- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Why does TT say I have no earned income when there is a profit on schedule C,

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT say I have no earned income when there is a profit on schedule C,

thank you volvogirl for tax calc , line 16 info. The secret tax calculation not mentioned in the 1040 instructions .

Question about Social Security mis calculation is still open. The info from IRS didn't mention any other info being changed. And, like I said, my use of the taxable SS worksheet gave a different , higher amount than TT. Using the same filed income, 1099-r amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT say I have no earned income when there is a profit on schedule C,

The notice from the IRS stated that your IRA was non-deductible. TurboTax has it entered as a deductible contribution, yes? Removing that deduction would increase your income and cause more of your social security to be taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT say I have no earned income when there is a profit on schedule C,

the letter from IRS said that there was a miscalculation in taxable SS, nothing about deductible IRA. TT had IRA as non-deductible, and excess.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT say I have no earned income when there is a profit on schedule C,

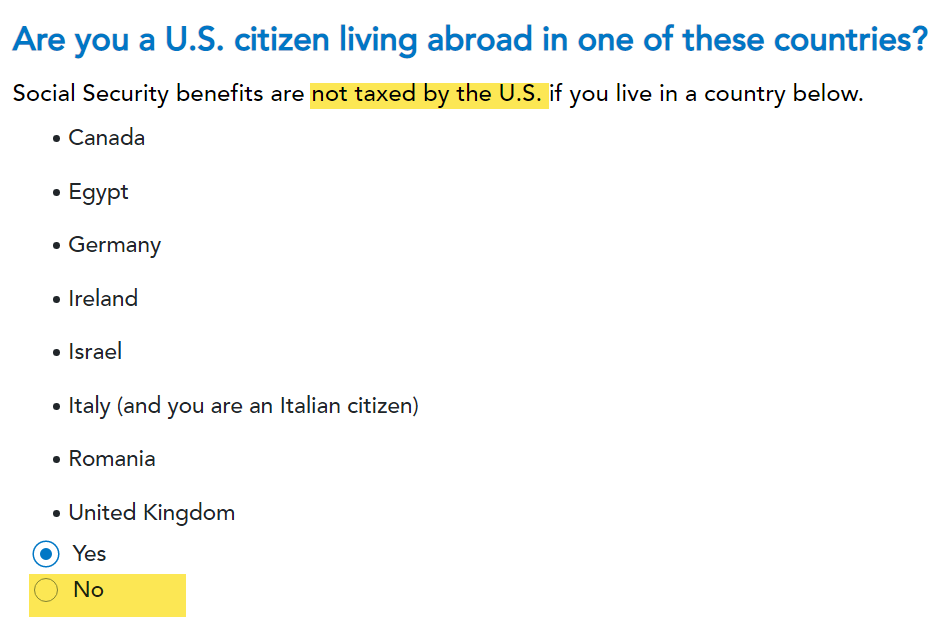

When entering your SSA-1099, did you accidentally click YES on the question below? If you answered Yes, your social security income would have been underreported.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does TT say I have no earned income when there is a profit on schedule C,

I don't think that I claimed to live in another country. It isn't that SS wasn't taxed, TT figured an amount to tax, but not the correct amount. I calculated it myself, as I mentioned in post above, using the IRS worksheet and the same numbers on 1040 that TT had entered for other income, and got a higher amount.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hjw77

Level 2

adm

Level 2

arjun25

New Member

Iowaboy

Returning Member

Kbird35

Level 1