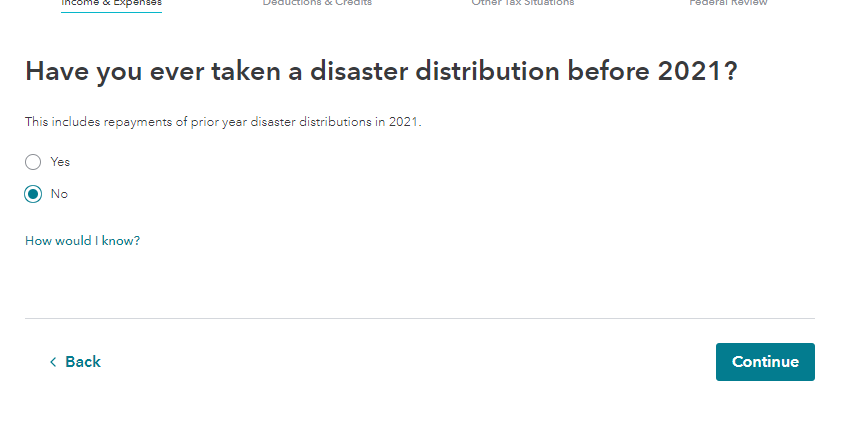

If you used TurboTax last year, the information should transfer automatically. You can find it under IRA, 401(K), Pension Plan Withdrawals (1099-R). If you have no new 1099-Rs to enter, click No on the Did you receive any 1099-Rs. The next page will ask about disaster distributions before 2021 (see below). Select Yes and continue through the interview. NOTE as of today, this section is not ready yet so check back soon.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"