- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Please see the following instructions:

- on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R” and enter your 1099-R

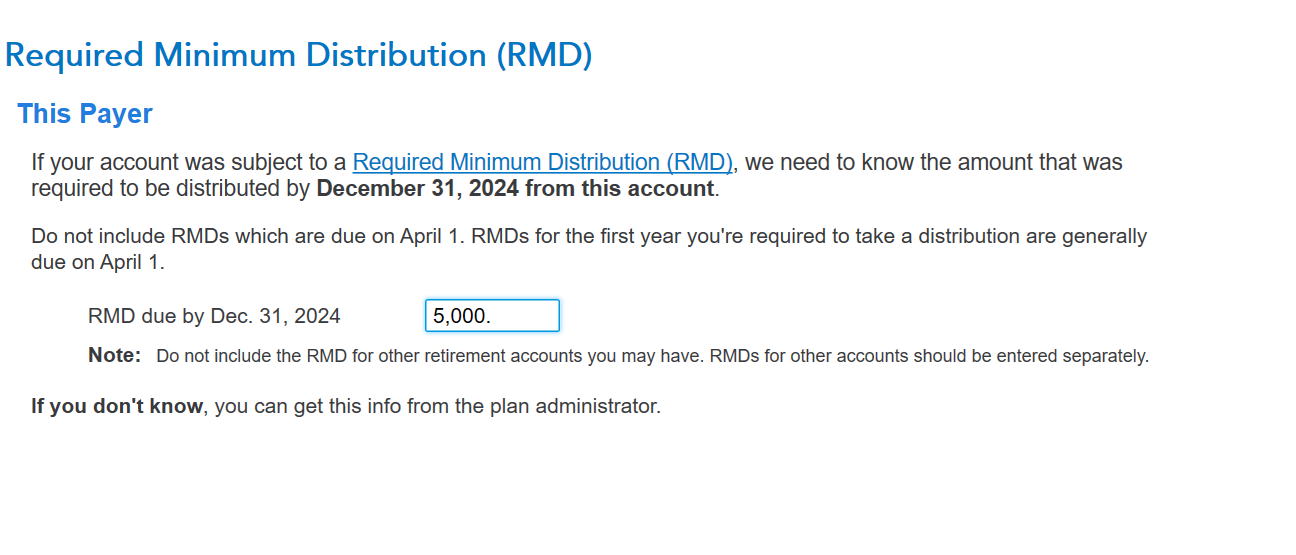

- On the "Required Minimum Distribution" screen enter RMD for this account

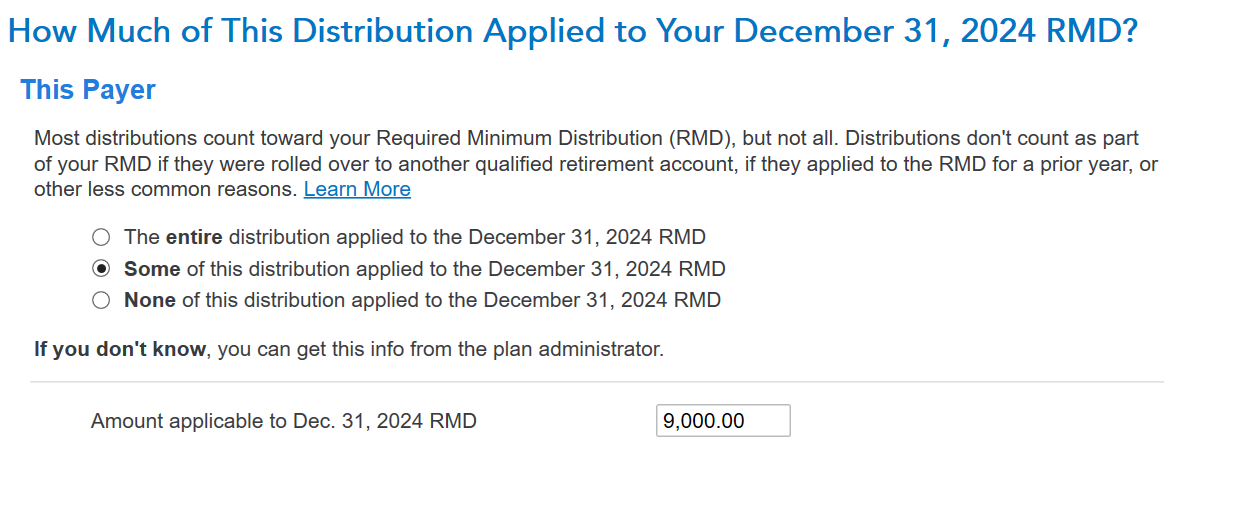

- On the "How much of This Distribution Applied to your December 31, 2024 RMD" select "Some of this distribution…" and enter the RMD from this distribution (RMD for this IRA plus RMD of other IRA taken from this distribution)

- On the "Review your 1099-R info" screen click "Continue"

- On the "Did You Miss a Required Distribution From Any Retirement Accounts?" screen you could select "None of these plans failed to withdraw the RMD" since you took all of your RMD but if you prefer to have a record of the IRAs you didn't take a distribution select "An IRA..."

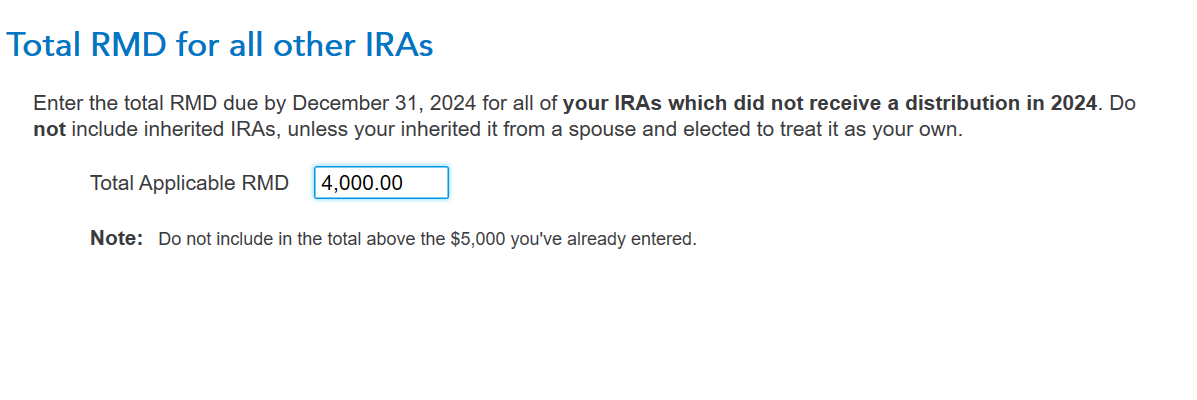

- On the "Total RMD for all other IRAs" screen enter the RMD from your other IRAs (where you didn't take a distribution from).

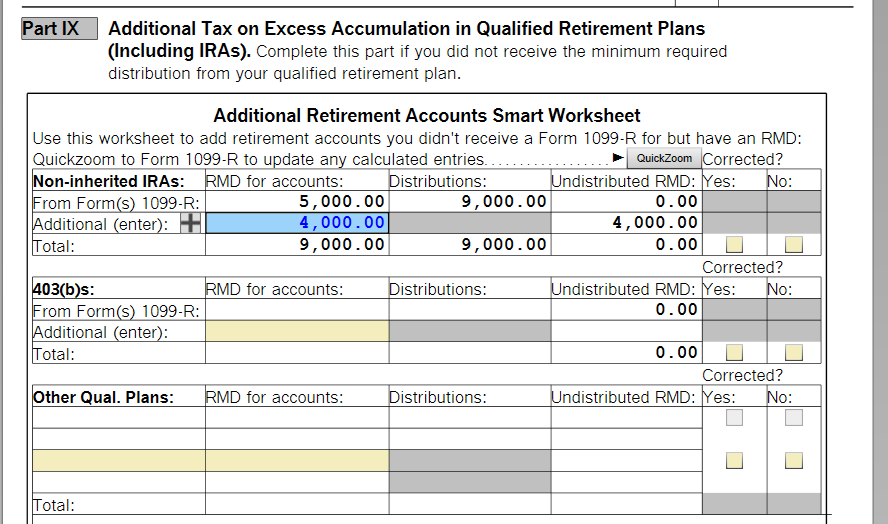

Example of $10,000 distribution from one IRA with $5,000 RMD. Another IRA with RMD of $4,000, nothing was withdrawn.

Step 3 Enter $5,000

Step 4 Enter $9,000

Step 7 Enter $4,000

Form 5329 shows that the $9,000 RMD distribution covered the $5,000 RMD of the distributed IRA and $4,000 RMD of the other IRAs. Therefore, all RMD was distributed.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 23, 2025

5:18 AM