asks this to determine how much of the distribution is eligible for rollover. If it's all RMD, TurboTax won't ask how much was rolled over. Otherwise, TurboTax will only allow you to report as rolled over that portion that was not RMD.

This particular question has nothing to do with determining whether or not you satisfied your RMD. That's a separate question asked by TurboTax and has nothing to do with the reporting of any particular distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax ask it all of the distribution from an IRA was RMD? It does not ask nor determine if the RMD was satisfied.

Therefore, if a person takes more than the RMD by rounding up, is the correct answer that all of the distribution taken from the IRA was a RMD?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax ask it all of the distribution from an IRA was RMD? It does not ask nor determine if the RMD was satisfied.

Yes ... if you are not rolling any of the distribution you can simply say ALL was the RMD and move on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax ask it all of the distribution from an IRA was RMD? It does not ask nor determine if the RMD was satisfied.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does Turbotax ask it all of the distribution from an IRA was RMD? It does not ask nor determine if the RMD was satisfied.

DMERTZ has the correct answer. The question wasn't about did you meet your RMD, it was why ask if it was more than needed. If you are rolling over to a Roth IRA, it can only be that amount that is more than your required for your RMD(s).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dmcrory

Returning Member

DConway104

New Member

bilodeau2

New Member

CRAZYHOUSE121

New Member

JLenci60

Level 1