- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

pension deduction worksheet: federal amount we're still working on updates related to retirement distributions that qualify for disaster or covid relief

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

Same. No errors registering on federal return, state keeps populating errors- Wisconsin. Keep seeing updates on the forums about the federal portion needing to be updated, then it will be fixed. First it was the 24th, then the 25th, then the 26th. Obviously still not fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

Be sure you go through the 1099R entry screens again before going to your state return.

Form 8915-E is available in both the CD/Download and online versions of TurboTax. If you are using the online version or after you have updated the CD/Download version be sure to go back through the 099-R section in the federal return.

In the screens following the 1099-R entry screen:

- You will see a series of questions to see if you are exempt from the additional taxes on early withdrawals [Screenshot #1, below]; and

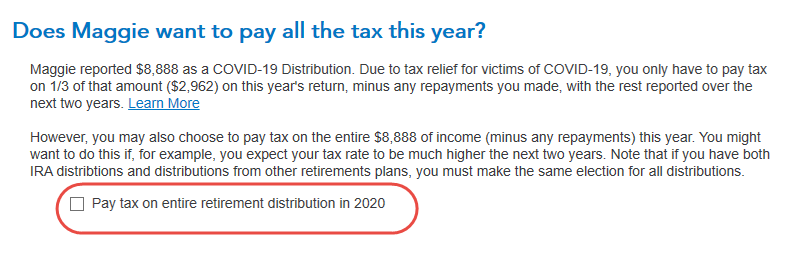

- You will be asked if you want to pay all the tax this year of just 1/3, with the rest reported over the next two years. [Screenshot #2] Check the box if want to pay tax on the entire retirement distribution in 2020.

Then proceed to your state return.

Screenshot #1

Screenshot #2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

This is not a helpful response. I have done this. Still errors on State returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

Be sure you go through the 1099R entry screens again before going to your state return.

Form 8915-E is available in both the CD/Download and online versions of TurboTax. If you are using the online version or after you have updated the CD/Download version be sure to go back through the 099-R section in the federal return.

In the screens following the 1099-R entry screen:

- You will see a series of questions to see if you are exempt from the additional taxes on early withdrawals [Screenshot #1, below]; and

- You will be asked if you want to pay all the tax this year of just 1/3, with the rest reported over the next two years. [Screenshot #2] Check the box if want to pay tax on the entire retirement distribution in 2020.

Then proceed to your state return.

Screenshot #1

Screenshot #2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

Even after going back through the 1099-R in the income part of the federal section multiple times it gives the same error during the state review. Whether the box to pay all of the tax in 2020 is checked or not doesn't make a difference.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

Information flows from the federal return into the state return, so we need to make sure the federal return is first updated with the correct information.

After doing that and then going into the WI return, what error message(s) are you receiving?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

"Form 1: Penalties on IRA we're still working on updates related to Penalties on IRAs, retirement plans, MSA's distributions (form 1099-R) that qualify for disaster or covid relief. You can keep working on your return and we'll remove this message when it's ready."

That's the message I get during the state review. I'm filing in Wisconsin.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

Same as the below poster: "Form 1: Penalties on IRA we're still working on updates related to Penalties on IRAs, retirement plans, MSA's distributions (form 1099-R) that qualify for disaster or covid relief. You can keep working on your return and we'll remove this message when it's ready."

I just called and spoke to customer service, and we combed through the entire return together. His advise was to wait for the updates to be completed. Every response we've received so far has been that the state forms will be updated when the federal form has been released and is updated, it appears there is no known timeline for a resolution on this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

Any updates on this? I'm still getting the same error message.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

I talked to an agent on Sunday. He said, I did nothing incorrectly and that they are still waiting on the IRS to update the form for the state of MI. He then said his notes say to check back in 48 hrs. I checked today and keep getting the same error. Hopefully soon.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

Just talked to CS on the phone and they said state forms should be updated March 5th with a possibility that I'd have to wait until the 6th depending on how long the process takes.

I don't know about other states but WI's Department of Revenue FAQ page says they accept the IRS's 8915-E and no extra WI form is required so I don't know why this is taking so **** long.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

Any updates? I am still receiving the same message.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

According to other posts I've seen, Intuit is saying it'll be done by the 19th now. I filed Federal separately for now and will be looking into other solutions next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do i keep getting check this entry for Pension Deduction worksheet on my state return?

Is anyone still having the issue with them saying somthing is wrong with your state and taking u back to the pension distribution page

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17724743702

New Member

maryherndon54

Level 2

user17724008297

New Member

billklueber

New Member

randyandlani

New Member