- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- TurboTax 2021 treatment of pension income when box 2b is checked

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2021 treatment of pension income when box 2b is checked

On our 1099-R from a qualified pension plan, box 2a is blank and box 2b (Taxable amount not determined) is checked. The whole amount (box 1) should be taxable, but the program seems to think it's an annuity because we got regular (monthly) payments from it. It asks "Which method did [we] use to figure the taxable amount of this annuity? Simplified method or General rule?" A pension is NOT an annuity, at least from the recipients standpoint! At any rate, filling in the rest of the "Annuity Information" concludes with it saying the taxable amount is $0, which is, of course, not correct.

This is different from TurboTax 2020, which understood that as a pension with box 2b checked, it is entirely taxable.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2021 treatment of pension income when box 2b is checked

If you're sure your pension is 100% taxable (or want to report it as such), the easiest solution is to put the Box 1 amount in Box 2a. Or you can tell TurboTax "No, I didn't get regular payments from this retirement account", even if you did.

The IRS won't question if you report 100% of your pension payments as taxable.

Pension administrators will generally not say Taxable amount not determined, unless there is a possible adjustment. Adjustments are not mandatory. You always have the option of reporting 100% of your pension as taxable, though you may end up paying more than your fair share of tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2021 treatment of pension income when box 2b is checked

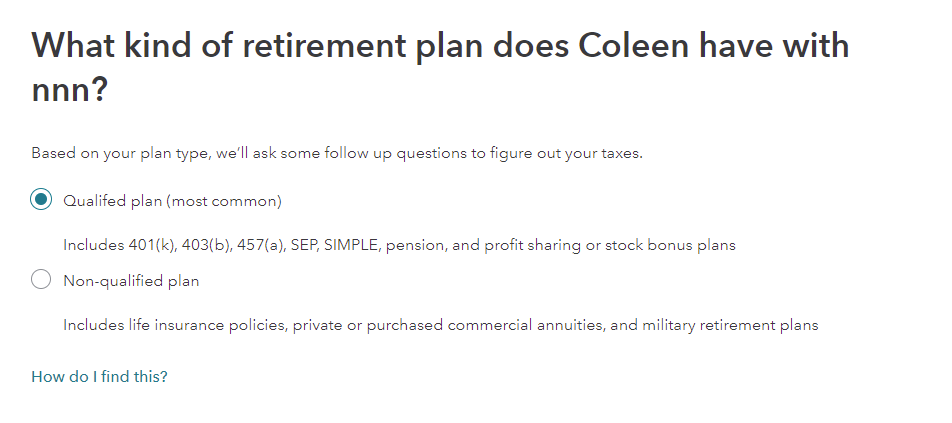

Make sure that you chose the correct box for Qualified Plans.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2021 treatment of pension income when box 2b is checked

With TurboTax Deluxe, I don't see the snippet you posted, I get the above. I did select the button "From a Qualified Plan" (not the highlighted button). So maybe this is an issue just with the Deluxe and not the Premier edition?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2021 treatment of pension income when box 2b is checked

If you're sure your pension is 100% taxable (or want to report it as such), the easiest solution is to put the Box 1 amount in Box 2a. Or you can tell TurboTax "No, I didn't get regular payments from this retirement account", even if you did.

The IRS won't question if you report 100% of your pension payments as taxable.

Pension administrators will generally not say Taxable amount not determined, unless there is a possible adjustment. Adjustments are not mandatory. You always have the option of reporting 100% of your pension as taxable, though you may end up paying more than your fair share of tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2021 treatment of pension income when box 2b is checked

I used the IRS Interactive Tax Assistant and it indicates that this pension is fully taxable. This is the third year we've received this pension, and TurboTax has (correctly) indicated that the pension is fully taxable in the previous 2 years, so I was surprised that it was wrong this year.

Thank you for your suggestion; putting in the full box 1 amount into 2a sounds like the easiest solution.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodiy2k21

Returning Member

tcondon21

Returning Member

kgsundar

Level 2

kgsundar

Level 2

henryway

Returning Member