- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- The boxes asking for information do not match the physical boxes on the 1099-R form I am holding in my hand. What do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The boxes asking for information do not match the physical boxes on the 1099-R form I am holding in my hand. What do I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The boxes asking for information do not match the physical boxes on the 1099-R form I am holding in my hand. What do I do?

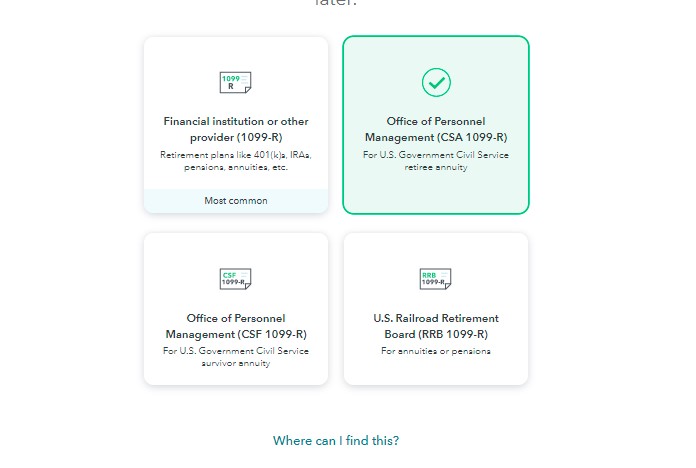

Please verify that you selected the correct option on the "Who gave you a 1099-R?" screen. For example, if you have a CSA 1099-R instead of a regular 1099-R then you will need to select "Office of Personnel Management (CSA 1099-R) For U.S. Government Civil Service retiree annuity" on the "Who gave you a 1099-R?" screen.

- Login to your TurboTax Account

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The boxes asking for information do not match the physical boxes on the 1099-R form I am holding in my hand. What do I do?

...Now...if it IS as standard 1099-R (and not a CSA- of CSF-1099-R from OPM)

....The IRS moved boxes 12,13,14 from the 2019 and earlier 1099-R format, and into boxes 14,15,16 respectively for 2020....BUT, a few irresponsible 1099-R providers failed to update their 1099-R forms to the new/correct 2020 box numbering format. So if you see boxes 12,13,14 on your standard 1099-R...match the subject of each line before entering the numbers/values .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The boxes asking for information do not match the physical boxes on the 1099-R form I am holding in my hand. What do I do?

Not helpful, as it assumes I am an idiot and don't know how to read what kind of form I got.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The boxes asking for information do not match the physical boxes on the 1099-R form I am holding in my hand. What do I do?

This one is helpful, as it explains why the forms don't match what TurboTax is asking for. I went in and simply entered what was asked for, disregarding what the box number was. It's the only thing I could do. Thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

PaulEppichlaw

New Member

Edward44

Level 1

culimaco114

New Member