- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- WHERE DO I REPORT MY RETIREMENT INCOME FROM MY PENSION FUND?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

WHERE DO I REPORT MY RETIREMENT INCOME FROM MY PENSION FUND?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

WHERE DO I REPORT MY RETIREMENT INCOME FROM MY PENSION FUND?

You will get a 1099R for the pension.

To enter pension and annuity Payments (1099-R)

• Click on Federal Taxes

• Click on Wages and Income

• Click on I'll choose what I work on (if shown)

• Scroll down to Retirement Plans and Social Security

• On IRA, 401(k), Pension Plan Withdrawals (1099-R), click the start or update button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

WHERE DO I REPORT MY RETIREMENT INCOME FROM MY PENSION FUND?

That is not the question, I got two separate funds. The program only asked for one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

WHERE DO I REPORT MY RETIREMENT INCOME FROM MY PENSION FUND?

You'll get a 1099-R if you received $10 or more from a retirement plan. Here's how to enter your 1099-R in TurboTax:

- Open (continue) return if you don't already have it open.

- Inside TurboTax, search for 1099-R and select the Jump to link in the search results.

- Answer Yes on the Your 1099-R screen, then select Continue.

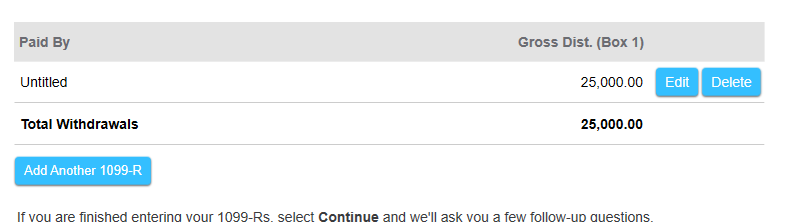

If you land on the Your 1099-R Entries screen instead, select Add Another 1099-R.

Select how you want to enter your 1099-R (import or type it in yourself) and then follow the instructions. You can add up to 20 1099-Rs.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chinyoung

New Member

TMM322

Level 2

user17539892623

Returning Member

ilenearg

Level 2

Kh52

Level 2