- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- what does 4D really mean on my 1009R? Can I just enter the info on it? It's not my RMD it's my dad's who died, can I ignore the RMD questions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what does 4D really mean on my 1009R? Can I just enter the info on it? It's not my RMD it's my dad's who died, can I ignore the RMD questions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what does 4D really mean on my 1009R? Can I just enter the info on it? It's not my RMD it's my dad's who died, can I ignore the RMD questions?

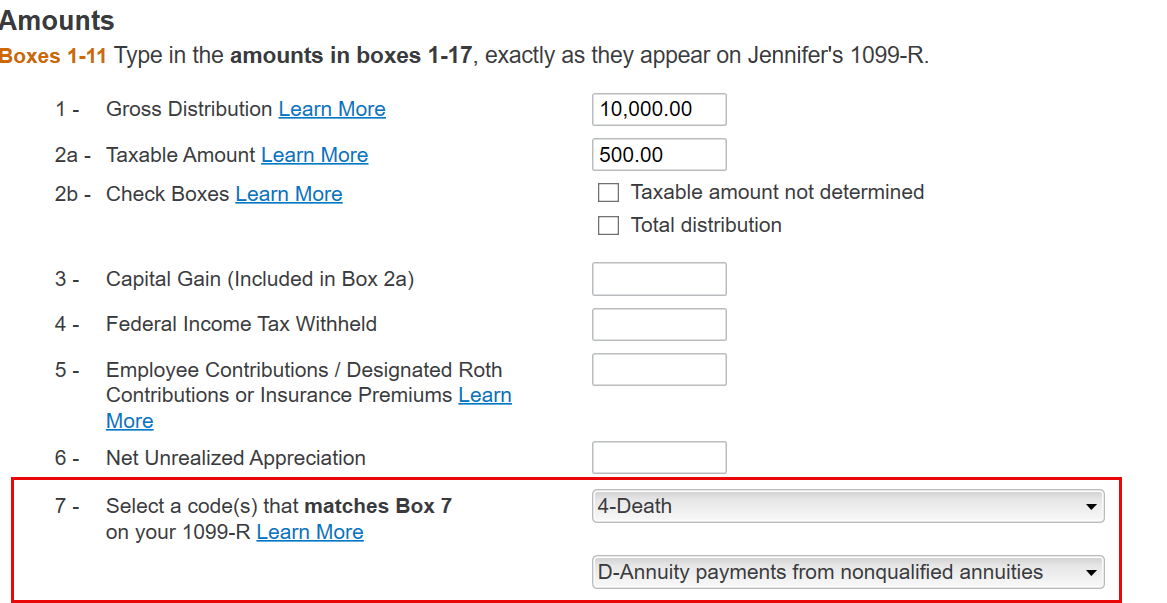

Code 4 is used to report that the retirement proceeds are from a death. Code D indicates that the payment is from an annuity from a nonqualified annuity. Only the earnings from these distributions are taxable as the annuity is funded with after-tax dollars.

As long as you enter the information from your 1099-R as provided, you should not be prompted to answer any questions regarding a RMD. I recommend following the steps in this link to get to the 1099-R input section. Select Update to the right of IRA, 401(k), Pension Plan Withdrawals (1099-R) on the applicable 1099-R.

On the screen asking you to enter the 1099-R, be sure to enter the applicable codes under Box 7. There are two boxes where you can enter both of your code options as listed on your 1099-R form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

djpmarconi

Level 1

fellynbal

Level 3

hojosverdes64

New Member

jenniferbannon2

New Member

ilenearg

Level 2