- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Where do I find a place to record a 2021 Refund Applied to 2022. Their directions don't offer visible links.

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find a place to record a 2021 Refund Applied to 2022. Their directions don't offer visible links.

Topics:

posted

January 31, 2023

1:12 PM

last updated

January 31, 2023

1:12 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find a place to record a 2021 Refund Applied to 2022. Their directions don't offer visible links.

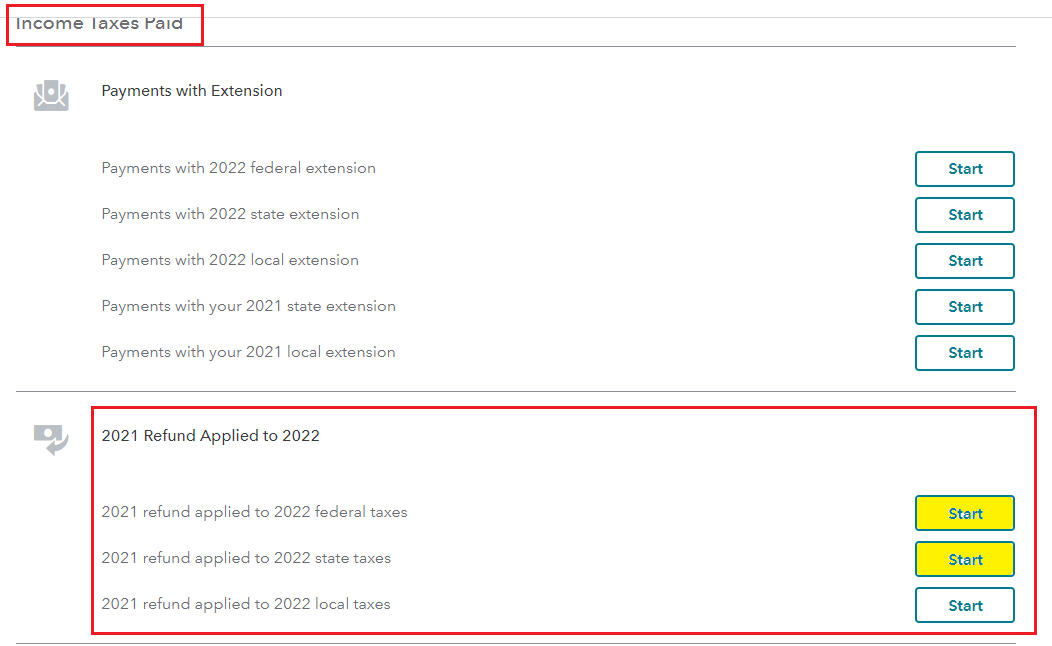

You can apply the refund that was applied from 2021 to the 2022 tax return in TurboTax by using the steps here.

It will be recorded like an estimated tax payment included with all other payments such as withholding. In TurboTax you can add that payment by using the steps below.

- Open your TurboTax return

- Select Deductions and Credits > Estimated Tax Payments > Select Income Taxes Paid (you may need to select see all deductions)

- Scroll to 2021 Refund Applied to 2022 > Select 2021 refund applied to 2022 federal taxes (and state if you did that also)

- Start or Revisit/Update

- Continue to enter your overpayment.

Make sure to continue through the screens to allow TurboTax to fully accept your entry.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 31, 2023

1:34 PM

194

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

David1729

Level 1

trust812

Level 4

mikeb77

Returning Member

SARA559743

New Member

harmoneesimone12

New Member