- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- TurboTax desktop is not calculating correctly if I indicate I made my 2024 IRA contribution after Jan 1, 2025 (which I did). I I leave that blank it calculates correct

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax desktop is not calculating correctly if I indicate I made my 2024 IRA contribution after Jan 1, 2025 (which I did). I I leave that blank it calculates correct

This seems like a bug - and would cost me $$ in overpaid taxes

Topics:

posted

March 30, 2025

1:47 PM

last updated

March 30, 2025

1:47 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax desktop is not calculating correctly if I indicate I made my 2024 IRA contribution after Jan 1, 2025 (which I did). I I leave that blank it calculates correct

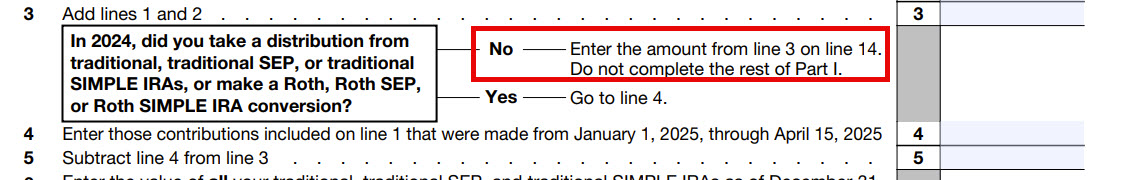

To clarify, did you take a distribution from the traditional IRA or made a conversion in 2024? If not, then line 4 of Form 8606 isn't filled out. If yes, then the contributions made in 2025 for 2024 are subtracted from the basis since they weren't in the account when you made the distribution/conversion in 2024.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 1, 2025

8:38 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

r-beckwith

New Member

sonia-yu

New Member

dougiedd

Returning Member

user17539892623

Returning Member

wcrisler

New Member