- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- TurboTax wants me to correct the amount of a wash sale. It says: Accrued market discount should not be 0. My 1099-R reports 0.84. How do I enter that amount?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax wants me to correct the amount of a wash sale. It says: Accrued market discount should not be 0. My 1099-R reports 0.84. How do I enter that amount?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax wants me to correct the amount of a wash sale. It says: Accrued market discount should not be 0. My 1099-R reports 0.84. How do I enter that amount?

You're correct, the issue with regard to the negative proceed on 1099-B isn't due to a mistake. It's a rounding issue.

If the adjustment is $0.49 or less, then it is automatically rounded to zero. This type of rounding is allowed by the IRS. Unfortunately, zero is not a valid value for this field -- thus the error message.

To resolve the issue, you can still import the transactions but you'll need do delete anything that is .49 or less. This will clear the error message.

To do this, you will need to revisit the input section for the Form 1099-B transactions. Use the following steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1099-B” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1099-B”

- Click on the blue “Jump to 1099-B” link

- Click Edit beside the institution name

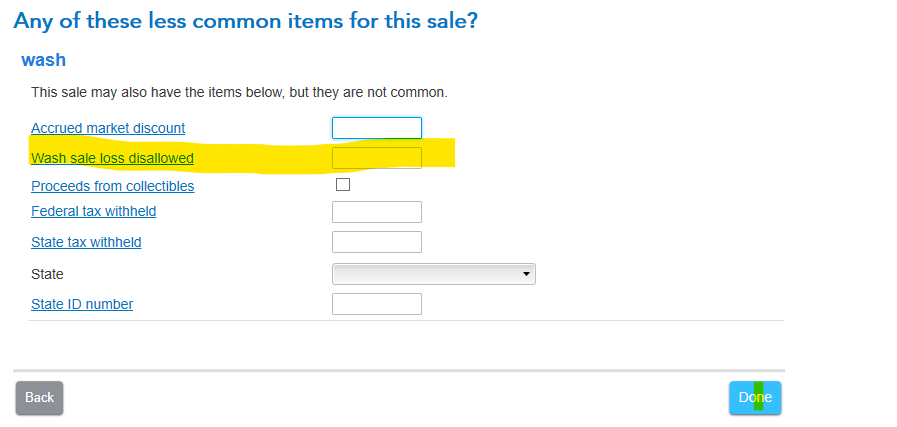

- Click Edit beside each transaction that contains a wash sale adjustment amount of $0.49 or less

- Delete the wash sale adjustment amount and click Done

Here is more information about IRS guidelines and rounding: https://www.irs.gov/publications/p17/ch01.html

Computations

The following information may be useful in making the return easier to complete.

Rounding off dollars.

You can round off cents to whole dollars on your return and schedules. If you do round to whole dollars, you must round all amounts. To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar. For example, $1.39 becomes $1 and $2.50 becomes $3.

If you have to add two or more amounts to figure the amount to enter on a line, include cents when adding the amounts and round off only the total.

Here is a TurboTax article that explains Form 1099-B Proceeds from Broker transactions

How Form 1099-B is used

The 1099-B helps you deal with capital gains taxes. Usually, when you sell something for more than it cost you to acquire it, the profit is a capital gain, and it may be taxable. On the other hand, if you sell something for less than you paid for it, then you may have a capital loss, which you might be able to use to reduce your taxable capital gains or other income.

If you have additional questions, please review the following link:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax wants me to correct the amount of a wash sale. It says: Accrued market discount should not be 0. My 1099-R reports 0.84. How do I enter that amount?

why are you trying to change the wash sale loss disallowed, when it is the accrued market discount that is in error?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax wants me to correct the amount of a wash sale. It says: Accrued market discount should not be 0. My 1099-R reports 0.84. How do I enter that amount?

I'm having a similar problem but I'm using the desktop software. When editing the form I can't change the disallowed wash sale amount either.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax wants me to correct the amount of a wash sale. It says: Accrued market discount should not be 0. My 1099-R reports 0.84. How do I enter that amount?

When you edit your 1099-R there will be a box to check that says Allow me continue with incomplete information. When you check that box you will get to the screen to enter your wash sale.

- A wash sale occurs when an investor sells a security at a loss for tax benefits.

- The IRS instituted the wash sale rule to prevent taxpayers from abusing wash sales.

- Investors who sell a security at a loss cannot purchase shares of the security—or one that is substantially identical to it—within 30 days (before or after) the sale of the security.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

4md

New Member

Th3turb0man

Level 1

jmgretired

New Member

colinsdds

New Member

brokewnribs20

New Member