- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- The 1099-G form has a box for Federal Income Tax Withheld but I was not able to enter this anywhere.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-G form has a box for Federal Income Tax Withheld but I was not able to enter this anywhere.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-G form has a box for Federal Income Tax Withheld but I was not able to enter this anywhere.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-G form has a box for Federal Income Tax Withheld but I was not able to enter this anywhere.

Check the box, Federal or state income tax was withheld on this payment, located just below the state box for a 1099-G for unemployment or family leave.

Look for a similar box if you received a 1099-G other than for unemployment/family leave. It looks similar to the one in the attached example below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-G form has a box for Federal Income Tax Withheld but I was not able to enter this anywhere.

In Turbo tax for tax year 2020 there is no box to check for Federal or State income withheld. The only way to enter it at this time is to click on "forms" in the top ribbon. Then select the 1099-G form and then enter the tax withheld directly into the 1099-G form,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-G form has a box for Federal Income Tax Withheld but I was not able to enter this anywhere.

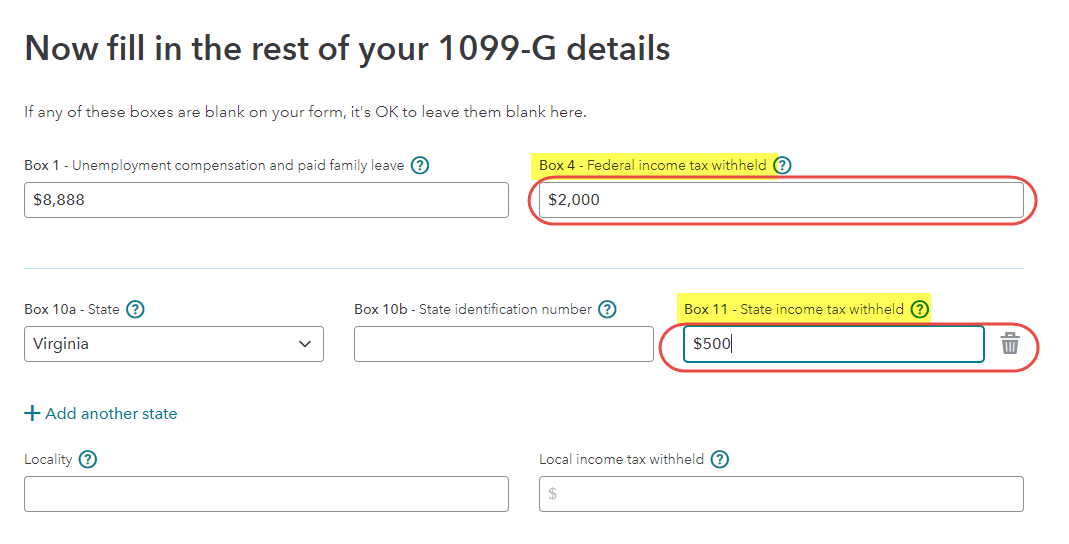

Please follow these steps for entering federal and state income tax withholding on Form 1099-G.

TurboTax Online

On the screen, Now fill in the rest of your 1099-G details, Box 4 is for Federal income tax withheld and Box 11 is for State income tax withheld. See screenshot below,

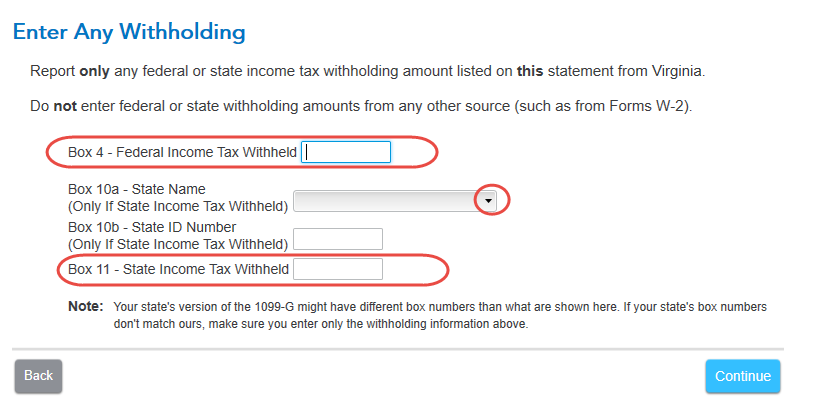

TurboTax CD/Download

- On the screen, What's the total amount you received on your 1099-G, mark the box Federal or state income tax was withheld on this payment. [It is located just below the State selection box.] [See screenshot below.]

- Enter any withholding on the next screen. [See screenshot below.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-G form has a box for Federal Income Tax Withheld but I was not able to enter this anywhere.

thanks, no box to check on federal turbo tax deluxe, just info for box 1. I think is right to add federal income tax withheld directly to the form section.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

peanutbuttertaxes

New Member

ke-neuner

New Member

Torpedo101

New Member

Danielvaneker93

New Member

user17552101674

New Member