- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- What indicates Bailey Retirement deduction applies on my 1099R?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What indicates Bailey Retirement deduction applies on my 1099R?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What indicates Bailey Retirement deduction applies on my 1099R?

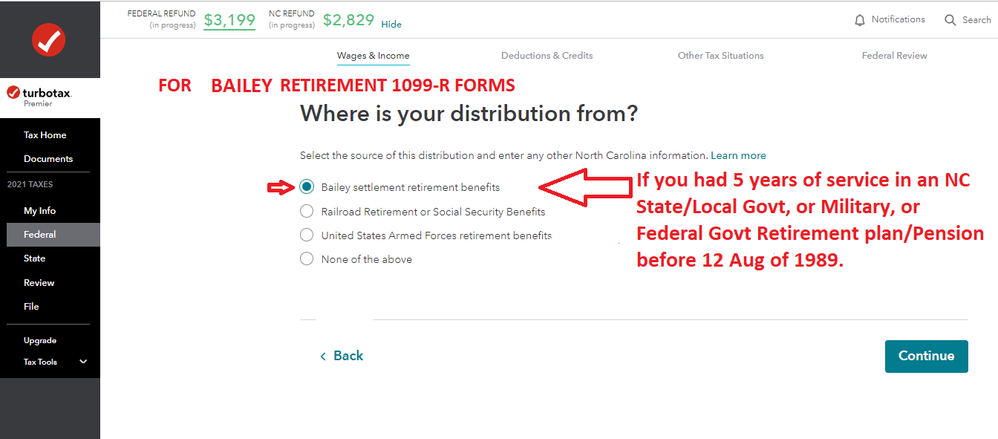

For any 1099-R received by a NC resident of retirement age.......if the retirement plan issuing the 1099-R was from a US Govt or Military retirement system, or an NC state Retirement system, then it's possible that it is not taxable by NC....but ONLY if you were in that retirement system 5 years before 12 Aug of 1989....That's the Bailey Settlement selection. Otherwise it's None of the above.

(the other two selections probably shouldn't show up at all. SS/RR forms are entered elsewhere, and I think eligibility for Falkenbury ended years ago, and again is just an NC state retirement system thing)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What indicates Bailey Retirement deduction applies on my 1099R?

Well, I don't even get that option. I reside in SC and had rental income and capital gains in NC to pay taxes on. My 1099R's should only be taxed on federal and SC. There was no withholding for NC. The deduction is called Bailey for the 1099R's in NC. It should be adjusted out but not for Bailey. How should I proceed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What indicates Bailey Retirement deduction applies on my 1099R?

If you will be doing an NC nonresident tax return.....ALL your Federal income will be dumped into the NC nonresident tax return "at first".....BUT...you will be able to remove most of that income from NC taxation during the NC nonresident interview. You will be able to make most of the NC allocation fields to be zero's, except for the rental and investment fields.

But get every scrap of Federal Income in first...and all Federal Deductions&Credits too....everything, and error checked...then do the NC Nonresident to do the income allocations....then SC resident last.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What indicates Bailey Retirement deduction applies on my 1099R?

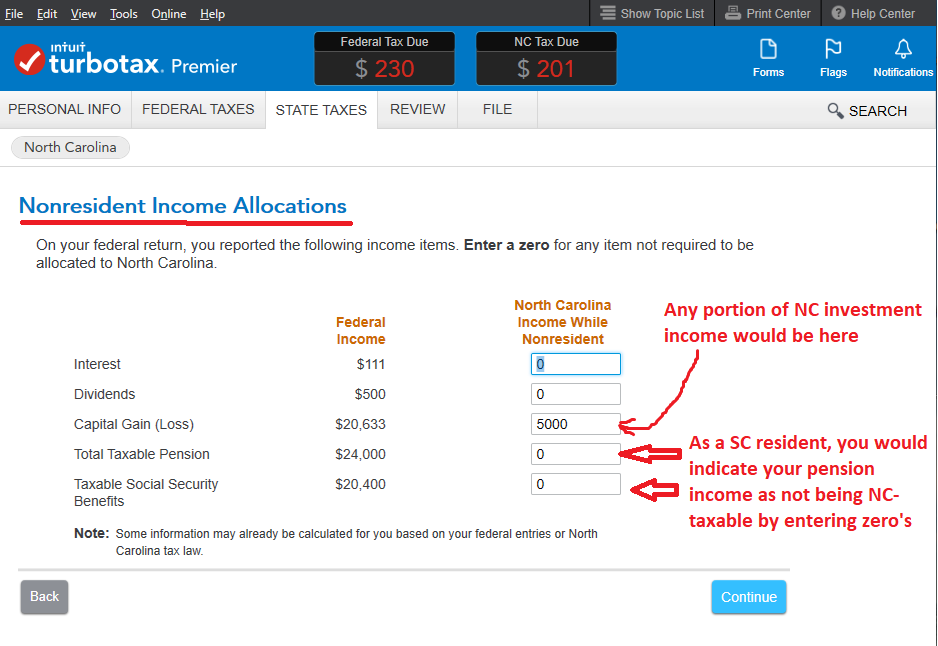

So, during the NC nonresident interview, you will be asked to allocate what is NC income for taxation... the investment and pensions income would be allocated like the following picture. This page is wehr you indicate the 1099-R income is a zero for NC purposes since you didn't live in NC. (I didn't get rental income in but there should be a line for that too)

___________________________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What indicates Bailey Retirement deduction applies on my 1099R?

that is exactly what i did

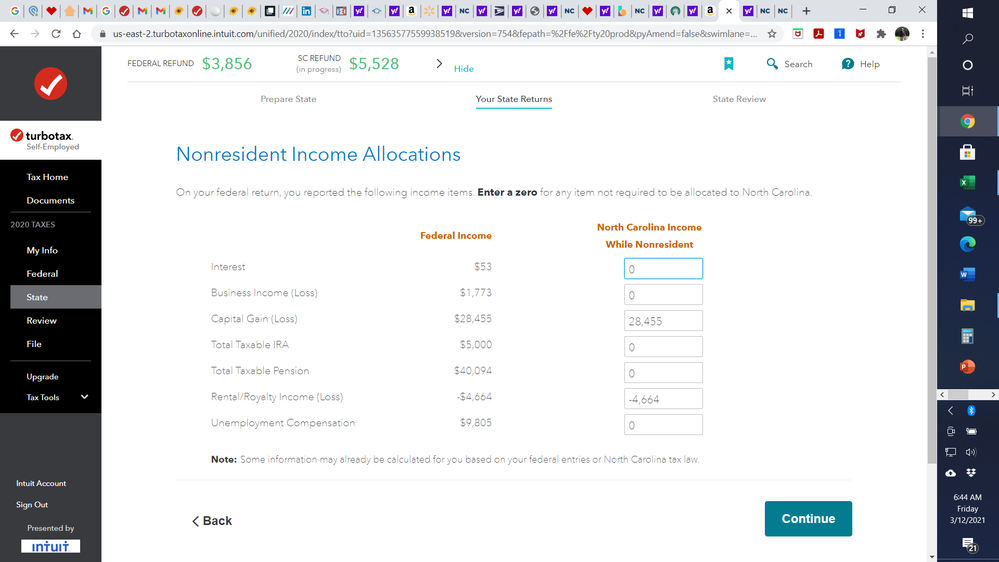

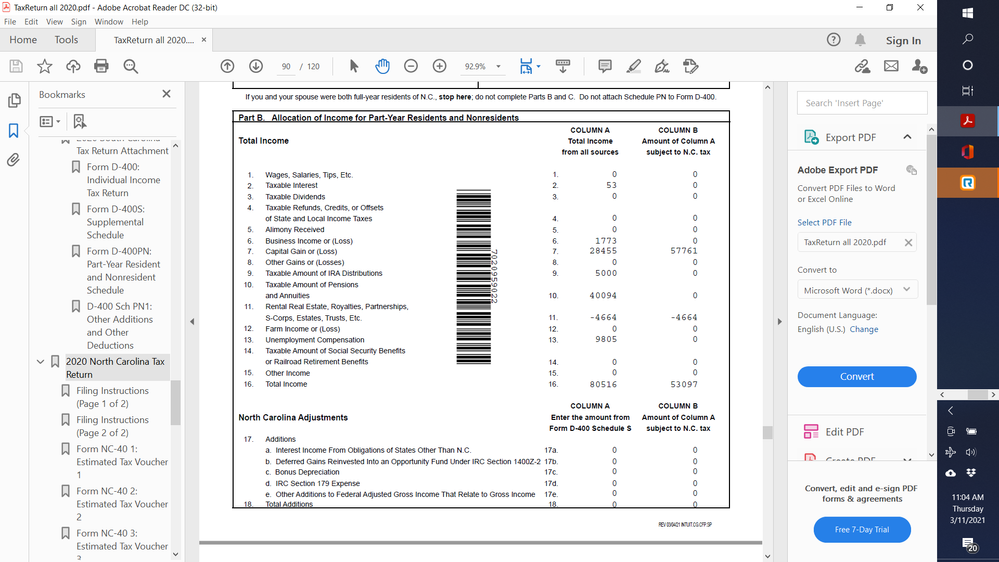

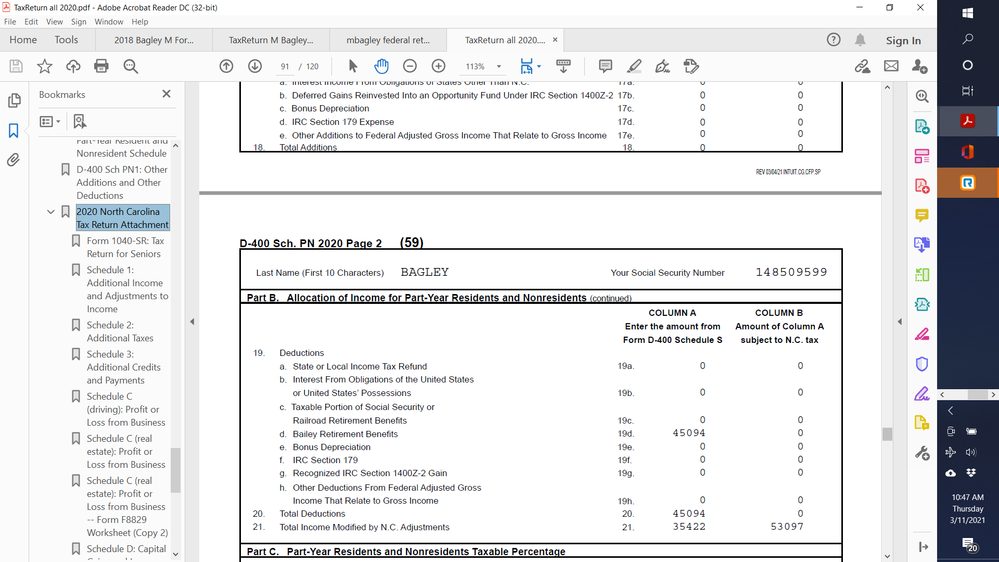

attached are my inputs and outputs in turbo tax

I don't understand why capital gains was adjusted for 28455 to 57761?

I understand the deduction on income for iras and pension but why listed as Bailey Retirement

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What indicates Bailey Retirement deduction applies on my 1099R?

I get none of that in my test tax return, but I'm using the desktop software....not Online, and programming is close, but never matches exactly.

1) The more than doubling of the investment gains is incomprehensible....normally a doubling is the result of someone double-entering something...but not in this case. The only thing I can think of to fix it is to call Customer Support dn have them look into it...they would have to get a diagnostic file from you (they would tell you how) and investigate it that way. You could also buy the desktop software and see what happens there, but you would have to buy the extra state to prepare both SC and NC tax returns.

2) For the pensions listed as "Bailey" on that line 19d of the allocation form? Correct, that does not belong there....if it somehow got set as Bailey during your entries in the Federal section, or during some error check...or some other strange reason...You could Edit each of your 1099R forms and make sure there was no Bailey question during the 1099-R interview where you accidentally set them as being Bailey Settlement eligible. Otherwise, the only way I could think of to fix that would be to delete all your 1099-R forms in the Federal section, and re-enter them manually. Don't import the data if that's what you originally did. But you would only do that if you have not filed Federal yet (too much potential for messing things up). Then if that doesn't fix it.....Call Customer Support for that too, since I'm using Desktop and have no other potentially useful suggestions for the Online software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What indicates Bailey Retirement deduction applies on my 1099R?

I used to get the Bailey retirement benefit, but it seem to have disappeared this year. Is it no longer available to North Carolina Military retirees?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What indicates Bailey Retirement deduction applies on my 1099R?

As long as you still lived in NC during 2023, and are filing a NC tax return, the Bailey settlement selection is still available.

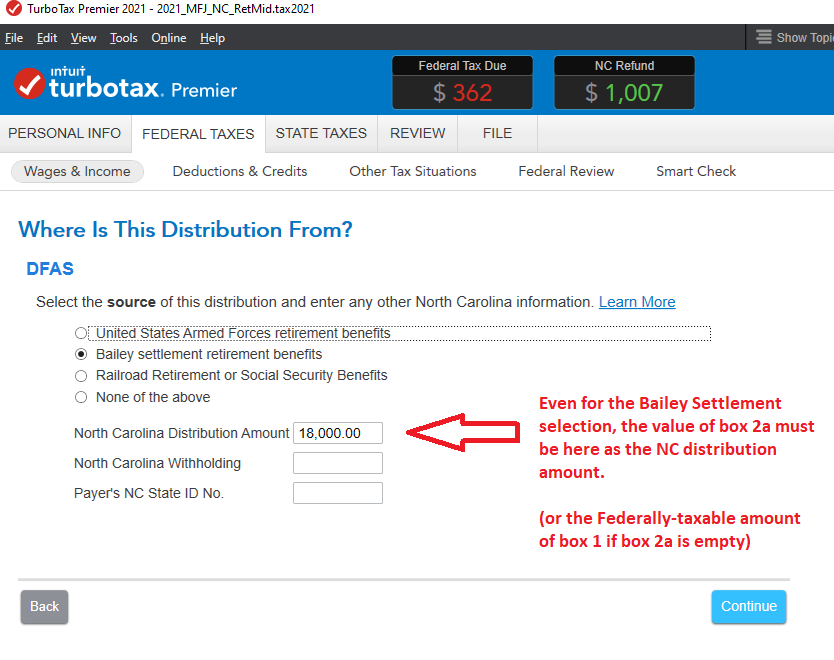

Edit that 1099-R in the Federal section, and on one of the pages AFTER the main form, there will be one that asks.."Where Is This Distribution From?".......the Bailey selection is the second one on that page. (I'll post a picture later today). The NC Distribution amount must be set as the $$ value form box 2a.

Note that there is now a Military (Uniformed services) Retiree deduction for those who do not meet the Bailey qualifications. You cannot get both. SO, if you select the Bailey Settlement deduction, do not also select the Uniformed services Retirment deduction when you go thru the NC section Q&A. It's one or the other, not both.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What indicates Bailey Retirement deduction applies on my 1099R?

here's where you select "either" the Bailey Settlement, or the Armed Forces retirement for NC (Not both), on one of the pages AFTER the main form in the Federal section:

____________________________

IF you are using the "Online" software, it looks like this:

_______________________

If you are using the Desktop software..it looks like this:

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cdtucker629

New Member

chiroman11

New Member

LLarsen1

Level 1

wilsonbrokl

New Member

ddm_25

Level 2