- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

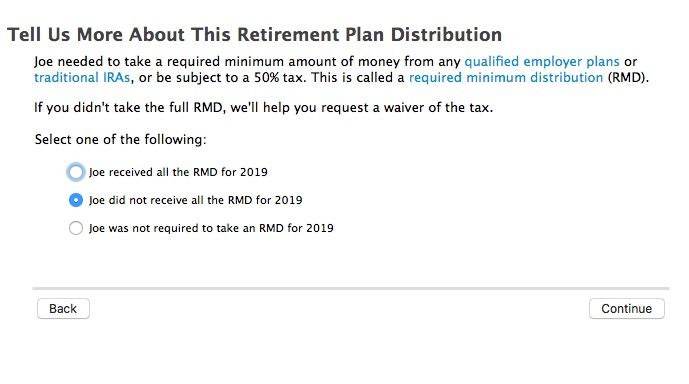

Actually it does ask that.

It asks for each 1099-R if *that* 1099-R was all a RMD or not.

Because you can have many IRA accounts with different financial institutions and the RMD can be taken from any (or several) accounts, it does not ask if the total years RMD was satisfied until all 1099-R's have been entered.

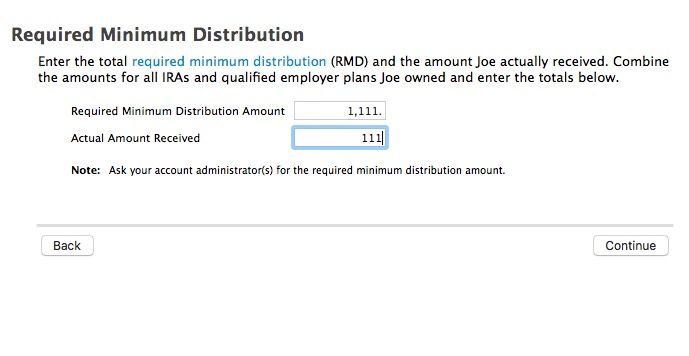

After the 1099-R summary screen it asks if the total RMD for the year has been taken and if not will ask the amounts and prepare a 5329 form if not all taken.

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

March 28, 2020

9:52 AM