- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Turbotax Deluxe does not handle RMD's correctly when the RMD is taken from one account for the total due for all accounts

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Deluxe does not handle RMD's correctly when the RMD is taken from one account for the total due for all accounts

I received one 1099R for an RMD taken from one IRA account. This amount was sufficient to cover all the RMDs for every IRA account I own. The other accounts provided fair market value statements with the RMD, but did not provide a 1099R since no distribution was made. When I enter the RMD from the 1099R that was provided, the following page states that I should enter only the RMD for that account, which I take to mean not the amount of the distribution actually taken, but the amount calculated for the FMV for that one account. There is no place to enter the other accounts FMV and RMDs. I do not like the fact that TurboTax does not let me enter all the accounts and their FMVs and RMDs and then show that the total was taken from one account. I feel like this will result in a question from the IRS. One other contributor indicated this was solved on 2/20/25, but it was not, despite me updating the program repeatedly. TT needs to fix this issue. I suggest a starting page where we can enter all the FMV data and associated RMDs and then another page that lets us select the account(s) from which the RMD total was taken and enter the values from the 1099R forms that we received for those accounts. Note again that institutions do not send out 1099R forms if no distribution was taken. They could, I suppose, with a zero in the distribution box, but they do not, so this is a TT problem to solve. Please do so immediately.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbotax Deluxe does not handle RMD's correctly when the RMD is taken from one account for the total due for all accounts

Please see the following instructions:

- on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R” and enter your 1099-R

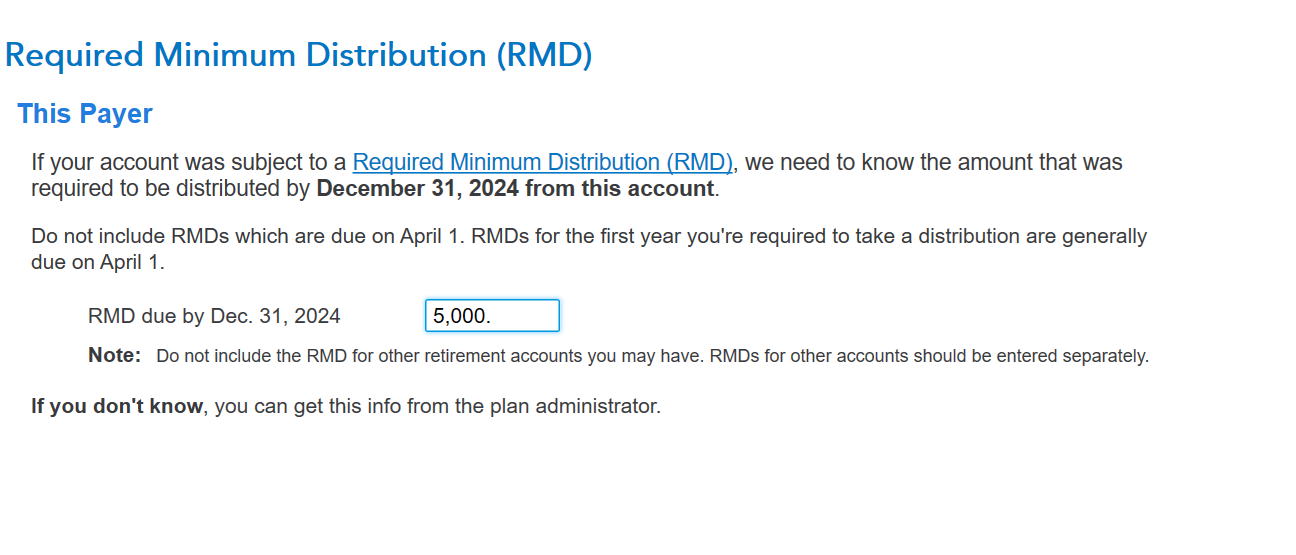

- On the "Required Minimum Distribution" screen enter RMD for this account

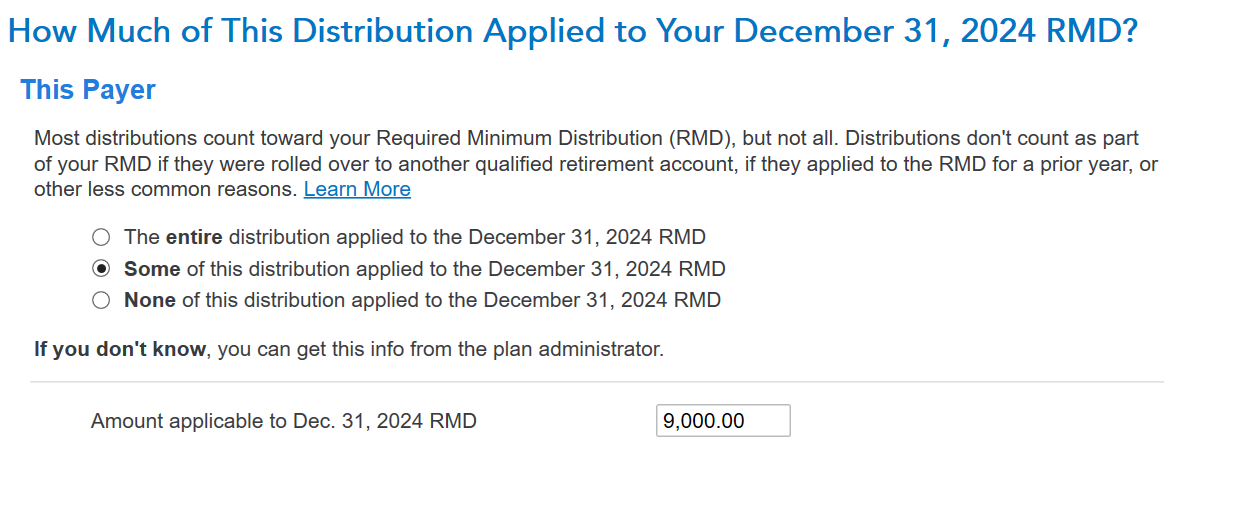

- On the "How much of This Distribution Applied to your December 31, 2024 RMD" select "Some of this distribution…" and enter the RMD from this distribution (RMD for this IRA plus RMD of other IRA taken from this distribution)

- On the "Review your 1099-R info" screen click "Continue"

- On the "Did You Miss a Required Distribution From Any Retirement Accounts?" screen you could select "None of these plans failed to withdraw the RMD" since you took all of your RMD but if you prefer to have a record of the IRAs you didn't take a distribution select "An IRA..."

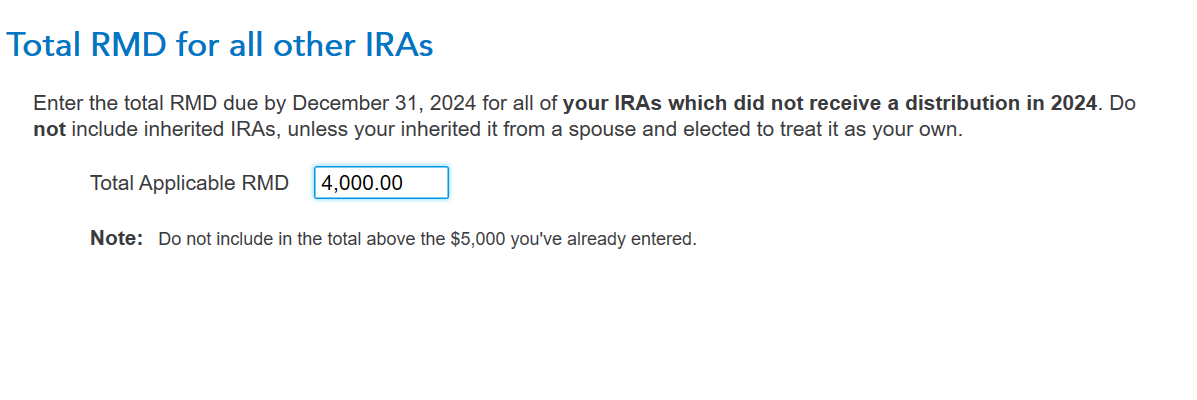

- On the "Total RMD for all other IRAs" screen enter the RMD from your other IRAs (where you didn't take a distribution from).

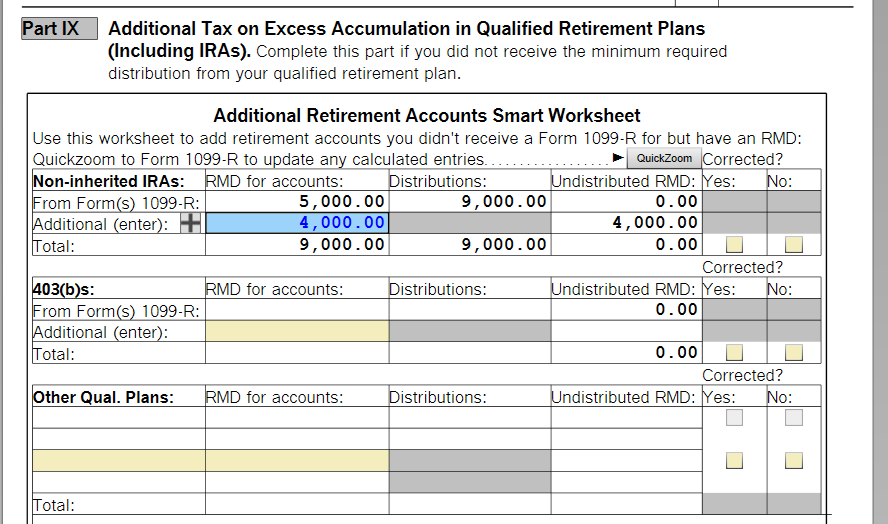

Example of $10,000 distribution from one IRA with $5,000 RMD. Another IRA with RMD of $4,000, nothing was withdrawn.

Step 3 Enter $5,000

Step 4 Enter $9,000

Step 7 Enter $4,000

Form 5329 shows that the $9,000 RMD distribution covered the $5,000 RMD of the distributed IRA and $4,000 RMD of the other IRAs. Therefore, all RMD was distributed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ProfDude

Level 1

itsagirltang69

New Member

jhancock1944

New Member

nishantgulia09

New Member

satrel

New Member